Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. B. C. D. E. F. G. H. 1. Required: 1. 2. The following information relates to Turkey Burger Inc. as at January 1,

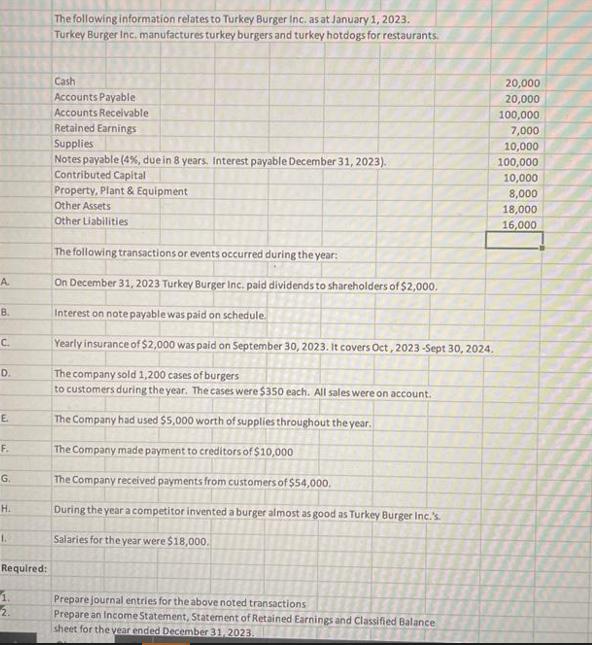

A. B. C. D. E. F. G. H. 1. Required: 1. 2. The following information relates to Turkey Burger Inc. as at January 1, 2023. Turkey Burger Inc. manufactures turkey burgers and turkey hotdogs for restaurants. Cash Accounts Payable Accounts Receivable Retained Earnings Supplies Notes payable ( 4 %, due in 8 years. Interest payable December 31, 2023). Contributed Capital Property, Plant & Equipment Other Assets Other Liabilities The following transactions or events occurred during the year: On December 31, 2023 Turkey Burger Inc. paid dividends to shareholders of $2,000. Interest on note payable was paid on schedule. Yearly insurance of $2,000 was paid on September 30, 2023. It covers Oct, 2023-Sept 30, 2024. The company sold 1,200 cases of burgers to customers during the year. The cases were $350 each. All sales were on account. The Company had used $5,000 worth of supplies throughout the year. The Company made payment to creditors of $10,000 The Company received payments from customers of $54,000. During the year a competitor invented a burger almost as good as Turkey Burger Inc.'s. Salaries for the year were $18,000. Prepare journal entries for the above noted transactions Prepare an Income Statement, Statement of Retained Earnings and Classified Balance sheet for the year ended December 31, 2023. 20,000 20,000 100,000 7,000 10,000 100,000 10,000 8,000 18,000 16,000

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions A Dividends Retained Earnings 2000 Dividends Payab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started