Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Answer both subquestions: i. Umberto is planning to retire in 30 years' time with a pension fund valued at 300,000. What is his

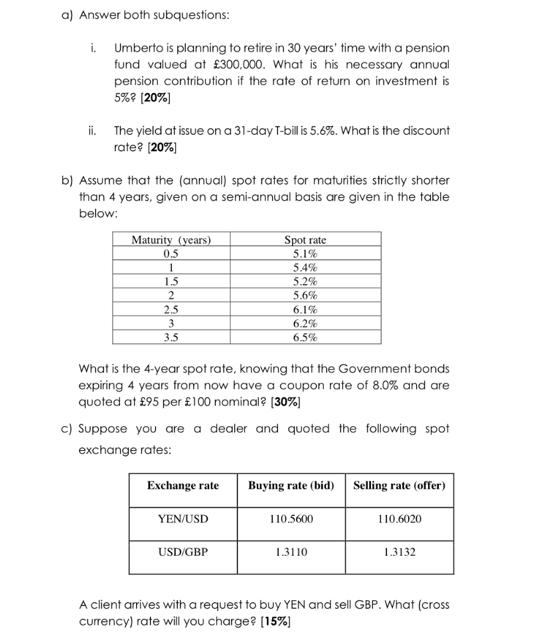

a) Answer both subquestions: i. Umberto is planning to retire in 30 years' time with a pension fund valued at 300,000. What is his necessary annual pension contribution if the rate of return on investment is 5%? [20%] ii. The yield at issue on a 31-day T-bill is 5.6%. What is the discount rate? [20%] b) Assume that the (annual) spot rates for maturities strictly shorter than 4 years, given on a semi-annual basis are given in the table below: Maturity (years) 0.5 1 1.5 2 2.5 3 3.5 What is the 4-year spot rate, knowing that the Government bonds expiring 4 years from now have a coupon rate of 8.0% and are quoted at 95 per 100 nominal? [30%] Exchange rate Spot rate 5.1% 5.4% 5.2% 5.6% 6.1% c) Suppose you are a dealer and quoted the following spot exchange rates: YEN/USD 6.2% 6.5% USD/GBP Buying rate (bid) Selling rate (offer) 110.5600 1.3110 110.6020 1.3132 A client arrives with a request to buy YEN and sell GBP. What (cross currency) rate will you charge? [15%]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started