Answered step by step

Verified Expert Solution

Question

1 Approved Answer

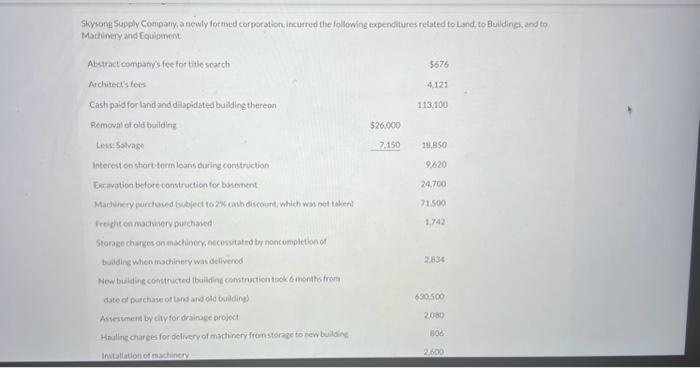

A B C Shysone Supply Comparyia newly formed corperation incurred the following expenditures related to Land to Bulding, and to Machinery and Equipment Hbstatceompany s

A

B

B

C

C

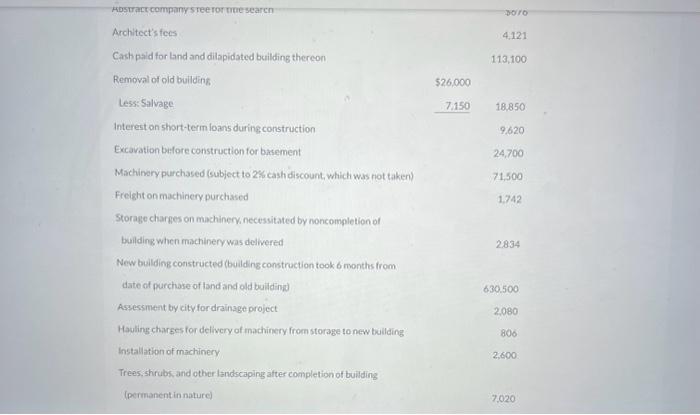

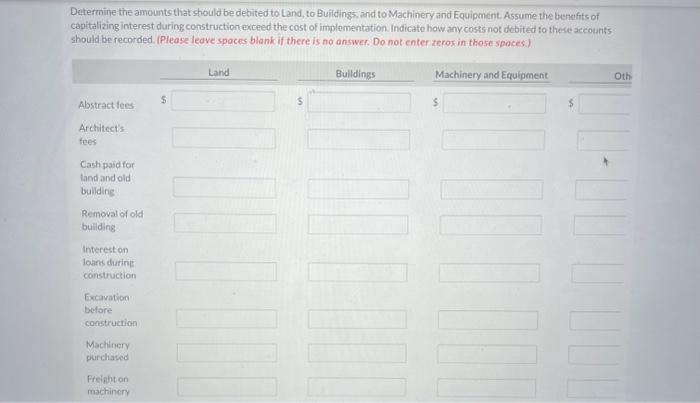

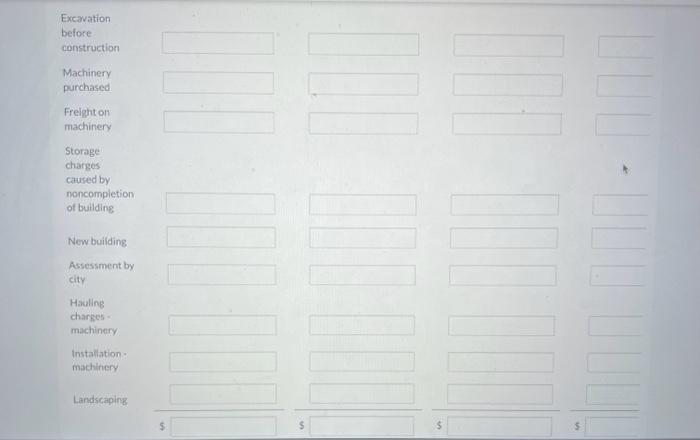

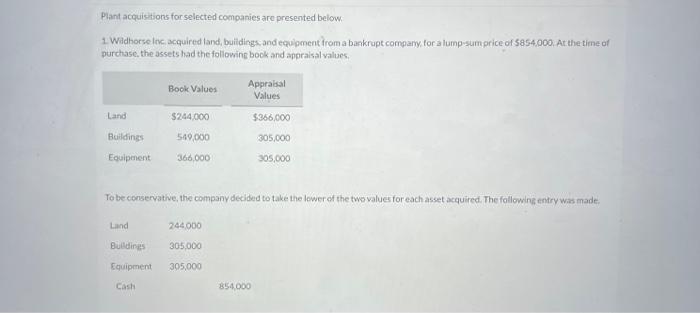

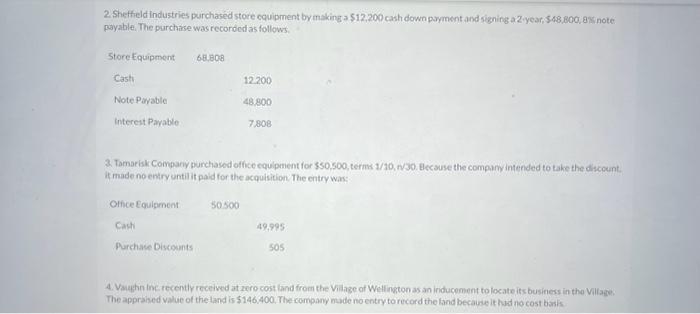

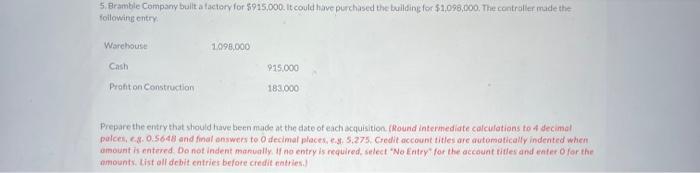

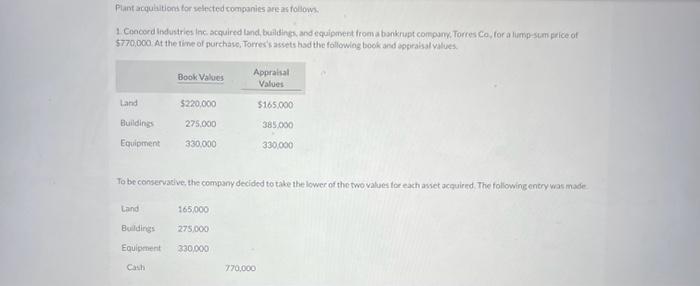

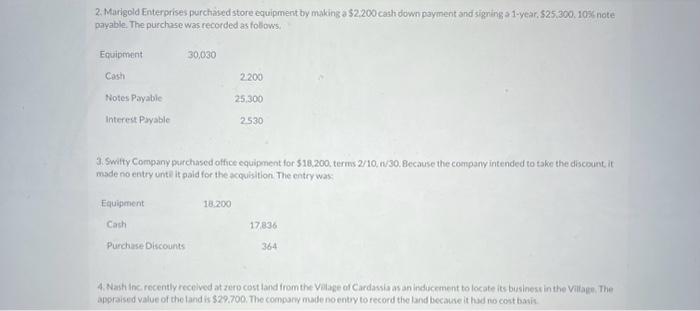

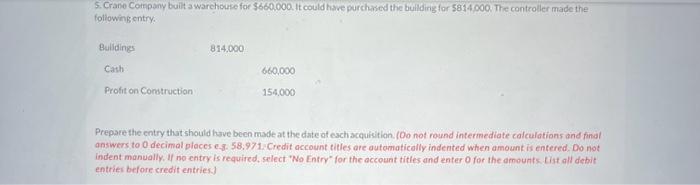

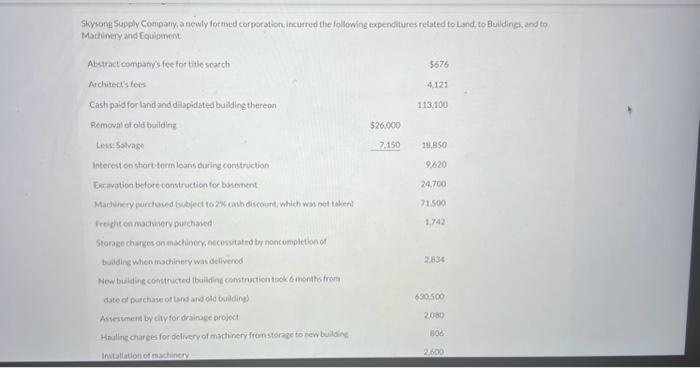

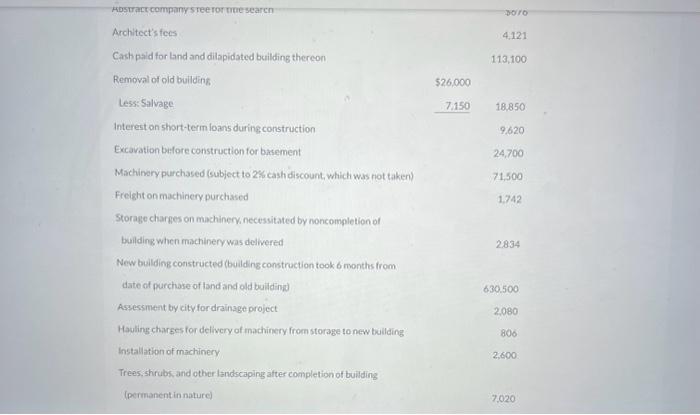

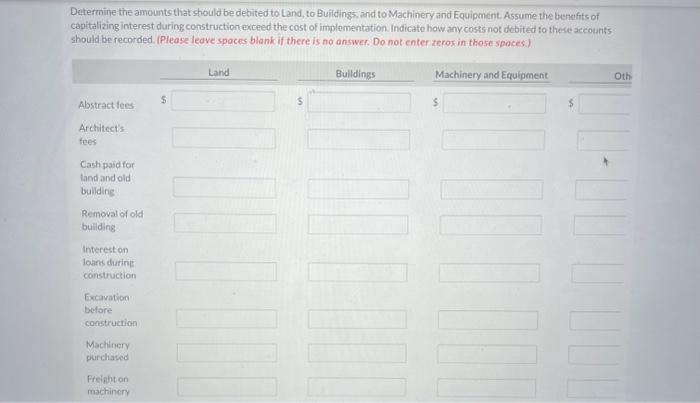

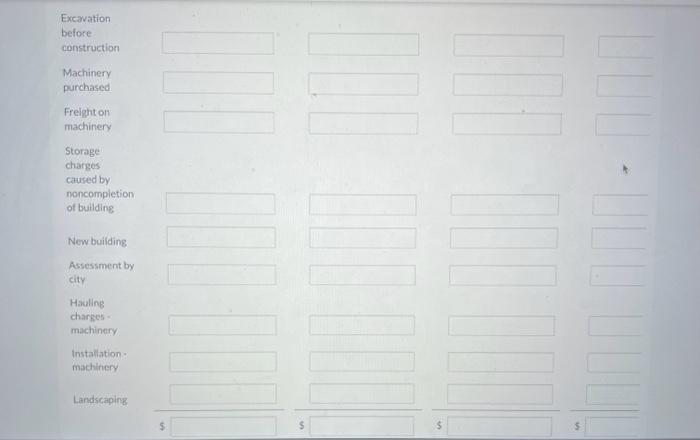

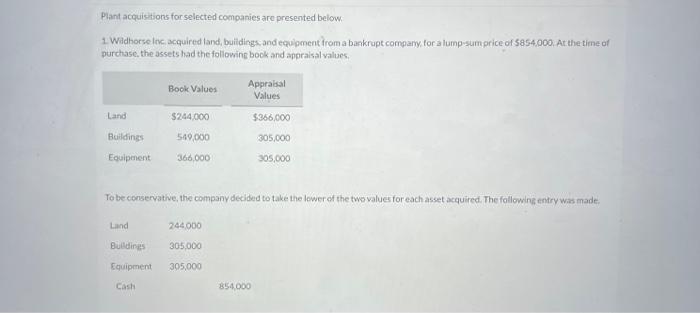

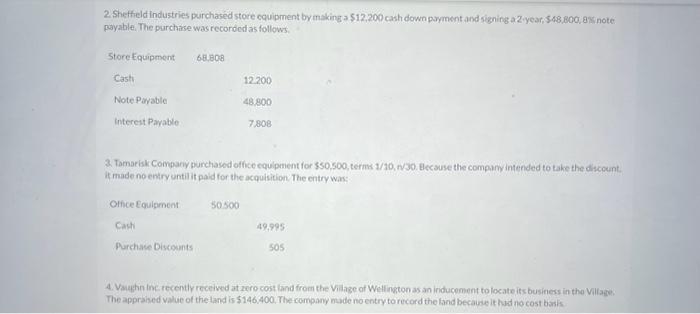

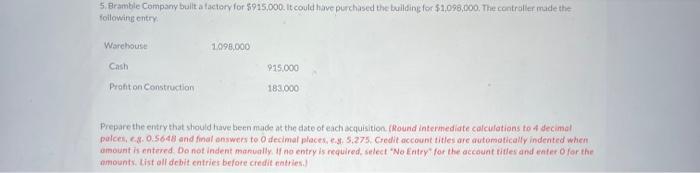

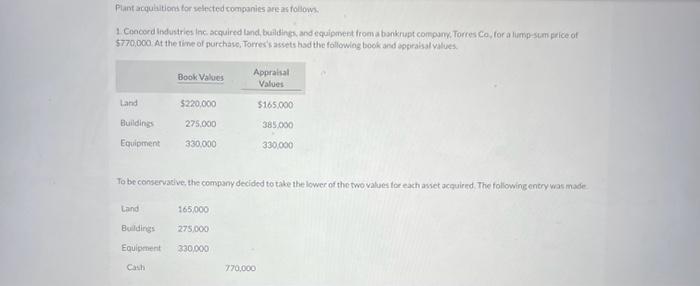

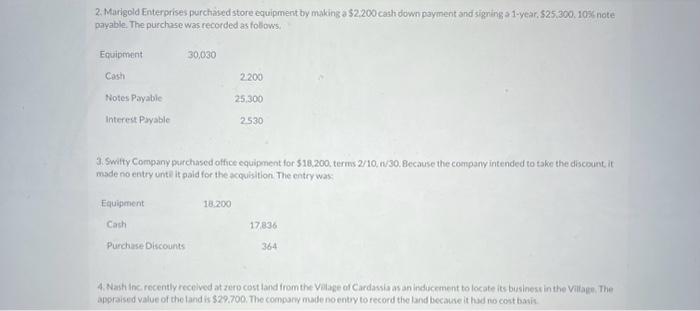

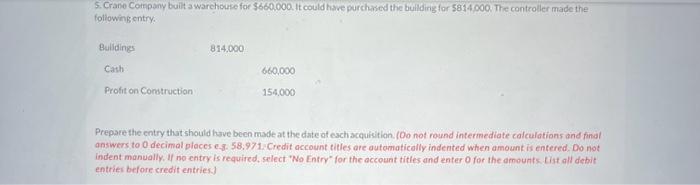

Shysone Supply Comparyia newly formed corperation incurred the following expenditures related to Land to Bulding, and to Machinery and Equipment Hbstatceompany s ree rot tae searen Architect's fees 4,121 Cash paid for land and dilapidated butilding thereon 113,100 Removal of old building $26,000 Less: 5alvage 7,150 Interest on shart-term loans during construction 9,620 Excavation bifore construction for basement 24,700 Machinerypurchased (subject to 2% cash discount, which was not taker)) 71,500 Freight on machinery purchased 1,742 Storage charges on machinery necessitated by noncompletion of bailding when machinery was delwered 2834 New bulding constructed (bulding construction took 6 months from date of purchase of land and old buidinided 630.500 Assessment by cityfordrainage project 2080 Hauling charges for delivery of machinery from storage to new buliding 806 Installation of machinery 2,600 Trees, shrubs, and other landscaping atter completion of buiding (permanentin nature) 7,020 Determine the amounts that should be debited to Land, to Buildings and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Indicate how any costs not dcbited to these accourits should be recorded. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces.) Excavation before construction Machinery purchased Freight on machinery Storage charges caused by noncompletion of building New building Assessment by city Hauling changes - machinery Installation- machinery Landscapins Plant acquisitions for selected companies are presented below 1. Wadhorse inc acquired land, buildings,and equpment from a bankrupt company, for a lump-sumprice of 5854,000 , At the time of purchase, the assets had the following bock and appraisal values. To be conservative, the company decided to take the lewer of the two values for each asset acquired. The following entry was made. 2. Shetfield industries purchased store cquipment bymaking a $12,200 cash down pryment and signing a 2 year, 548 , 800 , as note pryable, The purchise was recordodas follows. 3. Tamarisk Company purchased office equipment for 550,500 , terms 1/10,n/30. Hecause the compary intended to take the discount. it made no entry untilit paid for the acquisition, The entry war: 4. Vaghn ine recently received at zero cost land from the Vilage of Wellington as an inducement to locate its business in tho Viltage: The appraised value of theland is $146,400, The company bade no entry to record the land because it had no cost basis 5. Bramble Company bult a factory for 5915,000 . It could have purchased the building for $1,098,000. The contraller made the foilowing entry. Prepare the entrythat should have been made at the date of each acquisition (Mound intermediate calculations to 4 decimal palce,, 8.0 .5648 and final enswers to O decimal places, e.s, 5.275 . Credlit account titles are autumatically indented when omount is eatered. Do not indent manually. If no entry is required, select "No Entry" for the account vities and eater of for the amounts, List all debit entrier before credit natries.) Plant arqualtiond for yelected companies areas follows. 1. Concord Industries inc scquired land, buildings and equipment froma bonkrupt compunc. Torres co, for a lump-scm price of $770,000 At the tine of purchasc; Torres's assets had the following book and opprabal yalues. To be conservative, the company decided to tale the lower of the two values tor each asset acquired. The followingentry was made 2. Marigold Enterprises purchased store equipment by making a $2.200 cash down payment and signeng a 1-year, $25,300.105 note payable. The purchase was recorded as foblovs, 3. Smity Company purchased office equipment for 518,200 , terms 2/10,n/30, Because the company intended to tahe the discount it made no entry unte it paid for the acquisition. The entry was: 4, Nasti Inc recently recelved at zero cost land from the Valage of Cardassia as an inducement to locate its businesc in the Village. The appraised value of the land is $29,700. The compary nude no enty to record the land becauke it has no cost basis. 5. Crane Company built a warchouse for $660.000. It could have purchased the building for 5814,000 . The controller made the followingentry: Prepare the entry that should have been made at the date at esch acquisition. (Oo not round intermediate calculations and final answers to 0 decimal places es. 58,971. Credit account titles are autematically indented when amount is entered. Do not indent manually, If no entry is required, select 'No Entry' for the account titles and enter 0 for the amounts. Iist all debit entries before credit entries]

Shysone Supply Comparyia newly formed corperation incurred the following expenditures related to Land to Bulding, and to Machinery and Equipment Hbstatceompany s ree rot tae searen Architect's fees 4,121 Cash paid for land and dilapidated butilding thereon 113,100 Removal of old building $26,000 Less: 5alvage 7,150 Interest on shart-term loans during construction 9,620 Excavation bifore construction for basement 24,700 Machinerypurchased (subject to 2% cash discount, which was not taker)) 71,500 Freight on machinery purchased 1,742 Storage charges on machinery necessitated by noncompletion of bailding when machinery was delwered 2834 New bulding constructed (bulding construction took 6 months from date of purchase of land and old buidinided 630.500 Assessment by cityfordrainage project 2080 Hauling charges for delivery of machinery from storage to new buliding 806 Installation of machinery 2,600 Trees, shrubs, and other landscaping atter completion of buiding (permanentin nature) 7,020 Determine the amounts that should be debited to Land, to Buildings and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Indicate how any costs not dcbited to these accourits should be recorded. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces.) Excavation before construction Machinery purchased Freight on machinery Storage charges caused by noncompletion of building New building Assessment by city Hauling changes - machinery Installation- machinery Landscapins Plant acquisitions for selected companies are presented below 1. Wadhorse inc acquired land, buildings,and equpment from a bankrupt company, for a lump-sumprice of 5854,000 , At the time of purchase, the assets had the following bock and appraisal values. To be conservative, the company decided to take the lewer of the two values for each asset acquired. The following entry was made. 2. Shetfield industries purchased store cquipment bymaking a $12,200 cash down pryment and signing a 2 year, 548 , 800 , as note pryable, The purchise was recordodas follows. 3. Tamarisk Company purchased office equipment for 550,500 , terms 1/10,n/30. Hecause the compary intended to take the discount. it made no entry untilit paid for the acquisition, The entry war: 4. Vaghn ine recently received at zero cost land from the Vilage of Wellington as an inducement to locate its business in tho Viltage: The appraised value of theland is $146,400, The company bade no entry to record the land because it had no cost basis 5. Bramble Company bult a factory for 5915,000 . It could have purchased the building for $1,098,000. The contraller made the foilowing entry. Prepare the entrythat should have been made at the date of each acquisition (Mound intermediate calculations to 4 decimal palce,, 8.0 .5648 and final enswers to O decimal places, e.s, 5.275 . Credlit account titles are autumatically indented when omount is eatered. Do not indent manually. If no entry is required, select "No Entry" for the account vities and eater of for the amounts, List all debit entrier before credit natries.) Plant arqualtiond for yelected companies areas follows. 1. Concord Industries inc scquired land, buildings and equipment froma bonkrupt compunc. Torres co, for a lump-scm price of $770,000 At the tine of purchasc; Torres's assets had the following book and opprabal yalues. To be conservative, the company decided to tale the lower of the two values tor each asset acquired. The followingentry was made 2. Marigold Enterprises purchased store equipment by making a $2.200 cash down payment and signeng a 1-year, $25,300.105 note payable. The purchase was recorded as foblovs, 3. Smity Company purchased office equipment for 518,200 , terms 2/10,n/30, Because the company intended to tahe the discount it made no entry unte it paid for the acquisition. The entry was: 4, Nasti Inc recently recelved at zero cost land from the Valage of Cardassia as an inducement to locate its businesc in the Village. The appraised value of the land is $29,700. The compary nude no enty to record the land becauke it has no cost basis. 5. Crane Company built a warchouse for $660.000. It could have purchased the building for 5814,000 . The controller made the followingentry: Prepare the entry that should have been made at the date at esch acquisition. (Oo not round intermediate calculations and final answers to 0 decimal places es. 58,971. Credit account titles are autematically indented when amount is entered. Do not indent manually, If no entry is required, select 'No Entry' for the account titles and enter 0 for the amounts. Iist all debit entries before credit entries]

B

C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started