Answered step by step

Verified Expert Solution

Question

1 Approved Answer

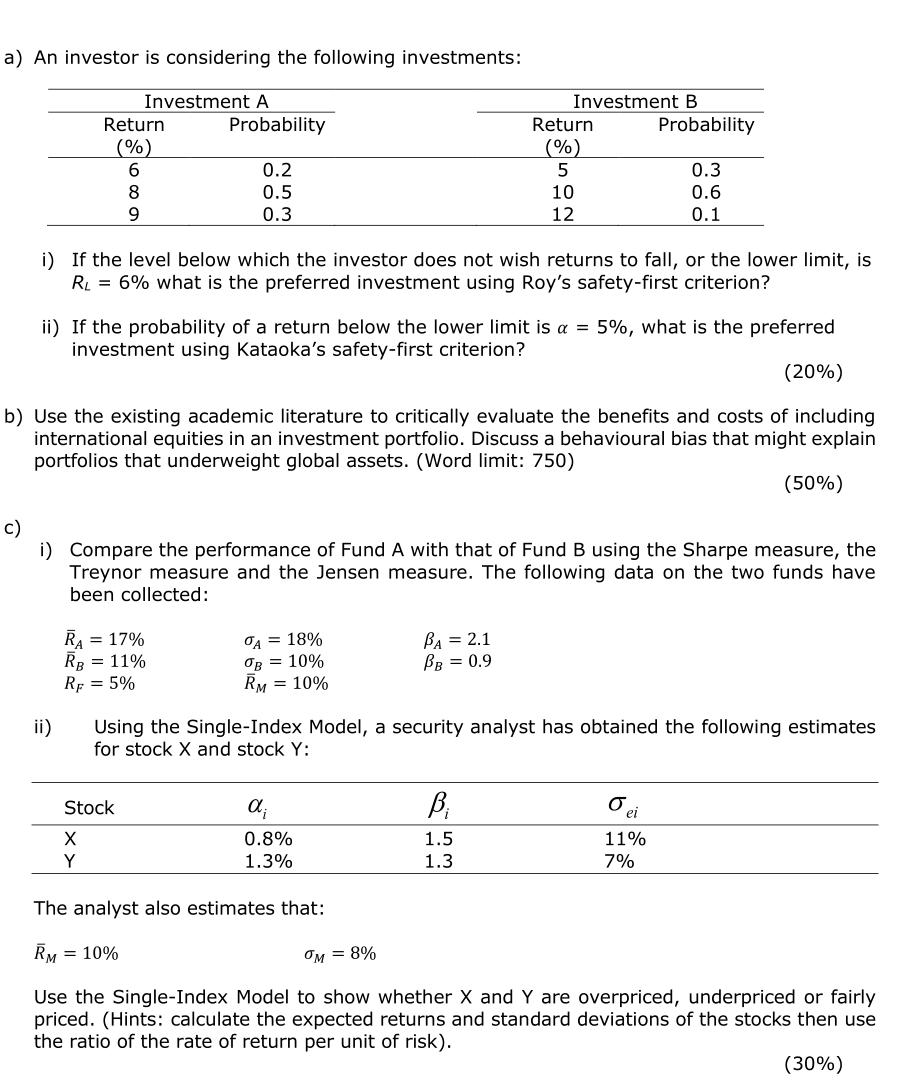

a) An investor is considering the following investments: Return (%) 6 8 9 ii) Investment A Probability R = 17% RB = 11% RF

a) An investor is considering the following investments: Return (%) 6 8 9 ii) Investment A Probability R = 17% RB = 11% RF = 5% 0.2 0.5 0.3 Stock X Y i) If the level below which the investor does not wish returns to fall, or the lower limit, is RL = 6% what is the preferred investment using Roy's safety-first criterion? ii) If the probability of a return below the lower limit is a = 5%, what is the preferred investment using Kataoka's safety-first criterion? (20%) b) Use the existing academic literature to critically evaluate the benefits and costs of including international equities in an investment portfolio. Discuss a behavioural bias that might explain portfolios that underweight global assets. (Word limit: 750) TA = 18% OB = 10% RM = 10% Investment B Return (%) 5 c) i) Compare the performance of Fund A with that of Fund B using the Sharpe measure, the Treynor measure and the Jensen measure. The following data on the two funds have been collected: BA = 2.1 BB = 0.9 ; 0.8% 1.3% 10 12 B 1.5 1.3 Probability 0.3 0.6 0.1 Using the Single-Index Model, a security analyst has obtained the following estimates for stock X and stock Y: ei 11% 7% (50%) The analyst also estimates that: RM = 10% OM = 8% Use the Single-Index Model to show whether X and Y are overpriced, underpriced or fairly priced. (Hints: calculate the expected returns and standard deviations of the stocks then use the ratio of the rate of return per unit of risk). (30%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i Using Roys safetyfirst criterion the preferred investment is Investment B since it has the highe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started