Answered step by step

Verified Expert Solution

Question

1 Approved Answer

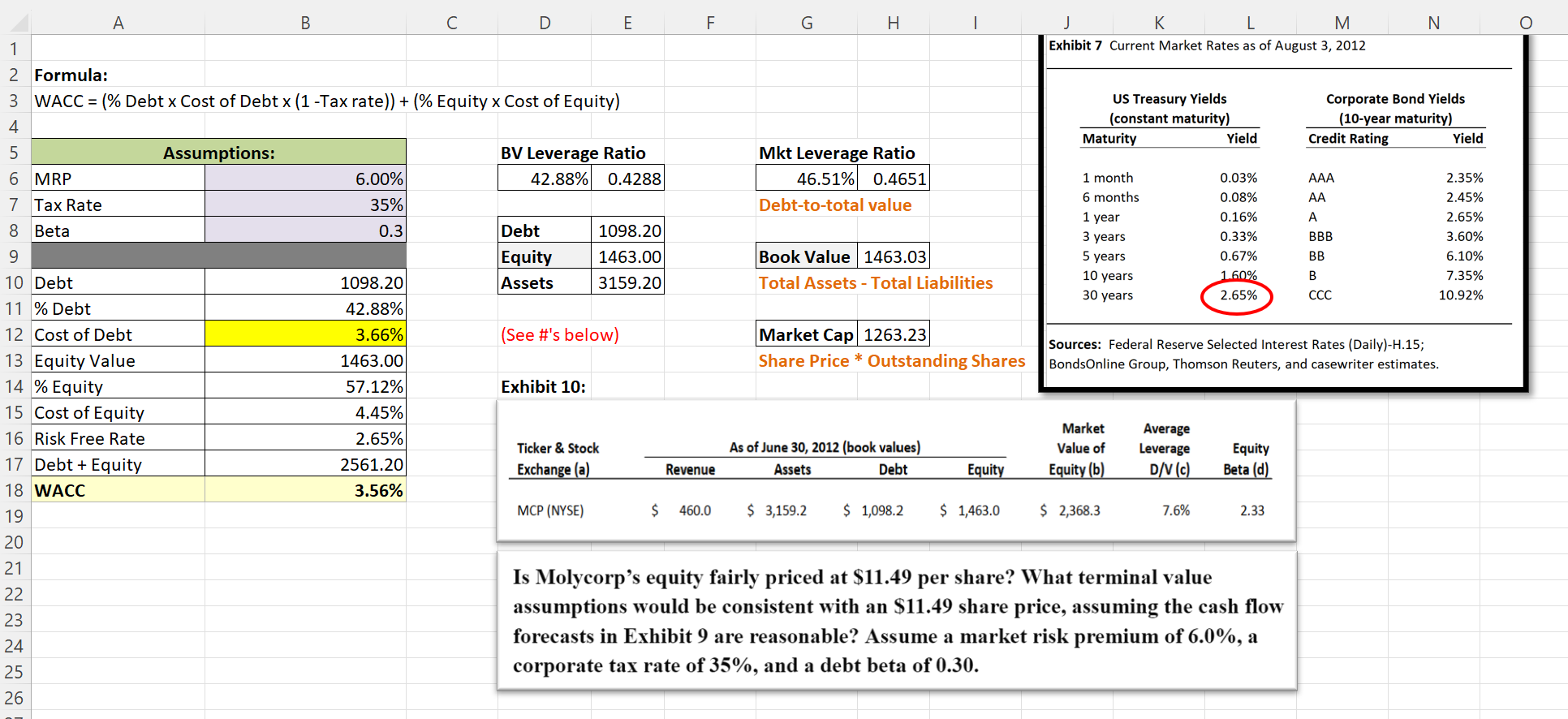

A B Assumptions: 1 2 Formula: 3 WACC = (% Debt x Cost of Debtx (1 -Tax rate)) + (% Equity x Cost of

A B Assumptions: 1 2 Formula: 3 WACC = (% Debt x Cost of Debtx (1 -Tax rate)) + (% Equity x Cost of Equity) 4 5 6 MRP 7 Tax Rate 8 Beta 9 10 Debt 11 % Debt 12 Cost of Debt 13 Equity Value 14 % Equity 15 Cost of Equity 16 Risk Free Rate 17 Debt + Equity 18 WACC 19 20 21 22 23 24 25 26 6.00% 35% 0.3 1098.20 42.88% 3.66% 1463.00 57.12% 4.45% 2.65% 2561.20 3.56% D BV Leverage Ratio 42.88% 0.4288 Debt Equity Assets (See #'s below) Exhibit 10: E 1098.20 1463.00 3159.20 Ticker & Stock Exchange (a) MCP (NYSE) $ F Revenue 460.0 G H Mkt Leverage Ratio 46.51% 0.4651 Debt-to-total value Book Value 1463.03 Total Assets - Total Liabilities Market Cap 1263.23 Share Price* Outstanding Shares As of June 30, 2012 (book values) Assets Debt $ 3,159.2 $ 1,098.2 Equity $ 1,463.0 M K Exhibit 7 Current Market Rates as of August 3, 2012 US Treasury Yields (constant maturity) Maturity 1 month 6 months 1 year 3 years 5 years 10 years 30 years Market Value of Equity (b) $ 2,368.3 Average Leverage D/V (c) Yield 7.6% 0.03% 0.08% 0.16% 0.33% 0.67% 1.60% 2.65% Sources: Federal Reserve Selected Interest Rates (Daily)-H.15; BondsOnline Group, Thomson Reuters, and casewriter estimates. Equity Beta (d) 2.33 Is Molycorp's equity fairly priced at $11.49 per share? What terminal value assumptions would be consistent with an $11.49 share price, assuming the cash flow forecasts in Exhibit 9 are reasonable? Assume a market risk premium of 6.0%, a corporate tax rate of 35%, and a debt beta of 0.30. Corporate Bond Yields (10-year maturity) Credit Rating N AAA AA A BBB BB B CCC Yield 2.35% 2.45% 2.65% 3.60% 6.10% 7.35% 10.92% O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine if Molycorps equity is fairly priced at 1149 per share we need to calculate the company...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started