Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B C The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per year

A

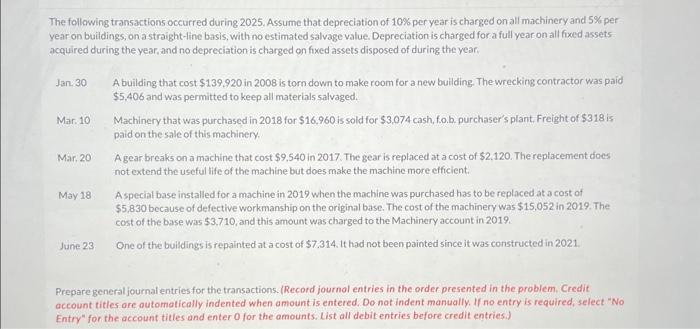

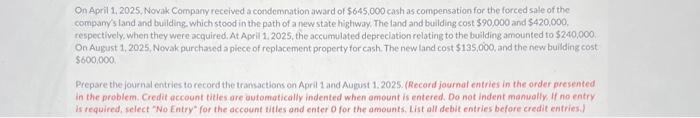

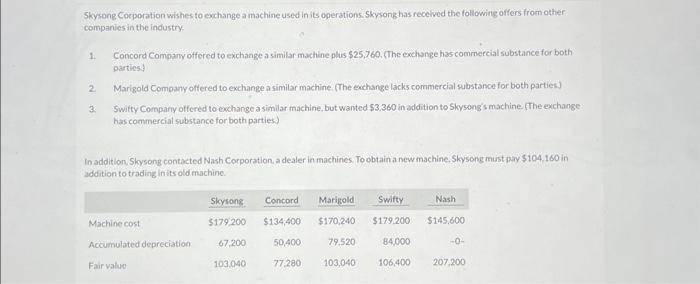

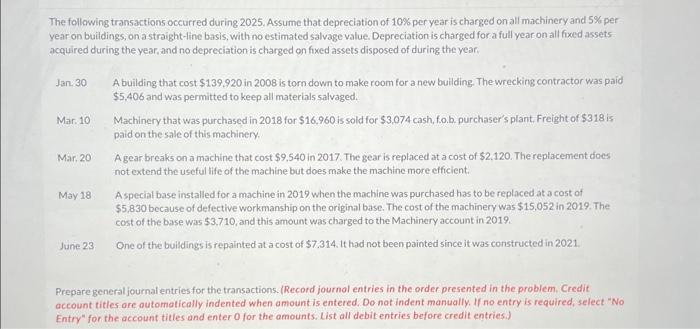

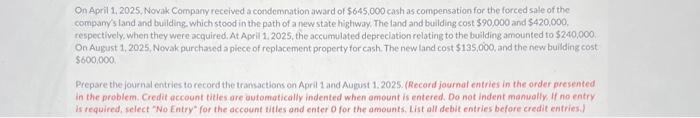

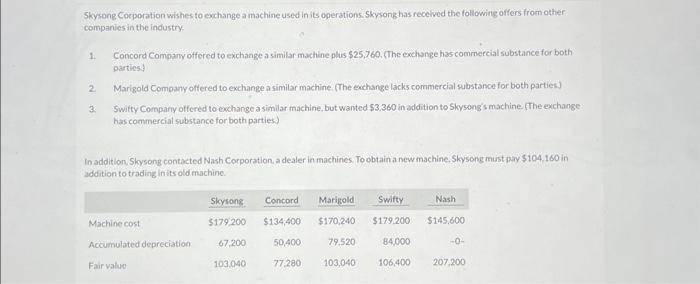

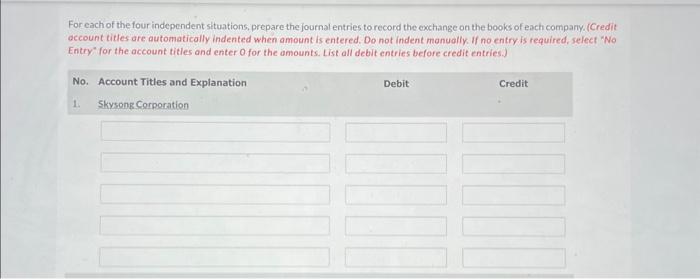

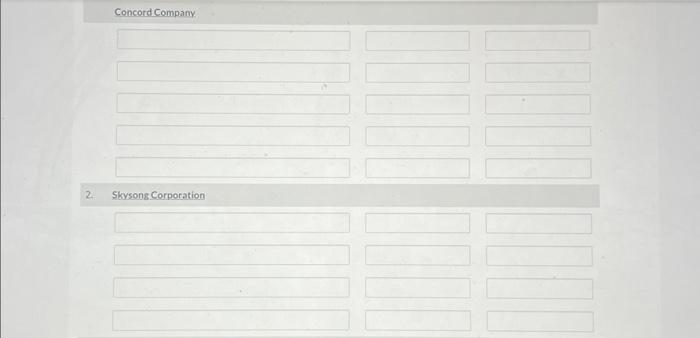

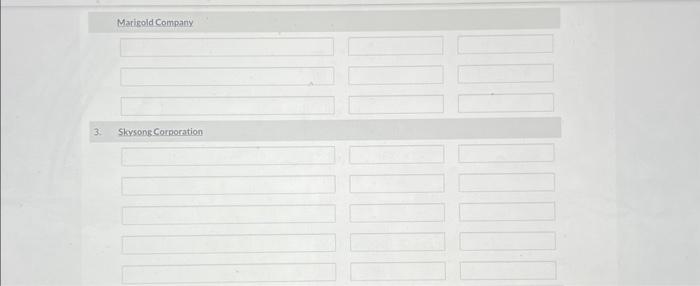

The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all fixed assets acquired during the year, and no depreciation is charged on fixed assets disposed of during the year: Jan. 30 A building that cost $139,920 in 2008 is torn down to make room for a new building. The wrecking contractor was paid $5,406 and was permitted to keep all materials salvaged. Mar. 10 Machinery that was purchased in 2018 for $16,960 is sold for $3,074 cash, f.o.b. purchaser's plant, Freight of $318 is paid on the sale of this machinery. Mar. 20 A gear breaks on a machine that cost $9,540 in 2017. The gear is replaced at a cost of $2.120. The replacement does not extend the useful life of the machine but does make the machine more efficient. May 18 A special base installed for a machine in 2019 when the machine was purchased has to be replaced at a cost of $5,830 because of defective workmanship on the original base. The cost of the machinery was $15,052 in 2019. The cost of the base was $3,710, and this amount was charged to the Machinery account in 2019. June 23 One of the buildings is repainted at a cost of $7.314. It had not been painted since it was constructed in 2021. Prepare general journal entries for the transactions. (Record journol entries in the order presented in the problem. Credit account titles ore automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) On April 1,2025, Novak Company received a condemnation award of $645,000 cash as compensation for the forced sale of the compary's land and building which stood in the poth of a new state highwiy. The land and building cost $90,000 and $420,000, respectively. when they were acquired, At April 1.2025, the accumulated depreciation relating to the building amounted to $240,000. On August 1, 2025, Nevak purchased a piece of replacement property for cash. The new land cost $135,000, and the new buiding cost $600,000, Prepare the journal entries to record the tramactions on April 1 and August 1.2025. (Record journaf entries in the order presented in the problem. Credit account tities are outomatically indented when amount is entered. Do not indent manually if no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before eredit entries. Skysong Corporation wishes to exchange a machine used in its operations. Skysong has recelved the following offers from other companies in the industry 1. Concord Company offercd to exchange a similar machine plus $25,760. (The exchange has commercial substance for both parties: 2. Marigold Compayy oftered to exchange a similar machine (The exchange lacks commercial substance for both parties) 3. Switty Company offered to exchange asimilar machine, but wanted $3.360 in addition to 5kysengs machine- IThe exchange has commercial substance for both parties. In addition. Skysong contacted Nash Corporation a dealer in machines. To obtain a new machine, Skysong must pay $104,160 in addition to trading inits old machine. For each of the four independent situations, prepare the journal entries to record the exchange on the books of each company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Concord Company 2. Skysong Corporation 5wifryCompany 4. Skytone Cormoration Nasti Company (To record levenue) (To record cost of inventory)

B

C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started