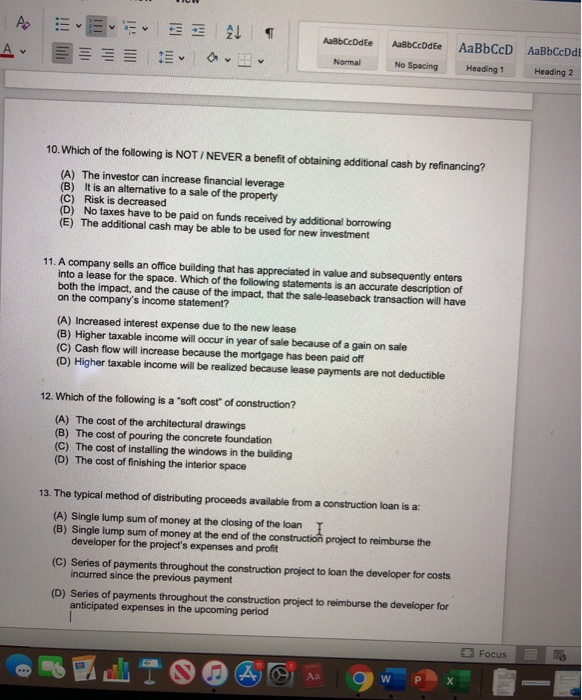

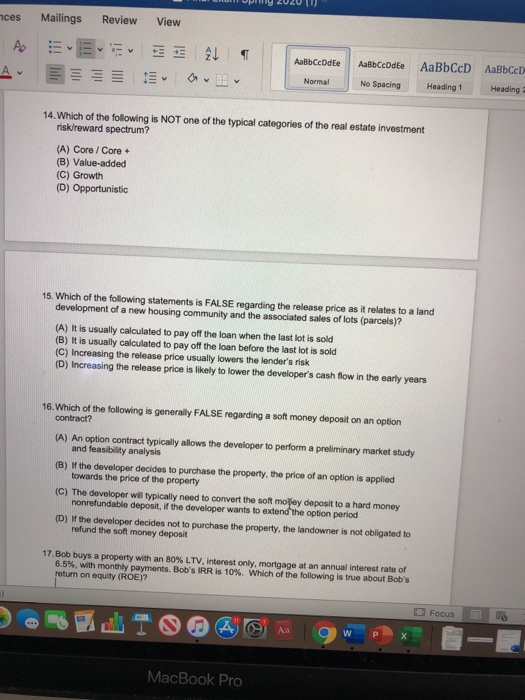

A AaCeDdEe gabCcDdEe v Normal AaBbCcD AaBbCcDdi Heading 1 Heading 2 No Spacing 10. Which of the following is NOT / NEVER a benefit of obtaining additional cash by refinancing? (A) The investor can increase financial leverage (B) It is an alternative to a sale of the property (C) Risk is decreased (D) No taxes have to be paid on funds received by additional borrowing (E) The additional cash may be able to be used for new investment 11. A company sells an office building that has appreciated in value and subsequently enters into a lease for the space. Which of the following statements is an accurate description of both the impact, and the cause of the impact that the sale-leaseback transaction will have on the company's income statement? (A) Increased interest expense due to the new lease (B) Higher taxable income will occur in year of sale because of a gain on sale (C) Cash flow will increase because the mortgage has been paid off (D) Higher taxable income will be realized because lease payments are not deductible 12. Which of the following is a 'soft cost of construction? (A) The cost of the architectural drawings (B) The cost of pouring the concrete foundation (C) The cost of installing the windows in the building (D) The cost of finishing the interior space 13. The typical method of distributing proceeds available from a construction loan is a: (A) Single lump sum of money at the closing of the loan I (B) Single lump sum of money at the end of the construction project to reimburse the developer for the project's expenses and profit (C) Series of payments throughout the construction project to loan the developer for costs incurred since the previous payment (D) Series of payments throughout the construction project to reimburse the developer for anticipated expenses in the upcoming period Focus W X ces Mailings Review View A v 1 AaBbceDdEe AaBbCcDdEe A AaBbCcD AaBbCcD Normal No Spacing Heading 1 Heading 14. Which of the following is NOT one of the typical categories of the real estate investment risk/reward spectrum? (A) Core / Core (B) Value-added (C) Growth (D) Opportunistic 15. Which of the following statements is FALSE regarding the release price as it relates to a land development of a new housing community and the associated sales of lots (parcels)? (A) It is usually calculated to pay off the loan when the last lot is sold (B) It is usually calculated to pay off the loan before the last lot is sold (C) Increasing the release price usually lowers the lender's risk (D) Increasing the release price is likely to lower the developer's cash flow in the early years 16. Which of the following is generally FALSE regarding a soft money deposit on an option contract? (A) An option contract typically allows the developer to perform a preliminary market study and feasibility analysis (B) If the developer decides to purchase the property, the price of an option is applied towards the price of the property (C) The developer wil typically need to convert the soft molley deposit to a hard money nonrefundable deposit, if the developer wants to extend the option period (D) If the developer decides not to purchase the property, the landowner is not obligated to refund the soft money deposit 17. Bob buys a property with an 80% LTV. Interest only, mortgage at an annual interest rate of 6.5%, with monthly payments. Bob's IRR is 10%. Which of the following is true about Bob's return on equity (ROE)? Focus w MacBook Pro