Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Assume the first year power production of a module to be 100% of the rated power of the module. The linear drop of power

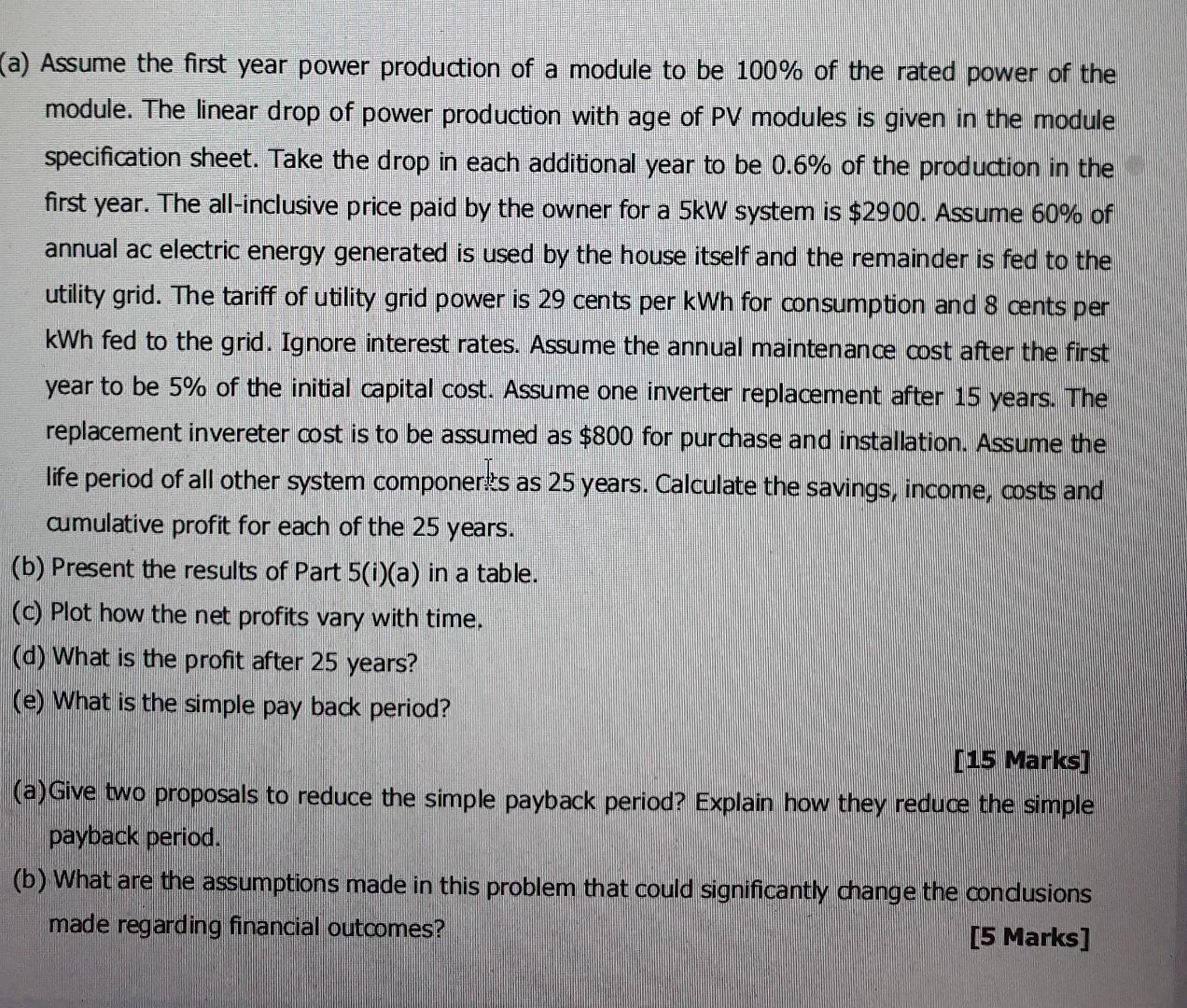

(a) Assume the first year power production of a module to be 100% of the rated power of the module. The linear drop of power production with age of PV modules is given in the module specification sheet. Take the drop in each additional year to be 0.6% of the production in the first year. The all-inclusive price paid by the owner for a 5kW system is $2900. Assume 60% of annual ac electric energy generated is used by the house itself and the remainder is fed to the utility grid. The tariff of utility grid power is 29 cents per kWh for consumption and 8 cents per kWh fed to the grid. Ignore interest rates. Assume the annual maintenance cost after the first year to be 5% of the initial capital cost. Assume one inverter replacement after 15 years. The replacement invereter cost is to be assumed as $800 for purchase and installation. Assume the life period of all other system componerks as 25 years. Calculate the savings, income, costs and cumulative profit for each of the 25 years. (b) Present the results of Part 5(1)(a) in a table. (c) Plot how the net profits vary with time. (d) What is the profit after 25 years? (e) What is the simple pay back period? [15 Marks] (a)Give two proposals to reduce the simple payback period? Explain how they reduce the simple payback period. (b) What are the assumptions made in this problem that could significantly change the condusions made regarding financial outcomes? [5 Marks] (a) Assume the first year power production of a module to be 100% of the rated power of the module. The linear drop of power production with age of PV modules is given in the module specification sheet. Take the drop in each additional year to be 0.6% of the production in the first year. The all-inclusive price paid by the owner for a 5kW system is $2900. Assume 60% of annual ac electric energy generated is used by the house itself and the remainder is fed to the utility grid. The tariff of utility grid power is 29 cents per kWh for consumption and 8 cents per kWh fed to the grid. Ignore interest rates. Assume the annual maintenance cost after the first year to be 5% of the initial capital cost. Assume one inverter replacement after 15 years. The replacement invereter cost is to be assumed as $800 for purchase and installation. Assume the life period of all other system componerks as 25 years. Calculate the savings, income, costs and cumulative profit for each of the 25 years. (b) Present the results of Part 5(1)(a) in a table. (c) Plot how the net profits vary with time. (d) What is the profit after 25 years? (e) What is the simple pay back period? [15 Marks] (a)Give two proposals to reduce the simple payback period? Explain how they reduce the simple payback period. (b) What are the assumptions made in this problem that could significantly change the condusions made regarding financial outcomes? [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started