Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) ABC Inc. has $50,000 in average inventory, $60,000 in average receivables, and $101,000 in average payables. Last year's annual sale was $700,000 with

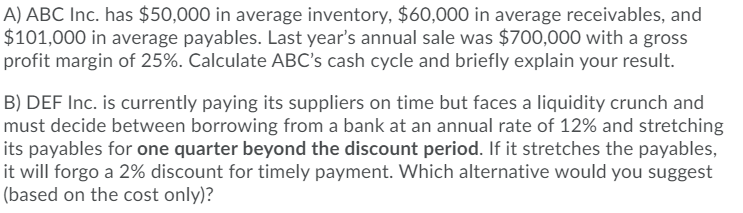

A) ABC Inc. has $50,000 in average inventory, $60,000 in average receivables, and $101,000 in average payables. Last year's annual sale was $700,000 with a gross profit margin of 25%. Calculate ABC's cash cycle and briefly explain your result. B) DEF Inc. is currently paying its suppliers on time but faces a liquidity crunch and must decide between borrowing from a bank at an annual rate of 12% and stretching its payables for one quarter beyond the discount period. If it stretches the payables, it will forgo a 2% discount for timely payment. Which alternative would you suggest (based on the cost only)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate ABC Incs cash cycle well use the formula Cash Cycle Inventory Conversion Period Receivables Collection Period Payables Deferral Period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started