Answered step by step

Verified Expert Solution

Question

1 Approved Answer

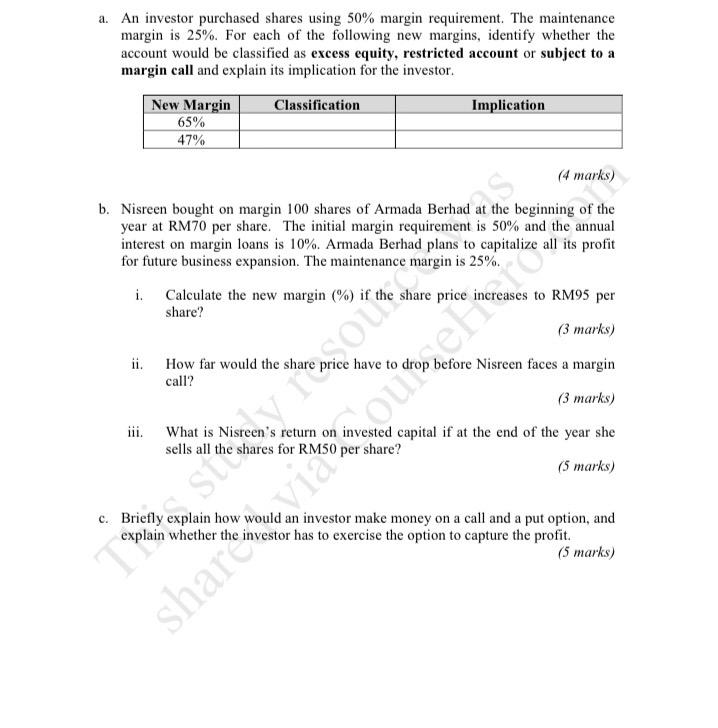

a. An investor purchased shares using 50% margin requirement. The maintenance margin is 25%. For each of the following new margins, identify whether the

a. An investor purchased shares using 50% margin requirement. The maintenance margin is 25%. For each of the following new margins, identify whether the account would be classified as excess equity, restricted account or subject to a margin call and explain its implication for the investor. New Margin 65% 47% Classification Implication ii. How far would the share price have to call? iii. c. Briefly explain how would an investor make money on a call and a put option, and explain whether the investor has to exercise the option to capture the profit. share via ou el fom (4 marks) b. Nisreen bought on margin 100 shares of Armada Berhad at the beginning of the year at RM70 per share. The initial margin requirement is 50% and the annual interest on margin loans is 10%. Armada Berhad plans to capitalize all its profit for future business expansion. The maintenance margin is 25%. i. Calculate the new margin (%) if share? cases to RM95 per (3 marks) before Nisreen faces a margin (3 marks) What is Nisreen's return on invested capital if at the end of the year she (5 marks) (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a New Margin 65 Classification Excess equity Implication With a new margin of 65 the investor has more equity in the account than required This means the investor has excess equity which provides a bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started