Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Assuming Cest directly acquires the shares of Parfum, construct the projected consolidated statement of financial position, the projected consolidated statement of profit or loss,

a. Assuming Cest directly acquires the shares of Parfum, construct the projected consolidated statement of financial position, the projected consolidated statement of profit or loss, and the projected consolidated statement of changes in equity (partial) for the Cest group for the year 20x3. Consolidation journal entries, consolidation worksheets, and independent calculations/proofs are not required.

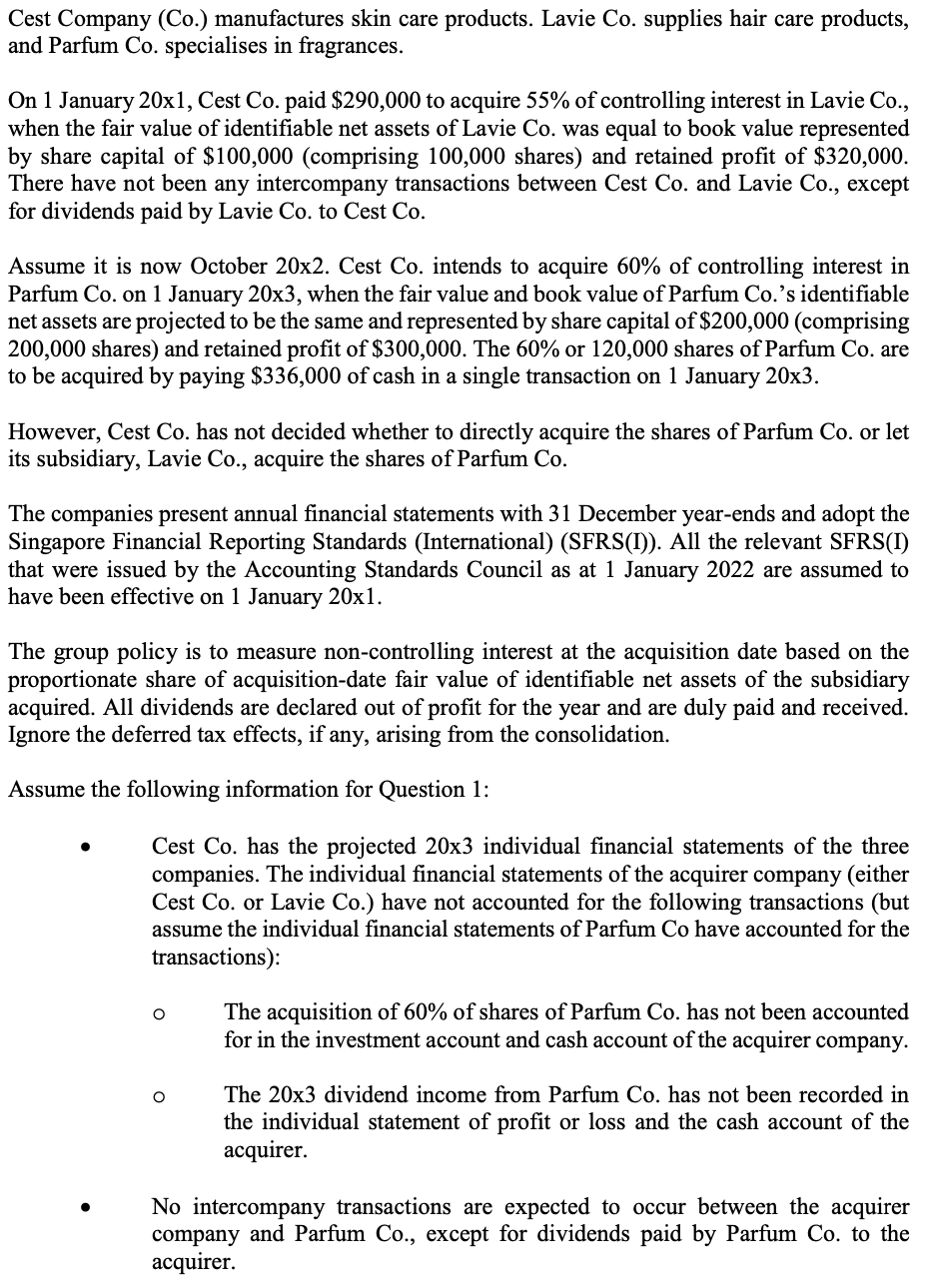

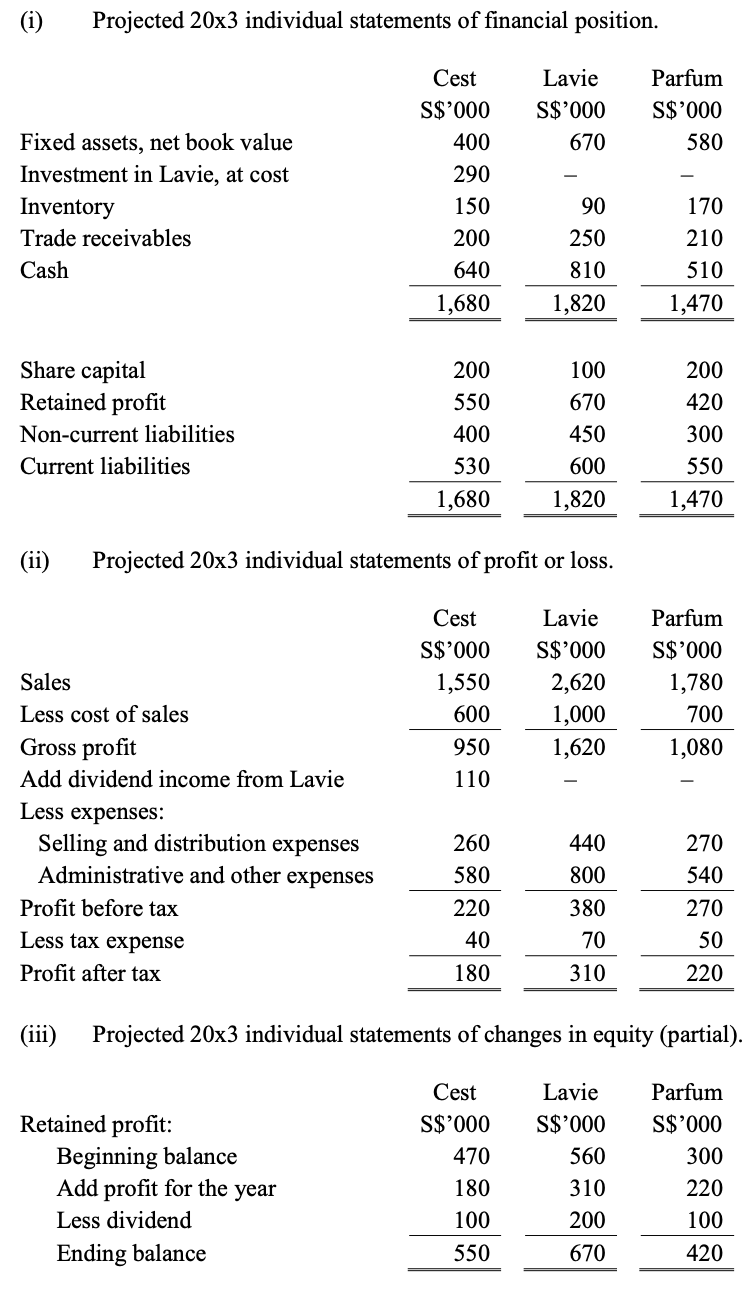

Cest Company (Co.) manufactures skin care products. Lavie Co. supplies hair care products, and Parfum Co. specialises in fragrances. On 1 January 20x1, Cest Co. paid $290,000 to acquire 55% of controlling interest in Lavie Co., when the fair value of identifiable net assets of Lavie Co. was equal to book value represented by share capital of $100,000 (comprising 100,000 shares) and retained profit of $320,000. There have not been any intercompany transactions between Cest Co. and Lavie Co., except for dividends paid by Lavie Co. to Cest Co. Assume it is now October 20x2. Cest Co. intends to acquire 60% of controlling interest in Parfum Co. on 1 January 20x3, when the fair value and book value of Parfum Co.'s identifiable net assets are projected to be the same and represented by share capital of $200,000 (comprising 200,000 shares) and retained profit of $300,000. The 60% or 120,000 shares of Parfum Co. are to be acquired by paying $336,000 of cash in a single transaction on 1 January 20x3. However, Cest Co. has not decided whether to directly acquire the shares of Parfum Co. or let its subsidiary, Lavie Co., acquire the shares of Parfum Co. The companies present annual financial statements with 31 December year-ends and adopt the Singapore Financial Reporting Standards (International) (SFRS(I)). All the relevant SFRS(I) that were issued by the Accounting Standards Council as at 1 January 2022 are assumed to have been effective on 1 January 20x1. The group policy is to measure non-controlling interest at the acquisition date based on the proportionate share of acquisition-date fair value of identifiable net assets of the subsidiary acquired. All dividends are declared out of profit for the year and are duly paid and received. Ignore the deferred tax effects, if any, arising from the consolidation. Assume the following information for Question 1: Cest Co. has the projected 20x3 individual financial statements of the three companies. The individual financial statements of the acquirer company (either Cest Co. or Lavie Co.) have not accounted for the following transactions (but assume the individual financial statements of Parfum Co have accounted for the transactions): O The acquisition of 60% of shares of Parfum Co. has not been accounted for in the investment account and cash account of the acquirer company. O The 20x3 dividend income from Parfum Co. has not been recorded in the individual statement of profit or loss and the cash account of the acquirer. No intercompany transactions are expected to occur between the acquirer company and Parfum Co., except for dividends paid by Parfum Co. to the acquirer. (i) Projected 20x3 individual statements of financial position. Lavie S$'000 670 Parfum S$'000 580 Fixed assets, net book value Investment in Lavie, at cost Inventory Trade receivables Cash Cest S$'000 400 290 150 200 640 1,680 90 250 810 170 210 510 1,470 1,820 Share capital Retained profit Non-current liabilities Current liabilities 200 550 400 530 1,680 100 670 450 600 1,820 200 420 300 550 1,470 (ii) Projected 20x3 individual statements of profit or loss. Cest S$'000 1,550 600 950 110 Lavie S$'000 2,620 1,000 1,620 Parfum S$'000 1,780 700 1,080 Sales Less cost of sales Gross profit Add dividend income from Lavie Less expenses: Selling and distribution expenses A nistrative and other expenses Profit before tax Less tax expense Profit after tax 440 800 270 540 260 580 220 40 180 380 70 310 270 50 220 (11) Projected 20x3 individual statements of changes in equity (partial). Retained profit: Beginning balance Add profit for the year Less dividend Ending balance Cest S$'000 470 180 Lavie S$'000 560 310 200 670 Parfum S$'000 300 220 100 420 100 550 Cest Company (Co.) manufactures skin care products. Lavie Co. supplies hair care products, and Parfum Co. specialises in fragrances. On 1 January 20x1, Cest Co. paid $290,000 to acquire 55% of controlling interest in Lavie Co., when the fair value of identifiable net assets of Lavie Co. was equal to book value represented by share capital of $100,000 (comprising 100,000 shares) and retained profit of $320,000. There have not been any intercompany transactions between Cest Co. and Lavie Co., except for dividends paid by Lavie Co. to Cest Co. Assume it is now October 20x2. Cest Co. intends to acquire 60% of controlling interest in Parfum Co. on 1 January 20x3, when the fair value and book value of Parfum Co.'s identifiable net assets are projected to be the same and represented by share capital of $200,000 (comprising 200,000 shares) and retained profit of $300,000. The 60% or 120,000 shares of Parfum Co. are to be acquired by paying $336,000 of cash in a single transaction on 1 January 20x3. However, Cest Co. has not decided whether to directly acquire the shares of Parfum Co. or let its subsidiary, Lavie Co., acquire the shares of Parfum Co. The companies present annual financial statements with 31 December year-ends and adopt the Singapore Financial Reporting Standards (International) (SFRS(I)). All the relevant SFRS(I) that were issued by the Accounting Standards Council as at 1 January 2022 are assumed to have been effective on 1 January 20x1. The group policy is to measure non-controlling interest at the acquisition date based on the proportionate share of acquisition-date fair value of identifiable net assets of the subsidiary acquired. All dividends are declared out of profit for the year and are duly paid and received. Ignore the deferred tax effects, if any, arising from the consolidation. Assume the following information for Question 1: Cest Co. has the projected 20x3 individual financial statements of the three companies. The individual financial statements of the acquirer company (either Cest Co. or Lavie Co.) have not accounted for the following transactions (but assume the individual financial statements of Parfum Co have accounted for the transactions): O The acquisition of 60% of shares of Parfum Co. has not been accounted for in the investment account and cash account of the acquirer company. O The 20x3 dividend income from Parfum Co. has not been recorded in the individual statement of profit or loss and the cash account of the acquirer. No intercompany transactions are expected to occur between the acquirer company and Parfum Co., except for dividends paid by Parfum Co. to the acquirer. (i) Projected 20x3 individual statements of financial position. Lavie S$'000 670 Parfum S$'000 580 Fixed assets, net book value Investment in Lavie, at cost Inventory Trade receivables Cash Cest S$'000 400 290 150 200 640 1,680 90 250 810 170 210 510 1,470 1,820 Share capital Retained profit Non-current liabilities Current liabilities 200 550 400 530 1,680 100 670 450 600 1,820 200 420 300 550 1,470 (ii) Projected 20x3 individual statements of profit or loss. Cest S$'000 1,550 600 950 110 Lavie S$'000 2,620 1,000 1,620 Parfum S$'000 1,780 700 1,080 Sales Less cost of sales Gross profit Add dividend income from Lavie Less expenses: Selling and distribution expenses A nistrative and other expenses Profit before tax Less tax expense Profit after tax 440 800 270 540 260 580 220 40 180 380 70 310 270 50 220 (11) Projected 20x3 individual statements of changes in equity (partial). Retained profit: Beginning balance Add profit for the year Less dividend Ending balance Cest S$'000 470 180 Lavie S$'000 560 310 200 670 Parfum S$'000 300 220 100 420 100 550Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started