Answered step by step

Verified Expert Solution

Question

1 Approved Answer

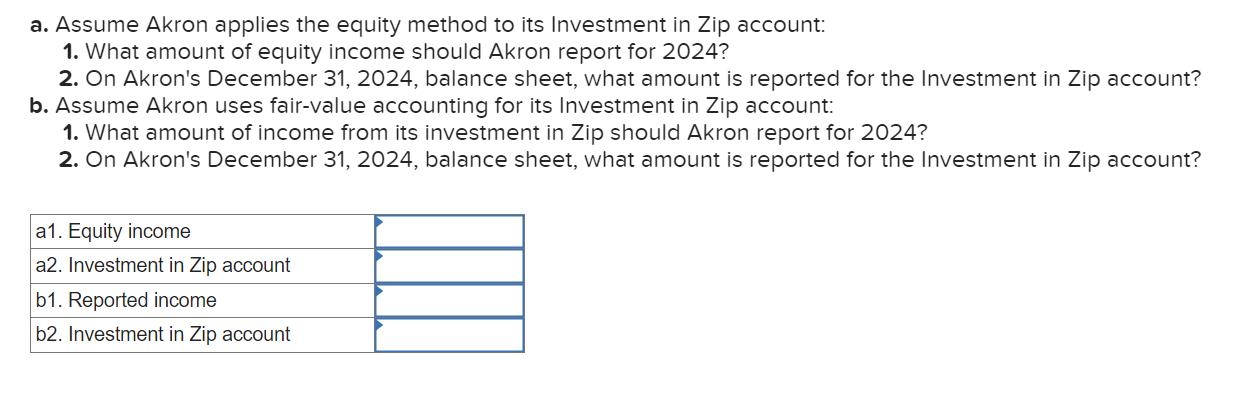

a. Assume Akron applies the equity method to its Investment in Zip account: 1. What amount of equity income should Akron report for 2024?

a. Assume Akron applies the equity method to its Investment in Zip account: 1. What amount of equity income should Akron report for 2024? 2. On Akron's December 31, 2024, balance sheet, what amount is reported for the Investment in Zip account? b. Assume Akron uses fair-value accounting for its Investment in Zip account: 1. What amount of income from its investment in Zip should Akron report for 2024? 2. On Akron's December 31, 2024, balance sheet, what amount is reported for the Investment in Zip account? a1. Equity income a2. Investment in Zip account b1. Reported income b2. Investment in Zip account

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Equity Method 1 Equity Income for 2024 To calculate equity income under the equity method we need the ownership percentage or shareholding of Akron ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started