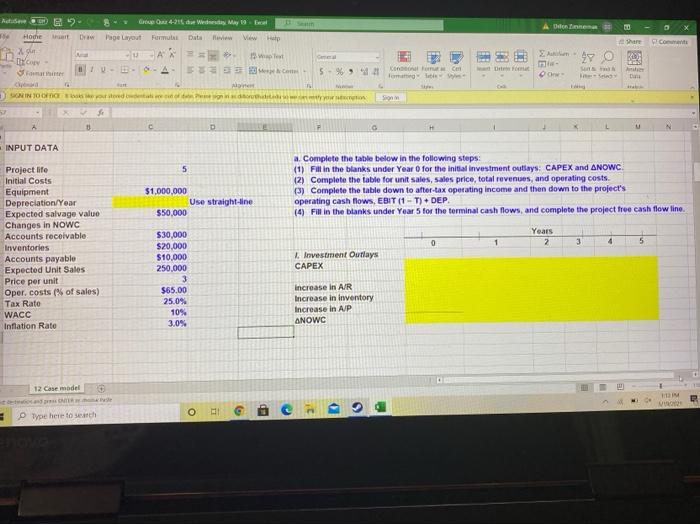

A B GO 4-21 Wed May 19 El AD Hoche Draw Page Layout Fum Vip there ad West CA 10--A 4 ORAS x.co 5% Konto Com OO Dune SO SINONEN & C F INPUT DATA 5 a. Complete the table below in the following steps: (1) Fill in the blanks under Year for the initial investment outlays: CAPEX and ANOWC (2) Complete the table for unit Sales, sales price, total revenues, and operating costs (3) Complete the table down to after-tax operating income and then down to the project's operating cash flows, EBIT (1-T) + DEP. (4) Fill in the blanks under Year 5 for the terminal cash flows, and complete the project free cash flow line $1,000,000 Use straight-line $50,000 Years 2 0 3 4 5 Project life Initial Costs Equipment Depreciation/Year Expected salvage value Changes in NOWC Accounts receivable Inventories Accounts payable Expected Unit Sales Price per unit Oper, costs of sales) Tax Rato WACC Inflation Rate 1. Investment Outlays CAPEX $30,000 $20,000 $10.000 250.000 3 $65.00 25.0% 10% 3.0% Increase in AIR Increase in Inventory Increase in AP ANOWC 12 Casemodel o TE 3 Type here to search A B GO 4-21 Wed May 19 El AD Hoche Draw Page Layout Fum Vip there ad West CA 10--A 4 ORAS x.co 5% Konto Com OO Dune SO SINONEN & C F INPUT DATA 5 a. Complete the table below in the following steps: (1) Fill in the blanks under Year for the initial investment outlays: CAPEX and ANOWC (2) Complete the table for unit Sales, sales price, total revenues, and operating costs (3) Complete the table down to after-tax operating income and then down to the project's operating cash flows, EBIT (1-T) + DEP. (4) Fill in the blanks under Year 5 for the terminal cash flows, and complete the project free cash flow line $1,000,000 Use straight-line $50,000 Years 2 0 3 4 5 Project life Initial Costs Equipment Depreciation/Year Expected salvage value Changes in NOWC Accounts receivable Inventories Accounts payable Expected Unit Sales Price per unit Oper, costs of sales) Tax Rato WACC Inflation Rate 1. Investment Outlays CAPEX $30,000 $20,000 $10.000 250.000 3 $65.00 25.0% 10% 3.0% Increase in AIR Increase in Inventory Increase in AP ANOWC 12 Casemodel o TE 3 Type here to search