Answered step by step

Verified Expert Solution

Question

1 Approved Answer

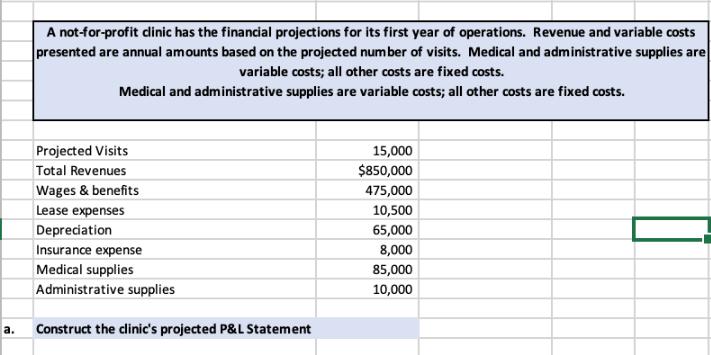

a. A not-for-profit clinic has the financial projections for its first year of operations. Revenue and variable costs presented are annual amounts based on

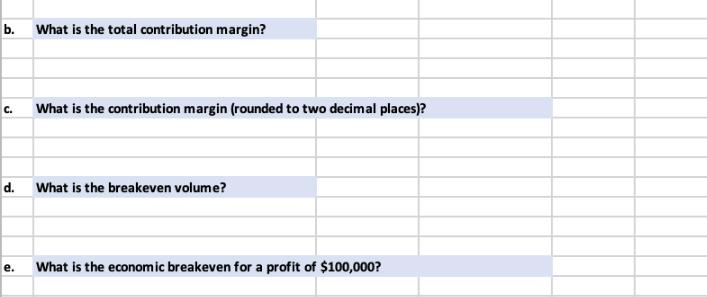

a. A not-for-profit clinic has the financial projections for its first year of operations. Revenue and variable costs presented are annual amounts based on the projected number of visits. Medical and administrative supplies are variable costs; all other costs are fixed costs. Medical and administrative supplies are variable costs; all other costs are fixed costs. Projected Visits Total Revenues Wages & benefits Lease expenses Depreciation Insurance expense Medical supplies Administrative supplies Construct the clinic's projected P&L Statement 15,000 $850,000 475,000 10,500 65,000 8,000 85,000 10,000 b. C. d. e. What is the total contribution margin? What is the contribution margin (rounded to two decimal places)? What is the breakeven volume? What is the economic breakeven for a profit of $100,000?

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started