Answered step by step

Verified Expert Solution

Question

1 Approved Answer

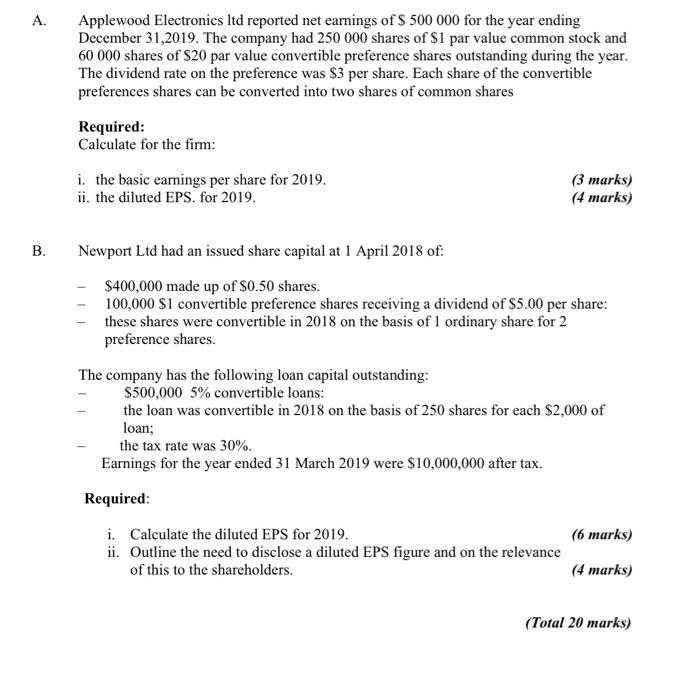

A. B. Applewood Electronics Itd reported net earnings of $ 500 000 for the year ending December 31,2019. The company had 250 000 shares

A. B. Applewood Electronics Itd reported net earnings of $ 500 000 for the year ending December 31,2019. The company had 250 000 shares of $1 par value common stock and 60 000 shares of $20 par value convertible preference shares outstanding during the year. The dividend rate on the preference was $3 per share. Each share of the convertible preferences shares can be converted into two shares of common shares Required: Calculate for the firm: i. the basic earnings per share for 2019. ii. the diluted EPS. for 2019. (3 marks) (4 marks) Newport Ltd had an issued share capital at 1 April 2018 of: $400,000 made up of $0.50 shares. 100,000 $1 convertible preference shares receiving a dividend of $5.00 per share: these shares were convertible in 2018 on the basis of 1 ordinary share for 2 preference shares. The company has the following loan capital outstanding: $500,000 5% convertible loans: the loan was convertible in 2018 on the basis of 250 shares for each $2,000 of loan; the tax rate was 30%. Earnings for the year ended 31 March 2019 were $10,000,000 after tax. Required: i. Calculate the diluted EPS for 2019. ii. Outline the need to disclose a diluted EPS figure and on the relevance of this to the shareholders. (6 marks) (4 marks) (Total 20 marks)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A i To calculate the basic earnings per share EPS for 2019 we need to divide the net earnings by the weighted average number of common shares outstand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started