Answered step by step

Verified Expert Solution

Question

1 Approved Answer

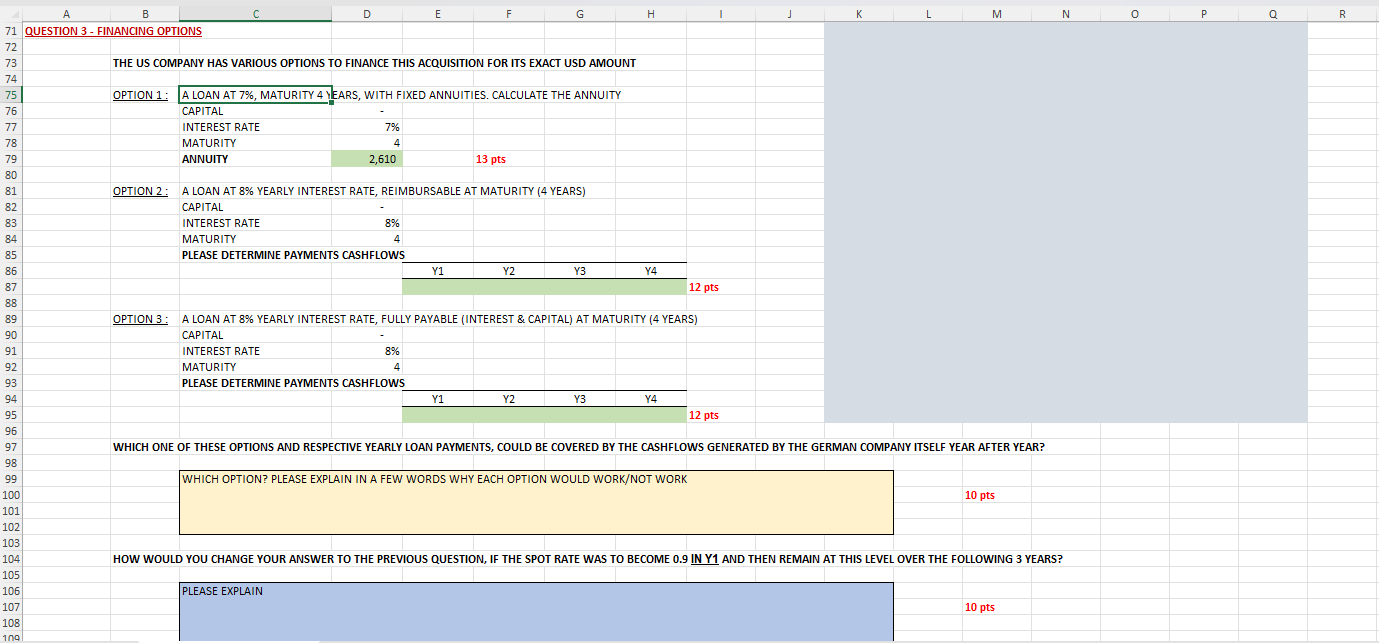

A B D E F G H J K M N R 72 73 74 75 71 QUESTION 3 - FINANCING OPTIONS THE US

A B D E F G H J K M N R 72 73 74 75 71 QUESTION 3 - FINANCING OPTIONS THE US COMPANY HAS VARIOUS OPTIONS TO FINANCE THIS ACQUISITION FOR ITS EXACT USD AMOUNT OPTION 1: A LOAN AT 7%, MATURITY 4 YEARS, WITH FIXED ANNUITIES. CALCULATE THE ANNUITY 76 77 CAPITAL INTEREST RATE 78 79 MATURITY ANNUITY 7% 4 2,610 13 pts 80 81 OPTION 2: 82 A LOAN AT 8% YEARLY INTEREST RATE, REIMBURSABLE AT MATURITY (4 YEARS) CAPITAL 83 84 85 INTEREST RATE MATURITY 8% 4 PLEASE DETERMINE PAYMENTS CASHFLOWS 86 87 Y1 Y2 Y3 Y4 12 pts 88 89 OPTION 3: A LOAN AT 8% YEARLY INTEREST RATE, FULLY PAYABLE (INTEREST & CAPITAL) AT MATURITY (4 YEARS) 90 91 92 93 CAPITAL INTEREST RATE MATURITY 8% 4 PLEASE DETERMINE PAYMENTS CASHFLOWS 94 Y1 Y2 Y3 Y4 95 12 pts 96 97 WHICH ONE OF THESE OPTIONS AND RESPECTIVE YEARLY LOAN PAYMENTS, COULD BE COVERED BY THE CASHFLOWS GENERATED BY THE GERMAN COMPANY ITSELF YEAR AFTER YEAR? 98 99 WHICH OPTION? PLEASE EXPLAIN IN A FEW WORDS WHY EACH OPTION WOULD WORK/NOT WORK 100 10 pts 101 102 103 104 HOW WOULD YOU CHANGE YOUR ANSWER TO THE PREVIOUS QUESTION, IF THE SPOT RATE WAS TO BECOME 0.9 IN Y1 AND THEN REMAIN AT THIS LEVEL OVER THE FOLLOWING 3 YEARS? 105 106 PLEASE EXPLAIN 107 10 pts 108 109

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started