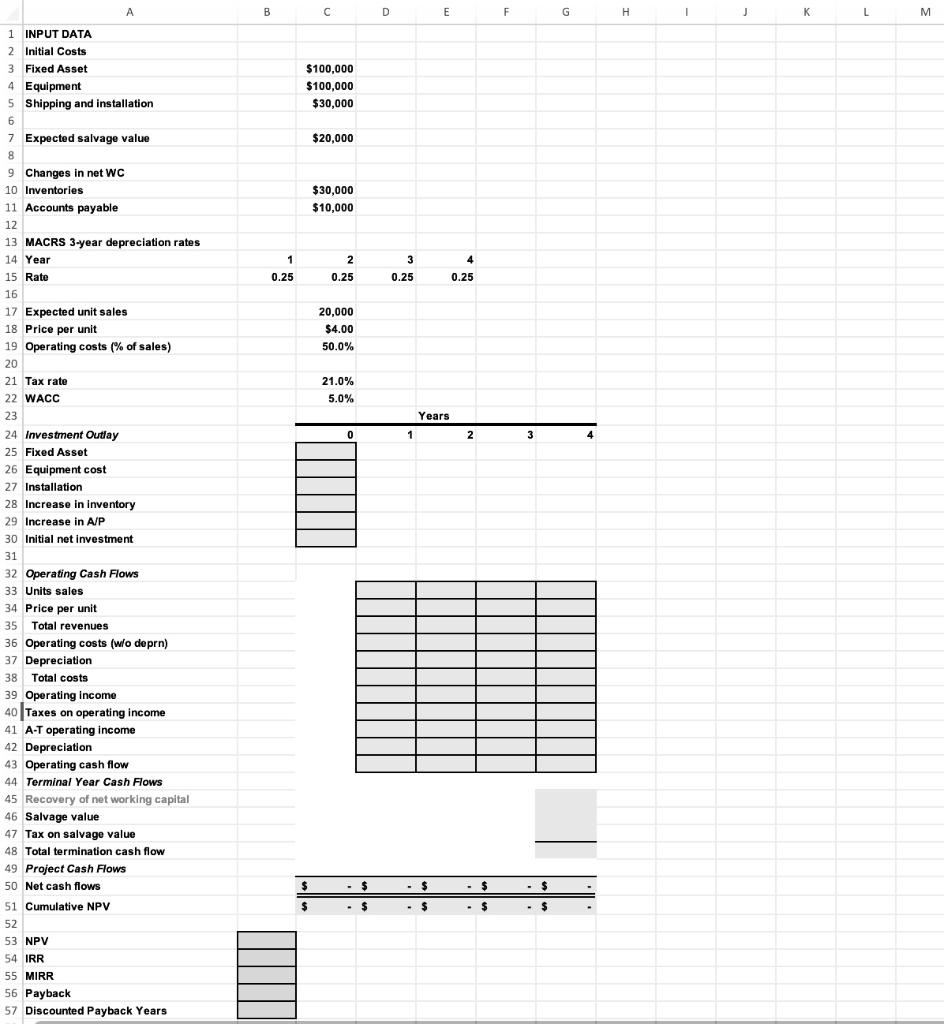

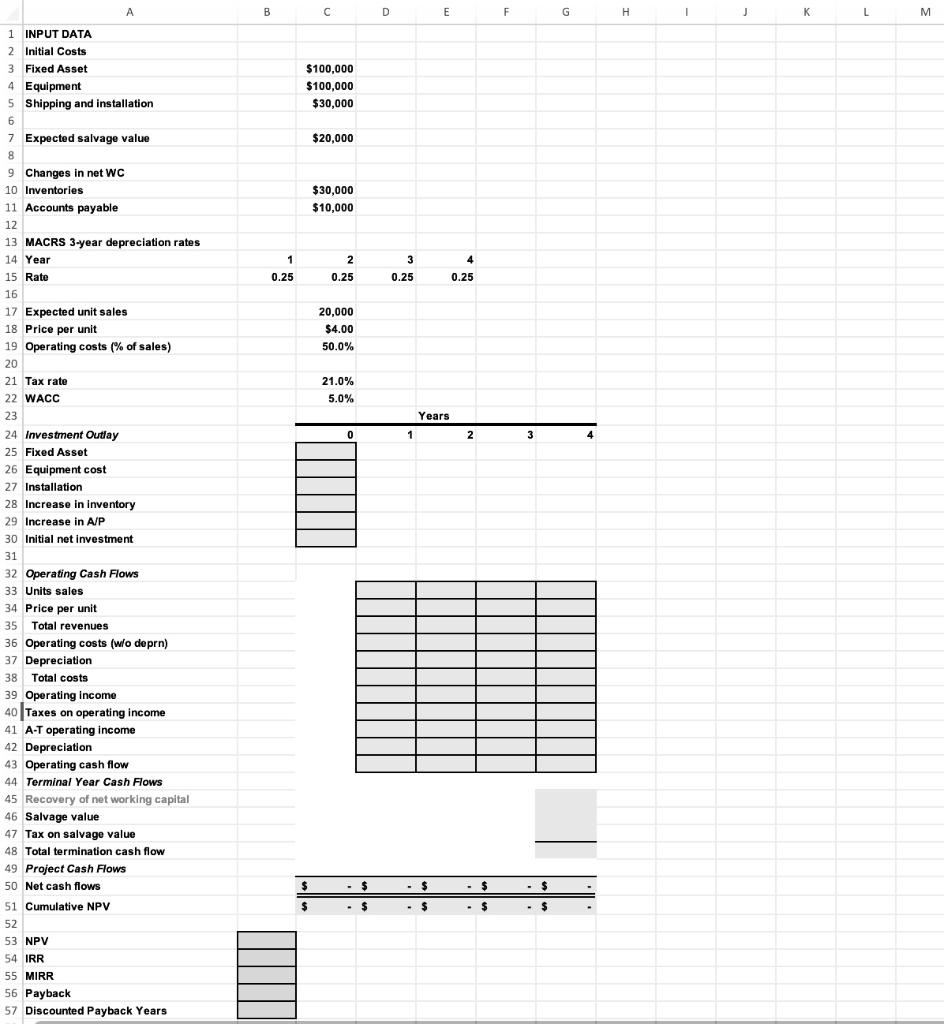

A B D E F G G I H 1 L 3 $100,000 $100,000 $30,000 $20,000 $30,000 $10,000 . 4 1 0.25 2 0.25 3 0.25 0.25 20,000 $4.00 50.0% 21.0% 5.0% Years 0 1 2 2 3 1 INPUT DATA 2 Initial Costs 3 Fixed Asset 4 Equipment 5 Shipping and installation 6 7 Expected salvage value 8 9 Changes in net WC 10 Inventories 11 Accounts payable 12 13 MACRS 3-year depreciation rates 14 Year 15 Rate 16 17 Expected unit sales 18 Price per unit 19 Operating costs (% of sales) 20 21 Tax rate 22 WACC 23 24 Investment Outlay 25 Fixed Asset 26 Equipment cost 27 Installation 28 Increase in inventory 29 Increase in A/P 30 Initial net investment 31 32 Operating Cash Flows 33 Units sales 34 Price per unit 35 Total revenues 36 Operating costs (w/o deprn) 37 Depreciation 38 Total costs 39 Operating income 40 Taxes on operating income 41 A-T operating income 42 Depreciation 43 Operating cash flow 44 Terminal Year Cash Flows 45 Recovery of net working capital 46 Salvage value 47 Tax on salvage value 48 Total termination cash flow 49 Project Cash Flows 50 Net cash flows 51 Cumulative NPV 52 53 NPV 54 IRR 55 MIRR 56 Payback 57 Discounted Payback Years $ - $ - $ - $ - $ $ - $ - $ - $ A B D E F G G I H 1 L 3 $100,000 $100,000 $30,000 $20,000 $30,000 $10,000 . 4 1 0.25 2 0.25 3 0.25 0.25 20,000 $4.00 50.0% 21.0% 5.0% Years 0 1 2 2 3 1 INPUT DATA 2 Initial Costs 3 Fixed Asset 4 Equipment 5 Shipping and installation 6 7 Expected salvage value 8 9 Changes in net WC 10 Inventories 11 Accounts payable 12 13 MACRS 3-year depreciation rates 14 Year 15 Rate 16 17 Expected unit sales 18 Price per unit 19 Operating costs (% of sales) 20 21 Tax rate 22 WACC 23 24 Investment Outlay 25 Fixed Asset 26 Equipment cost 27 Installation 28 Increase in inventory 29 Increase in A/P 30 Initial net investment 31 32 Operating Cash Flows 33 Units sales 34 Price per unit 35 Total revenues 36 Operating costs (w/o deprn) 37 Depreciation 38 Total costs 39 Operating income 40 Taxes on operating income 41 A-T operating income 42 Depreciation 43 Operating cash flow 44 Terminal Year Cash Flows 45 Recovery of net working capital 46 Salvage value 47 Tax on salvage value 48 Total termination cash flow 49 Project Cash Flows 50 Net cash flows 51 Cumulative NPV 52 53 NPV 54 IRR 55 MIRR 56 Payback 57 Discounted Payback Years $ - $ - $ - $ - $ $ - $ - $ - $