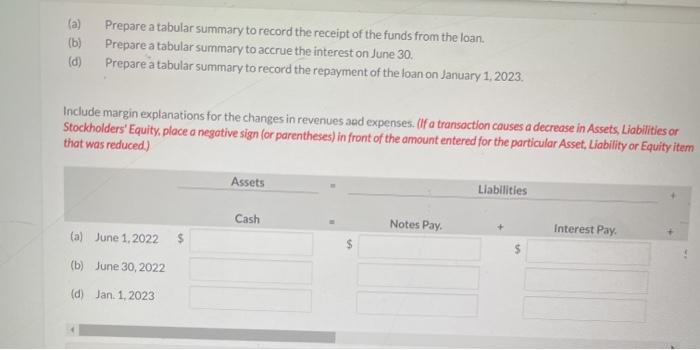

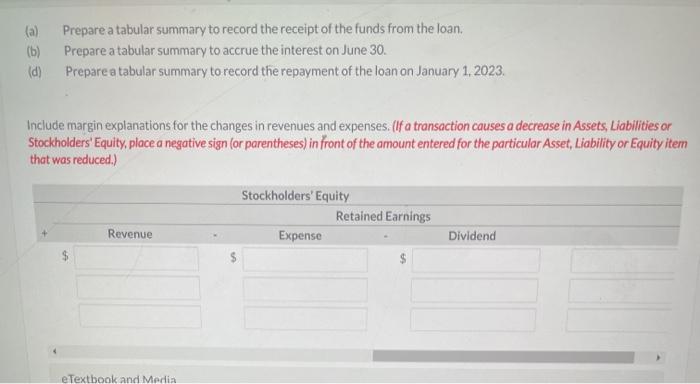

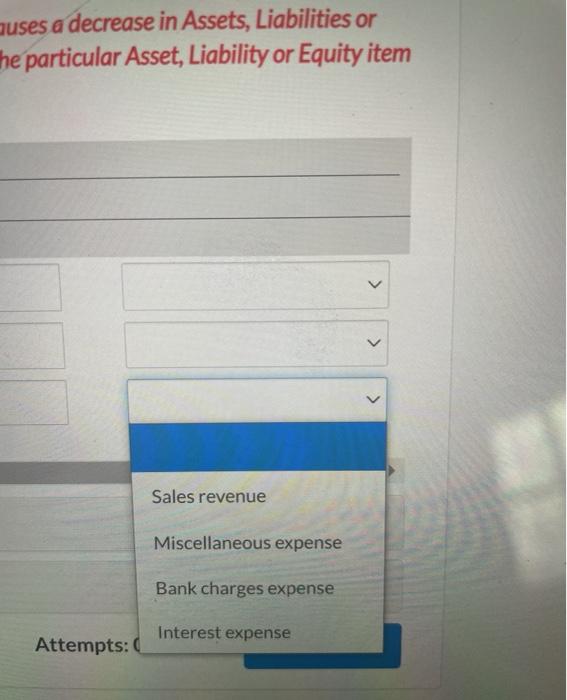

(a) (b) (d) Prepare a tabular summary to record the receipt of the funds from the loan. Prepare a tabular summary to accrue the interest on June 30. Prepare a tabular summary to record the repayment of the loan on January 1, 2023. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity Item that was reduced.) Assets Liabilities Cash Notes Pay. (a) June 1, 2022 Interest Pay. (b) June 30, 2022 (d) Jan 1, 2023 (a) (6) Prepare a tabular summary to record the receipt of the funds from the loan Prepare a tabular summary to accrue the interest on June 30. Prepare a tabular summary to record the repayment of the loan on January 1, 2023. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Expense Revenue Dividend eTextbook and Media uses a decrease in Assets, Liabilities or he particular Asset, Liability or Equity item > > Sales revenue Miscellaneous expense Bank charges expense Interest expense Attempts: (a) (b) (d) Prepare a tabular summary to record the receipt of the funds from the loan. Prepare a tabular summary to accrue the interest on June 30. Prepare a tabular summary to record the repayment of the loan on January 1, 2023. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity Item that was reduced.) Assets Liabilities Cash Notes Pay. (a) June 1, 2022 Interest Pay. (b) June 30, 2022 (d) Jan 1, 2023 (a) (6) Prepare a tabular summary to record the receipt of the funds from the loan Prepare a tabular summary to accrue the interest on June 30. Prepare a tabular summary to record the repayment of the loan on January 1, 2023. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Expense Revenue Dividend eTextbook and Media uses a decrease in Assets, Liabilities or he particular Asset, Liability or Equity item > > Sales revenue Miscellaneous expense Bank charges expense Interest expense Attempts