Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) After completing all of the entries in Exercise 1, what is the correct credit balance recorded to Paid-In Capital in Excess of ParPreferred Stock

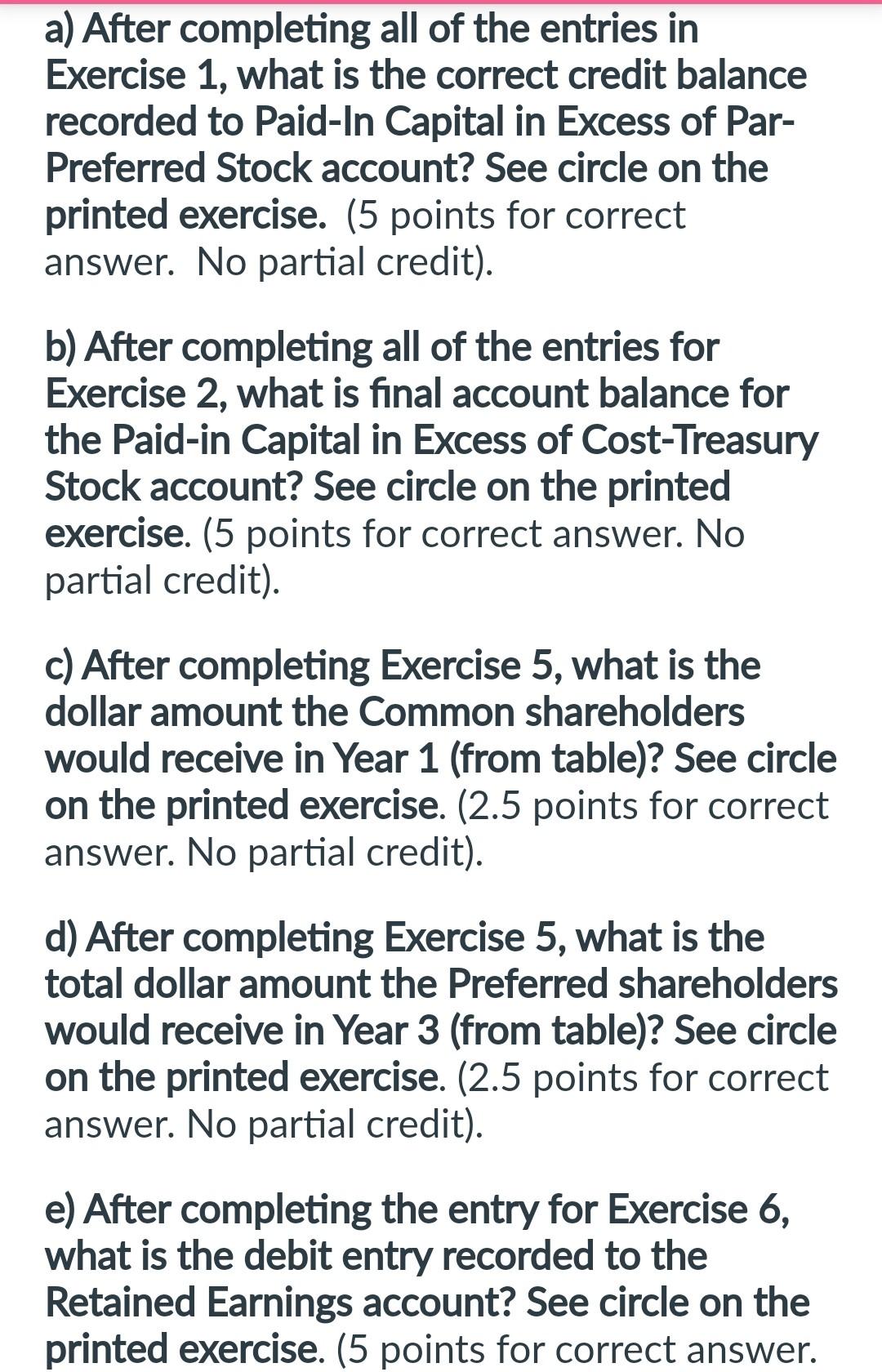

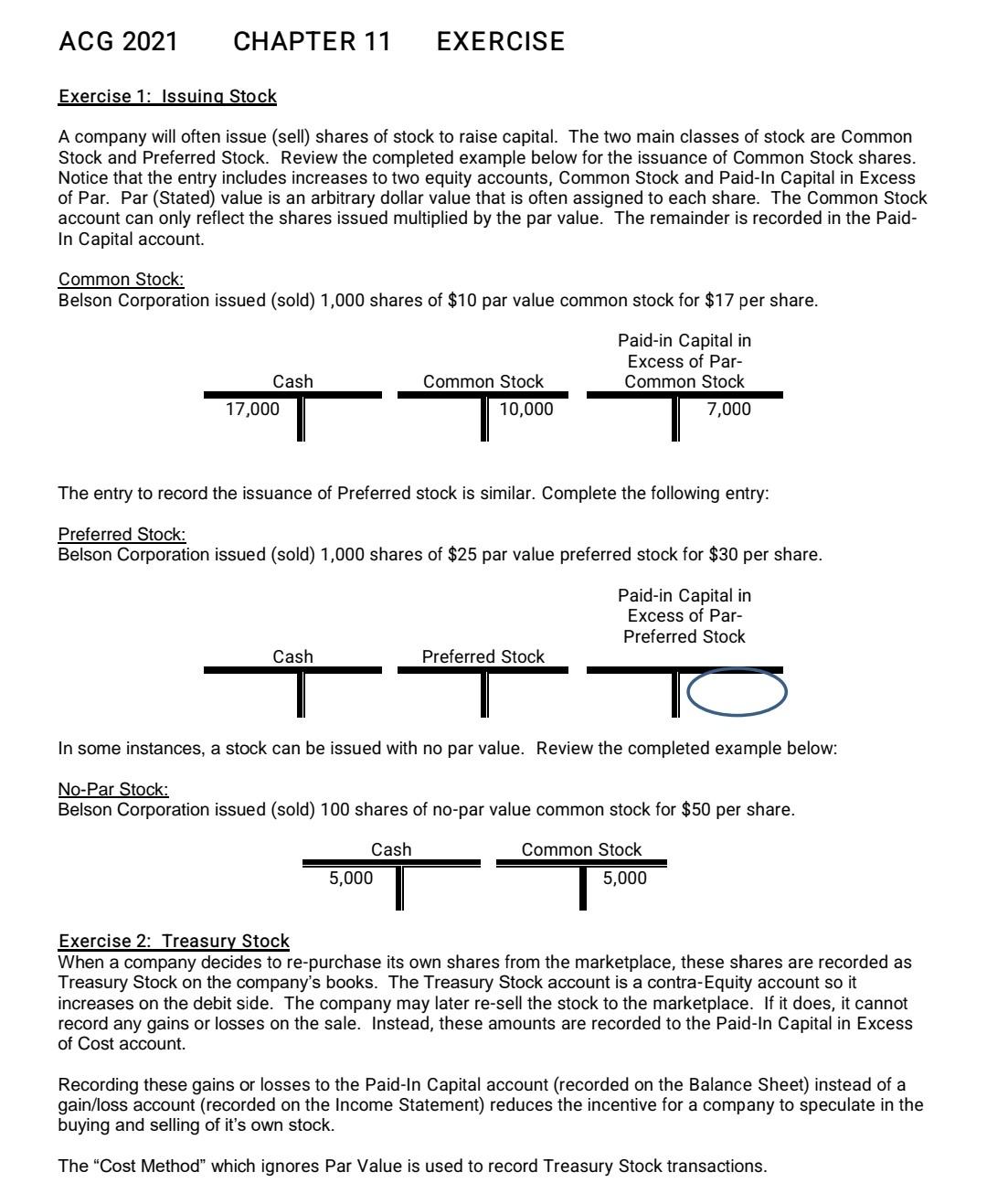

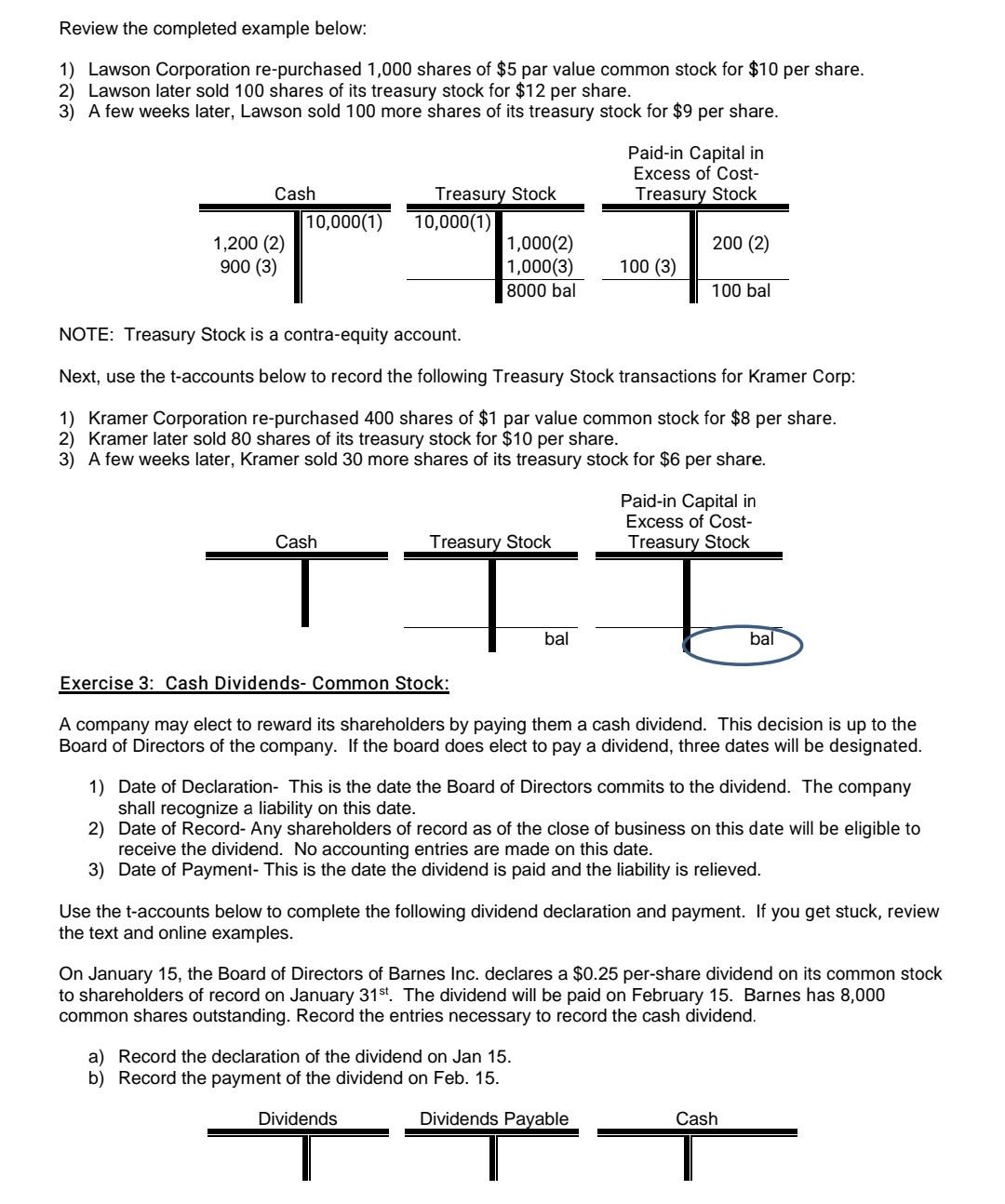

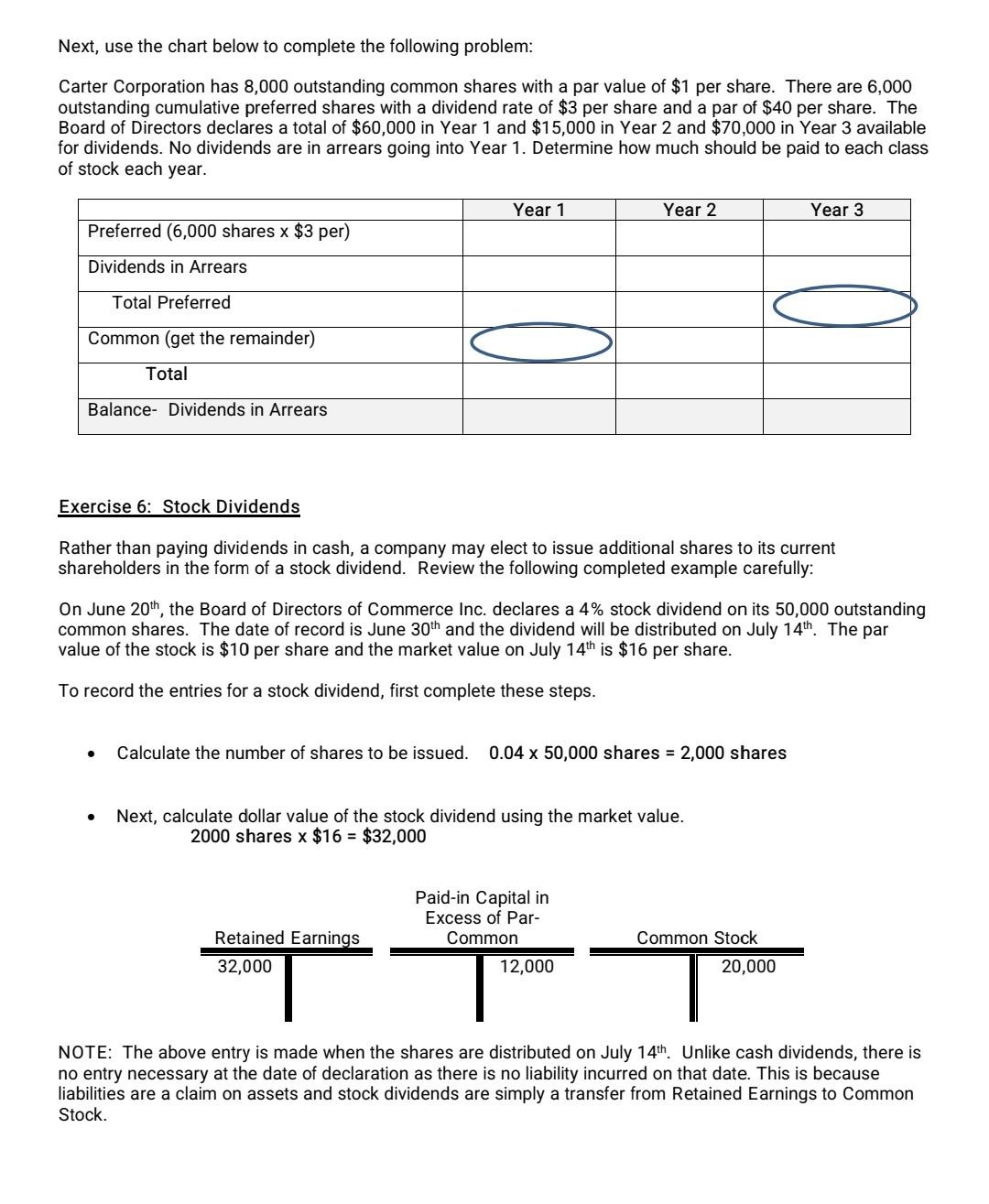

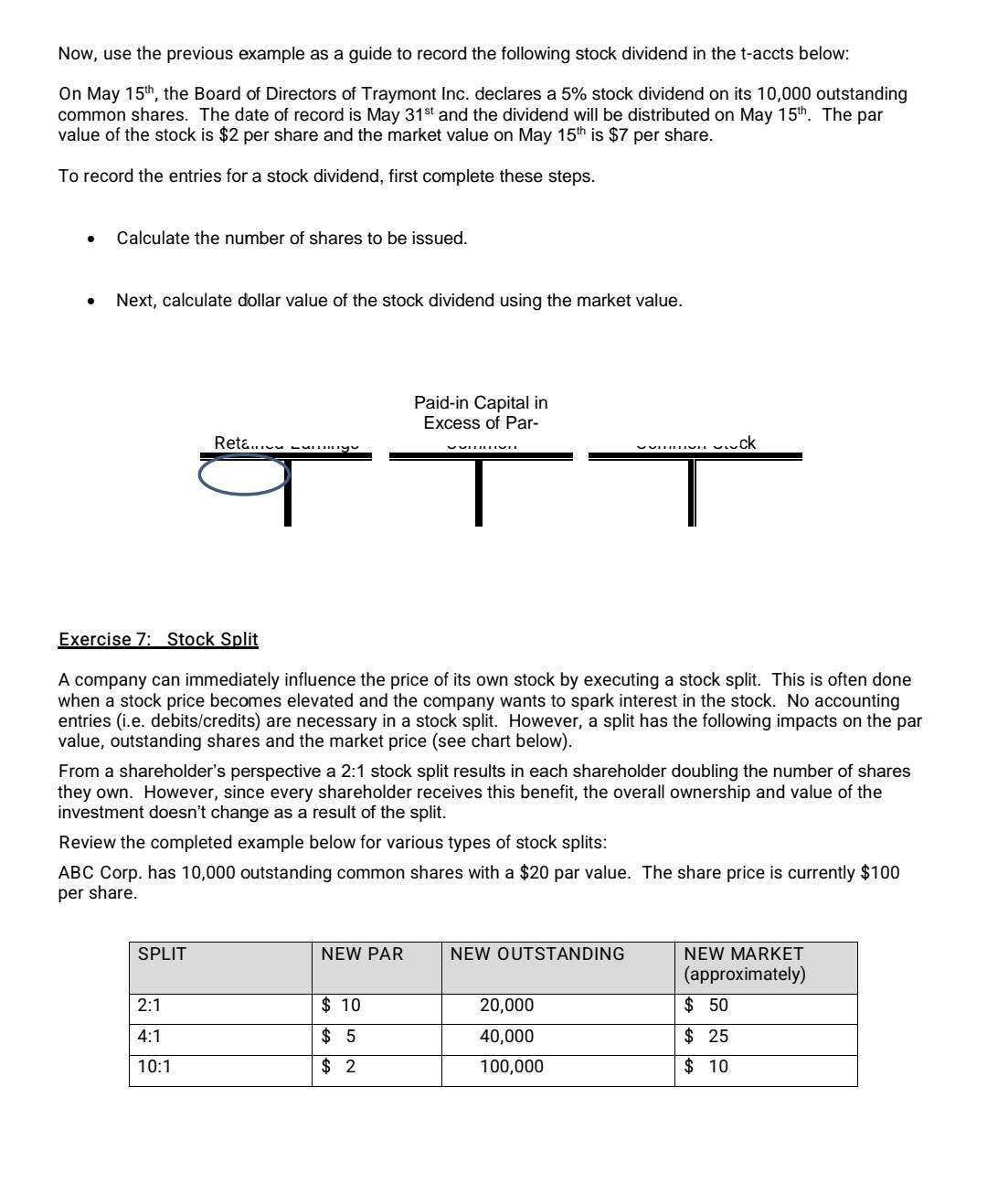

a) After completing all of the entries in Exercise 1, what is the correct credit balance recorded to Paid-In Capital in Excess of ParPreferred Stock account? See circle on the printed exercise. (5 points for correct answer. No partial credit). b) After completing all of the entries for Exercise 2, what is final account balance for the Paid-in Capital in Excess of Cost-Treasury Stock account? See circle on the printed exercise. (5 points for correct answer. No partial credit). c) After completing Exercise 5, what is the dollar amount the Common shareholders would receive in Year 1 (from table)? See circle on the printed exercise. ( 2.5 points for correct answer. No partial credit). d) After completing Exercise 5, what is the total dollar amount the Preferred shareholders would receive in Year 3 (from table)? See circle on the printed exercise. ( 2.5 points for correct answer. No partial credit). e) After completing the entry for Exercise 6, what is the debit entry recorded to the Retained Earnings account? See circle on the printed exercise. ( 5 points for correct answer. Exercise 1: Issuing Stock A company will often issue (sell) shares of stock to raise capital. The two main classes of stock are Common Stock and Preferred Stock. Review the completed example below for the issuance of Common Stock shares. Notice that the entry includes increases to two equity accounts, Common Stock and Paid-In Capital in Excess of Par. Par (Stated) value is an arbitrary dollar value that is often assigned to each share. The Common Stock account can only reflect the shares issued multiplied by the par value. The remainder is recorded in the PaidIn Capital account. Common Stock: Belson Corporation issued (sold) 1,000 shares of $10 par value common stock for $17 per share. The entry to record the issuance of Preferred stock is similar. Complete the following entry: Preferred Stock: Belson Corporation issued (sold) 1,000 shares of $25 par value preferred stock for $30 per share. In some instances, a stock can be issued with no par value. Review the completed example below: No-Par Stock: Belson Corporation issued (sold) 100 shares of no-par value common stock for $50 per share. Exercise 2: Treasury Stock When a company decides to re-purchase its own shares from the marketplace, these shares are recorded as Treasury Stock on the company's books. The Treasury Stock account is a contra-Equity account so it increases on the debit side. The company may later re-sell the stock to the marketplace. If it does, it cannot record any gains or losses on the sale. Instead, these amounts are recorded to the Paid-In Capital in Excess of Cost account. Recording these gains or losses to the Paid-In Capital account (recorded on the Balance Sheet) instead of a gain/loss account (recorded on the Income Statement) reduces the incentive for a company to speculate in the buying and selling of it's own stock. The "Cost Method" which ignores Par Value is used to record Treasury Stock transactions. Review the completed example below: 1) Lawson Corporation re-purchased 1,000 shares of $5 par value common stock for $10 per share. 2) Lawson later sold 100 shares of its treasury stock for $12 per share. 3) A few weeks later, Lawson sold 100 more shares of its treasury stock for $9 per share. NOTE: Treasury Stock is a contra-equity account. Next, use the t-accounts below to record the following Treasury Stock transactions for Kramer Corp: 1) Kramer Corporation re-purchased 400 shares of $1 par value common stock for $8 per share. 2) Kramer later sold 80 shares of its treasury stock for $10 per share. 3) A few weeks later, Kramer sold 30 more shares of its treasury stock for $6 per share. Exercise 3: Cash Dividends- Common Stock: A company may elect to reward its shareholders by paying them a cash dividend. This decision is up to the Board of Directors of the company. If the board does elect to pay a dividend, three dates will be designated. 1) Date of Declaration- This is the date the Board of Directors commits to the dividend. The company shall recognize a liability on this date. 2) Date of Record- Any shareholders of record as of the close of business on this date will be eligible to receive the dividend. No accounting entries are made on this date. 3) Date of Payment- This is the date the dividend is paid and the liability is relieved. Use the t-accounts below to complete the following dividend declaration and payment. If you get stuck, review the text and online examples. On January 15 , the Board of Directors of Barnes Inc. declares a $0.25 per-share dividend on its common stock to shareholders of record on January 31st.. The dividend will be paid on February 15 . Barnes has 8,000 common shares outstanding. Record the entries necessary to record the cash dividend. a) Record the declaration of the dividend on Jan 15. b) Record the payment of the dividend on Feb. 15. Next, use the chart below to complete the following problem: Carter Corporation has 8,000 outstanding common shares with a par value of $1 per share. There are 6,000 outstanding cumulative preferred shares with a dividend rate of $3 per share and a par of $40 per share. The Board of Directors declares a total of $60,000 in Year 1 and $15,000 in Year 2 and $70,000 in Year 3 available for dividends. No dividends are in arrears going into Year 1 . Determine how much should be paid to each class of stock each year. Exercise 6: Stock Dividends Rather than paying dividends in cash, a company may elect to issue additional shares to its current shareholders in the form of a stock dividend. Review the following completed example carefully: On June 20th, the Board of Directors of Commerce Inc. declares a 4% stock dividend on its 50,000 outstanding common shares. The date of record is June 30th and the dividend will be distributed on July 14th. The par value of the stock is $10 per share and the market value on July 14th is $16 per share. To record the entries for a stock dividend, first complete these steps. - Calculate the number of shares to be issued. 0.0450,000 shares =2,000 shares - Next, calculate dollar value of the stock dividend using the market value. 2000sharesx$16=$32,000 NOTE: The above entry is made when the shares are distributed on July 14th. Unlike cash dividends, there is no entry necessary at the date of declaration as there is no liability incurred on that date. This is because liabilities are a claim on assets and stock dividends are simply a transfer from Retained Earnings to Common Stock. Now, use the previous example as a guide to record the following stock dividend in the t-accts below: On May 15th, the Board of Directors of Traymont Inc. declares a 5% stock dividend on its 10,000 outstanding common shares. The date of record is May 31st and the dividend will be distributed on May 15th. The par value of the stock is $2 per share and the market value on May 15th is $7 per share. To record the entries for a stock dividend, first complete these steps. - Calculate the number of shares to be issued. - Next, calculate dollar value of the stock dividend using the market value. Exercise 7: Stock Split A company can immediately influence the price of its own stock by executing a stock split. This is often done when a stock price becomes elevated and the company wants to spark interest in the stock. No accounting entries (i.e. debits/credits) are necessary in a stock split. However, a split has the following impacts on the par value, outstanding shares and the market price (see chart below). From a shareholder's perspective a 2:1 stock split results in each shareholder doubling the number of shares they own. However, since every shareholder receives this benefit, the overall ownership and value of the investment doesn't change as a result of the split. Review the completed example below for various types of stock splits: ABC Corp. has 10,000 outstanding common shares with a $20 par value. The share price is currently $100 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started