Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. An accountant found the following errors in the books of Adnan. (i) A purchase for cash of $750 had been correctly entered into the

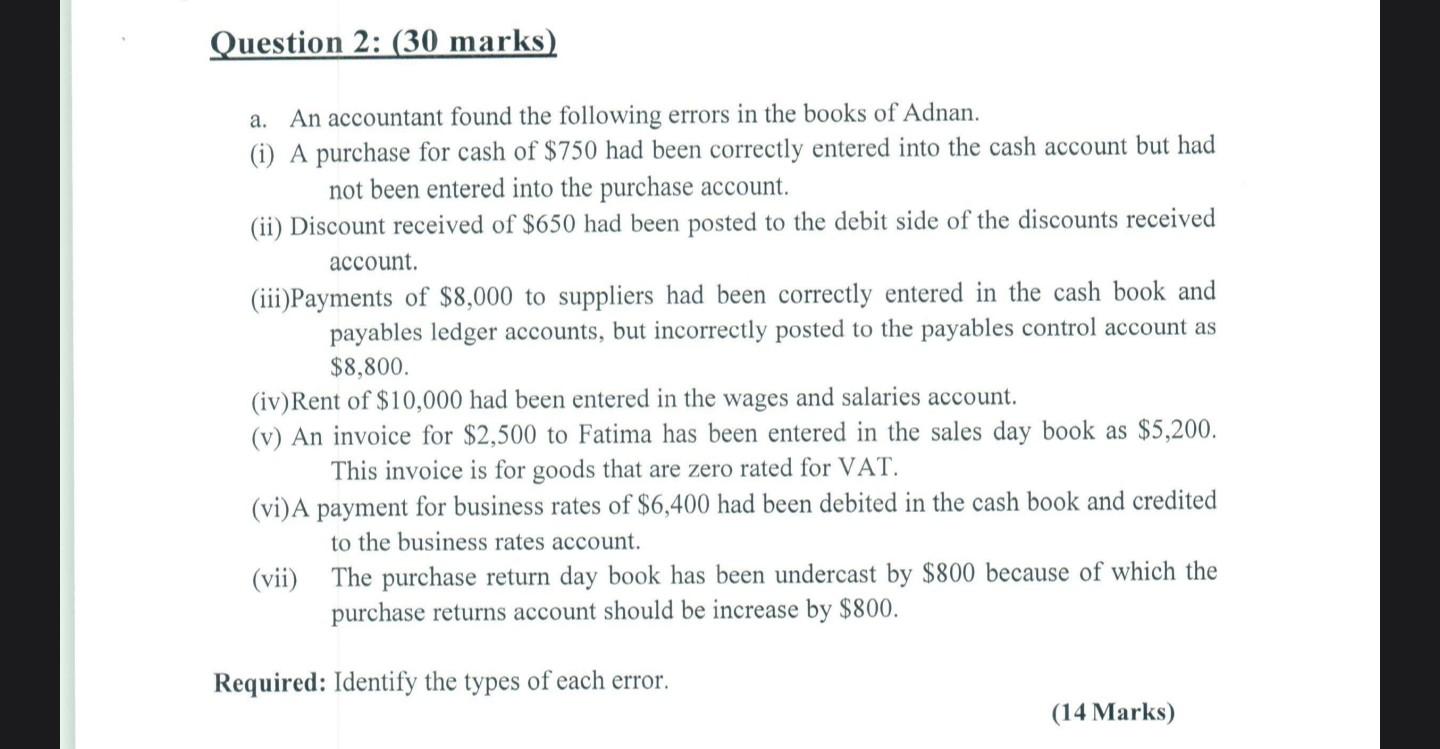

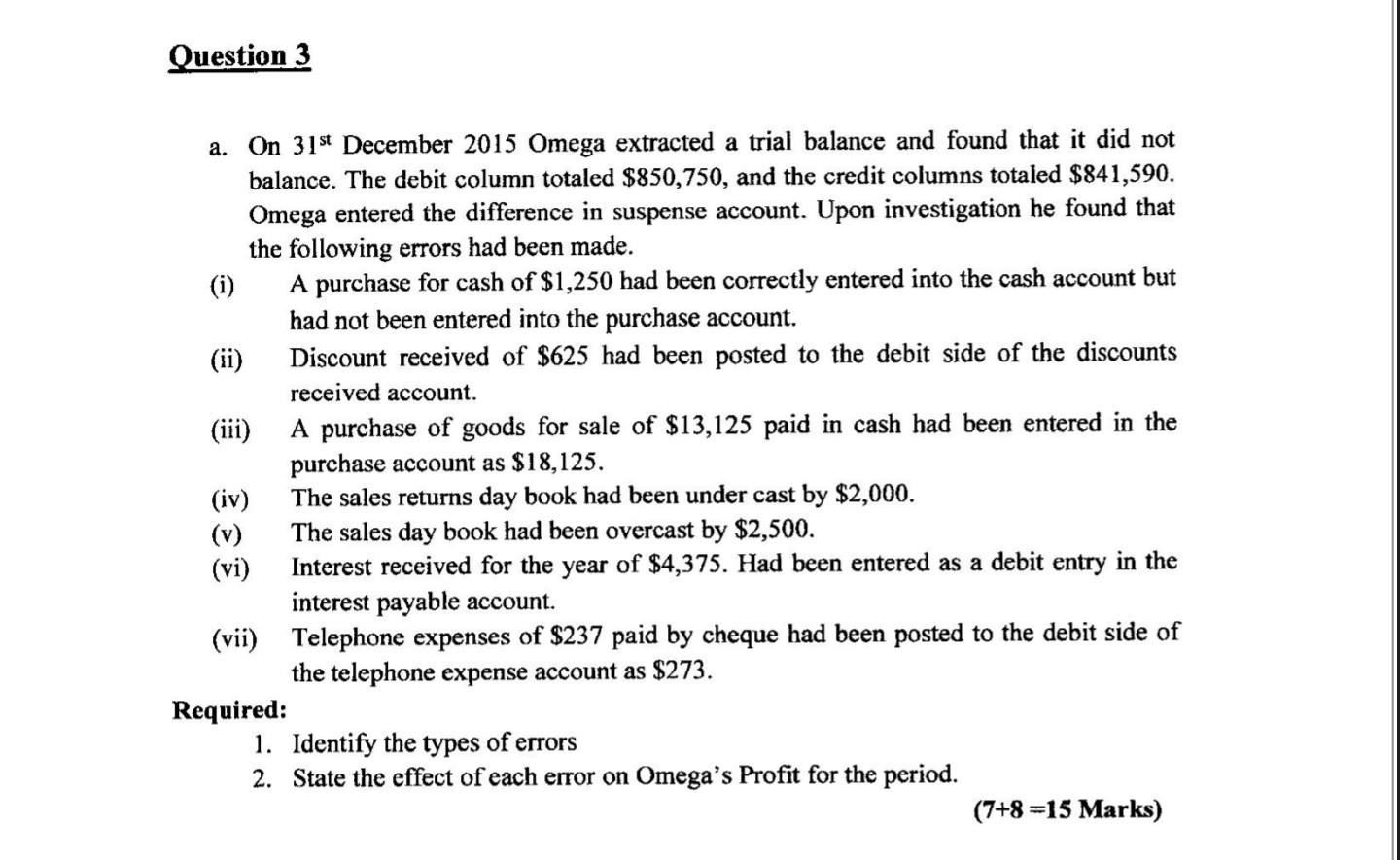

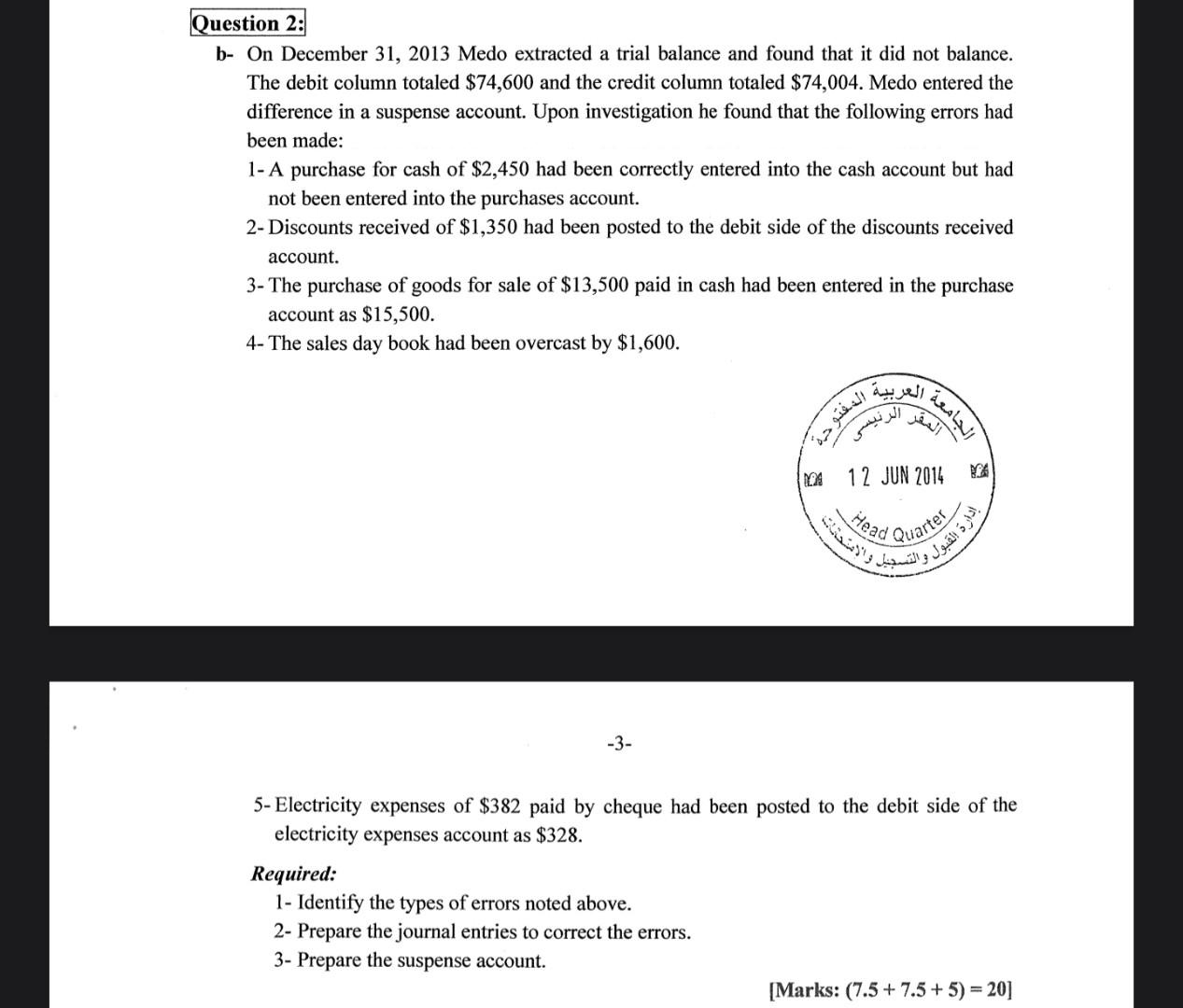

a. An accountant found the following errors in the books of Adnan. (i) A purchase for cash of $750 had been correctly entered into the cash account but had not been entered into the purchase account. (ii) Discount received of $650 had been posted to the debit side of the discounts received account. (iii)Payments of $8,000 to suppliers had been correctly entered in the cash book and payables ledger accounts, but incorrectly posted to the payables control account as $8,800. (iv)Rent of $10,000 had been entered in the wages and salaries account. (v) An invoice for $2,500 to Fatima has been entered in the sales day book as $5,200. This invoice is for goods that are zero rated for VAT. (vi) A payment for business rates of $6,400 had been debited in the cash book and credited to the business rates account. (vii) The purchase return day book has been undercast by $800 because of which the purchase returns account should be increase by $800. Required: Identify the types of each error. (14 Marks) a. On 31st December 2015 Omega extracted a trial balance and found that it did not balance. The debit column totaled $850,750, and the credit columns totaled $841,590. Omega entered the difference in suspense account. Upon investigation he found that the following errors had been made. (i) A purchase for cash of $1,250 had been correctly entered into the cash account but had not been entered into the purchase account. (ii) Discount received of $625 had been posted to the debit side of the discounts received account. (iii) A purchase of goods for sale of $13,125 paid in cash had been entered in the purchase account as $18,125. (iv) The sales returns day book had been under cast by $2,000. (v) The sales day book had been overcast by $2,500. (vi) Interest received for the year of $4,375. Had been entered as a debit entry in the interest payable account. (vii) Telephone expenses of $237 paid by cheque had been posted to the debit side of the telephone expense account as $273. Required: 1. Identify the types of errors 2. State the effect of each error on Omega's Profit for the period. (7+8=15Marks) b- On December 31, 2013 Medo extracted a trial balance and found that it did not balance. The debit column totaled $74,600 and the credit column totaled $74,004. Medo entered the difference in a suspense account. Upon investigation he found that the following errors had been made: 1- A purchase for cash of $2,450 had been correctly entered into the cash account but had not been entered into the purchases account. 2- Discounts received of $1,350 had been posted to the debit side of the discounts received account. 3- The purchase of goods for sale of $13,500 paid in cash had been entered in the purchase account as $15,500. 4- The sales day book had been overcast by $1,600. 5- Electricity expenses of $382 paid by cheque had been posted to the debit side of the electricity expenses account as $328. Required: 1- Identify the types of errors noted above. 2- Prepare the journal entries to correct the errors. 3- Prepare the suspense account. [ Marks: (7.5+7.5+5)=20] a. An accountant found the following errors in the books of Adnan. (i) A purchase for cash of $750 had been correctly entered into the cash account but had not been entered into the purchase account. (ii) Discount received of $650 had been posted to the debit side of the discounts received account. (iii)Payments of $8,000 to suppliers had been correctly entered in the cash book and payables ledger accounts, but incorrectly posted to the payables control account as $8,800. (iv)Rent of $10,000 had been entered in the wages and salaries account. (v) An invoice for $2,500 to Fatima has been entered in the sales day book as $5,200. This invoice is for goods that are zero rated for VAT. (vi) A payment for business rates of $6,400 had been debited in the cash book and credited to the business rates account. (vii) The purchase return day book has been undercast by $800 because of which the purchase returns account should be increase by $800. Required: Identify the types of each error. (14 Marks) a. On 31st December 2015 Omega extracted a trial balance and found that it did not balance. The debit column totaled $850,750, and the credit columns totaled $841,590. Omega entered the difference in suspense account. Upon investigation he found that the following errors had been made. (i) A purchase for cash of $1,250 had been correctly entered into the cash account but had not been entered into the purchase account. (ii) Discount received of $625 had been posted to the debit side of the discounts received account. (iii) A purchase of goods for sale of $13,125 paid in cash had been entered in the purchase account as $18,125. (iv) The sales returns day book had been under cast by $2,000. (v) The sales day book had been overcast by $2,500. (vi) Interest received for the year of $4,375. Had been entered as a debit entry in the interest payable account. (vii) Telephone expenses of $237 paid by cheque had been posted to the debit side of the telephone expense account as $273. Required: 1. Identify the types of errors 2. State the effect of each error on Omega's Profit for the period. (7+8=15Marks) b- On December 31, 2013 Medo extracted a trial balance and found that it did not balance. The debit column totaled $74,600 and the credit column totaled $74,004. Medo entered the difference in a suspense account. Upon investigation he found that the following errors had been made: 1- A purchase for cash of $2,450 had been correctly entered into the cash account but had not been entered into the purchases account. 2- Discounts received of $1,350 had been posted to the debit side of the discounts received account. 3- The purchase of goods for sale of $13,500 paid in cash had been entered in the purchase account as $15,500. 4- The sales day book had been overcast by $1,600. 5- Electricity expenses of $382 paid by cheque had been posted to the debit side of the electricity expenses account as $328. Required: 1- Identify the types of errors noted above. 2- Prepare the journal entries to correct the errors. 3- Prepare the suspense account. [ Marks: (7.5+7.5+5)=20]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started