Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A acquired 60% of the 1 million $1 ordinary shares of B on 1 July 20X0 for $3,250,000 when B's retained earnings were $2,760,000.

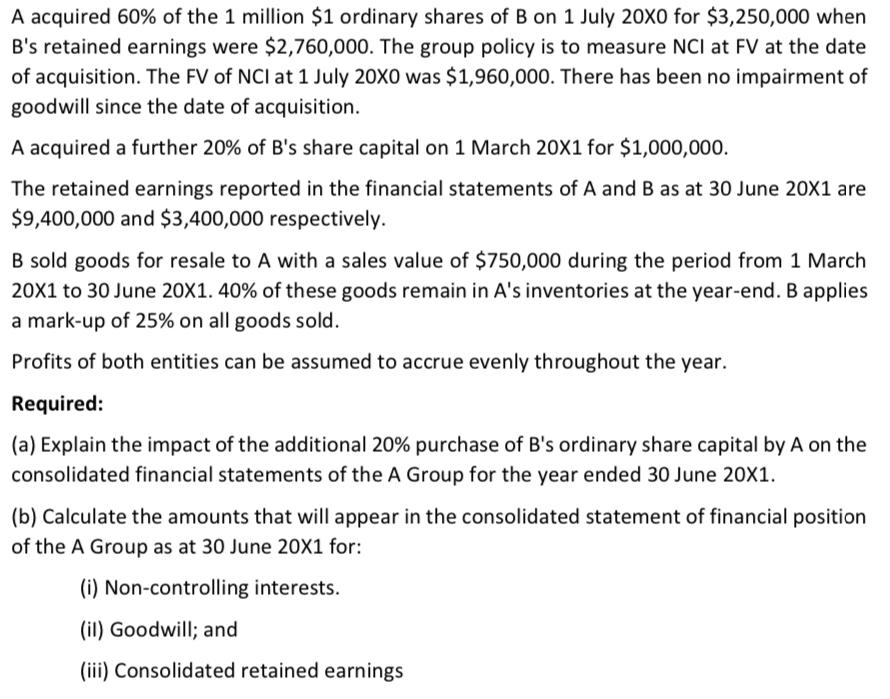

A acquired 60% of the 1 million $1 ordinary shares of B on 1 July 20X0 for $3,250,000 when B's retained earnings were $2,760,000. The group policy is to measure NCI at FV at the date of acquisition. The FV of NCI at 1 July 20X0 was $1,960,000. There has been no impairment of goodwill since the date of acquisition. A acquired a further 20% of B's share capital on 1 March 20X1 for $1,000,000. The retained earnings reported in the financial statements of A and B as at 30 June 20X1 are $9,400,000 and $3,400,000 respectively. B sold goods for resale to A with a sales value of $750,000 during the period from 1 March 20X1 to 30 June 20X1. 40% of these goods remain in A's inventories at the year-end. B applies a mark-up of 25% on all goods sold. Profits of both entities can be assumed to accrue evenly throughout the year. Required: (a) Explain the impact of the additional 20% purchase of B's ordinary share capital by A on the consolidated financial statements of the A Group for the year ended 30 June 20X1. (b) Calculate the amounts that will appear in the consolidated statement of financial position of the A Group as at 30 June 20X1 for: (i) Non-controlling interests. (il) Goodwill; and (iii) Consolidated retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Impact of the additional 20 purchase of Bs ordinary share capital by A on the consolidated financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642b4593747c_975645.pdf

180 KBs PDF File

6642b4593747c_975645.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started