A, B and C please

VaR approach

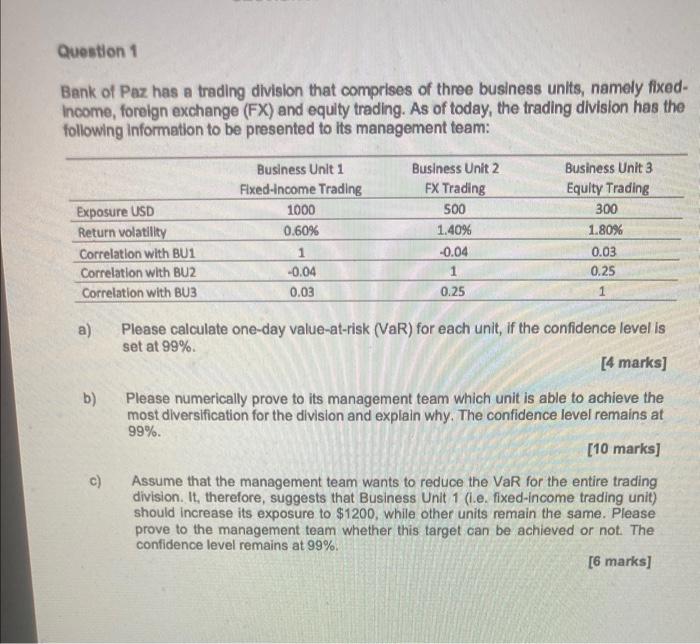

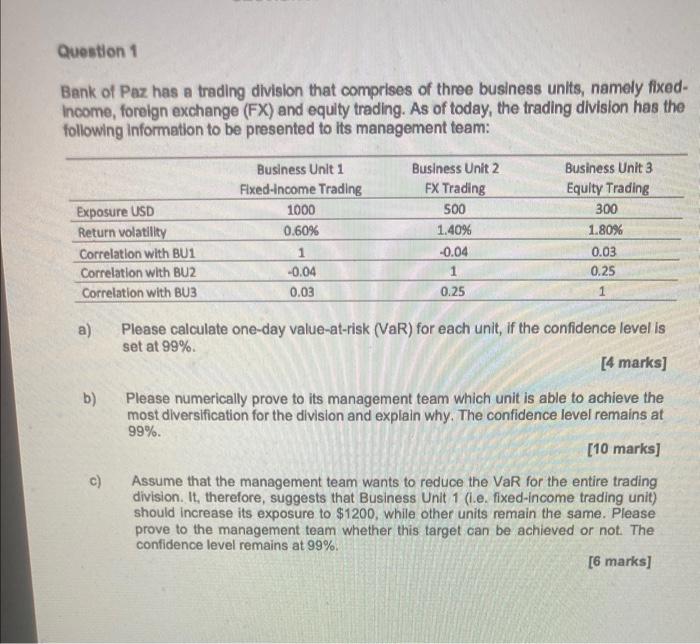

Question 1 Bank of Paz has a trading division that comprises of three business units, namely fixed- Income, foreign exchange (FX) and equity trading. As of today, the trading division has the following Information to be presented to its management team: Exposure USD Return volatility Correlation with BU1 Correlation with BU2 Correlation with BU3 Business Unit 1 Fixed Income Trading 1000 0.60% 1 -0.04 0.03 Business Unit 2 FX Trading 500 1.40% -0.04 1 0.25 Business Unit 3 Equity Trading 300 1.80% 0.03 0.25 1 a) ) b) Please calculate one-day value-at-risk (VaR) for each unit, if the confidence level is set at 99% [4 marks] Please numerically prove to its management team which unit is able to achieve the most diversification for the division and explain why. The confidence level remains at 99% [10 marks] Assume that the management team wants to reduce the VaR for the entire trading division. It, therefore, suggests that Business Unit 1 (l.e. fixed-income trading unit) should increase its exposure to $1200, while other units remain the same. Please prove to the management team whether this target can be achieved or not. The confidence level remains at 99% [6 marks] c) Question 1 Bank of Paz has a trading division that comprises of three business units, namely fixed- Income, foreign exchange (FX) and equity trading. As of today, the trading division has the following Information to be presented to its management team: Exposure USD Return volatility Correlation with BU1 Correlation with BU2 Correlation with BU3 Business Unit 1 Fixed Income Trading 1000 0.60% 1 -0.04 0.03 Business Unit 2 FX Trading 500 1.40% -0.04 1 0.25 Business Unit 3 Equity Trading 300 1.80% 0.03 0.25 1 a) ) b) Please calculate one-day value-at-risk (VaR) for each unit, if the confidence level is set at 99% [4 marks] Please numerically prove to its management team which unit is able to achieve the most diversification for the division and explain why. The confidence level remains at 99% [10 marks] Assume that the management team wants to reduce the VaR for the entire trading division. It, therefore, suggests that Business Unit 1 (l.e. fixed-income trading unit) should increase its exposure to $1200, while other units remain the same. Please prove to the management team whether this target can be achieved or not. The confidence level remains at 99% [6 marks] c)