Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B C F G H M N E K Q II. Your division is considering two investment projects, each of which require s an

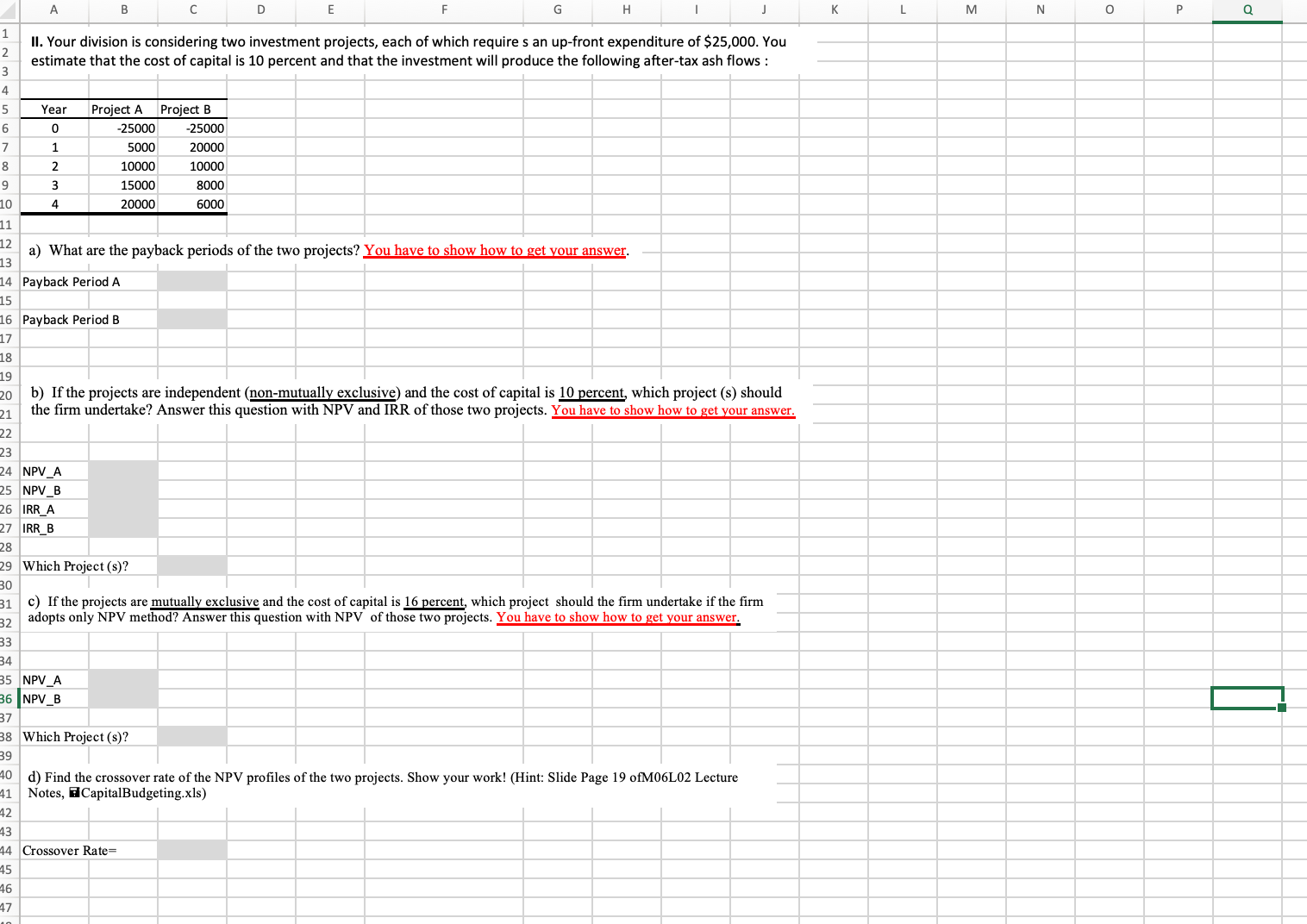

A B C F G H M N E K Q II. Your division is considering two investment projects, each of which require s an up-front expenditure of $25,000. You estimate that the cost of capital is 10 percent and that the investment will produce the following after-tax ash flows : \begin{tabular}{|c|r|r|} \hline Year & Project A & Project B \\ \hline 0 & -25000 & -25000 \\ \hline 1 & 5000 & 20000 \\ \hline 2 & 10000 & 10000 \\ \hline 3 & 15000 & 8000 \\ \hline 4 & 20000 & 6000 \\ \hline \end{tabular} a) What are the payback periods of the two projects? You have to show how to get your answer. Payback Period A Payback Period B b) If the projects are independent (non-mutually exclusive) and the cost of capital is 10 percent, which project (s) should the firm undertake? Answer this question with NPV and IRR of those two projects. You have to show how to get your answer. NPV_A NPV_B IRR_A IRR_B Which Project (s)? c) If the projects are mutually exclusive and the cost of capital is 16 percent, which project should the firm undertake if the firm adopts only NPV method? Answer this question with NPV of those two projects. You have to show how to get your answer. NPV_A NPV_B Which Project (s)? d) Find the crossover rate of the NPV profiles of the two projects. Show your work! (Hint: Slide Page 19 ofM06L02 Lecture Notes, 7 CapitalBudgeting.xls) Crossover Rate =

A B C F G H M N E K Q II. Your division is considering two investment projects, each of which require s an up-front expenditure of $25,000. You estimate that the cost of capital is 10 percent and that the investment will produce the following after-tax ash flows : \begin{tabular}{|c|r|r|} \hline Year & Project A & Project B \\ \hline 0 & -25000 & -25000 \\ \hline 1 & 5000 & 20000 \\ \hline 2 & 10000 & 10000 \\ \hline 3 & 15000 & 8000 \\ \hline 4 & 20000 & 6000 \\ \hline \end{tabular} a) What are the payback periods of the two projects? You have to show how to get your answer. Payback Period A Payback Period B b) If the projects are independent (non-mutually exclusive) and the cost of capital is 10 percent, which project (s) should the firm undertake? Answer this question with NPV and IRR of those two projects. You have to show how to get your answer. NPV_A NPV_B IRR_A IRR_B Which Project (s)? c) If the projects are mutually exclusive and the cost of capital is 16 percent, which project should the firm undertake if the firm adopts only NPV method? Answer this question with NPV of those two projects. You have to show how to get your answer. NPV_A NPV_B Which Project (s)? d) Find the crossover rate of the NPV profiles of the two projects. Show your work! (Hint: Slide Page 19 ofM06L02 Lecture Notes, 7 CapitalBudgeting.xls) Crossover Rate = Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started