Answered step by step

Verified Expert Solution

Question

1 Approved Answer

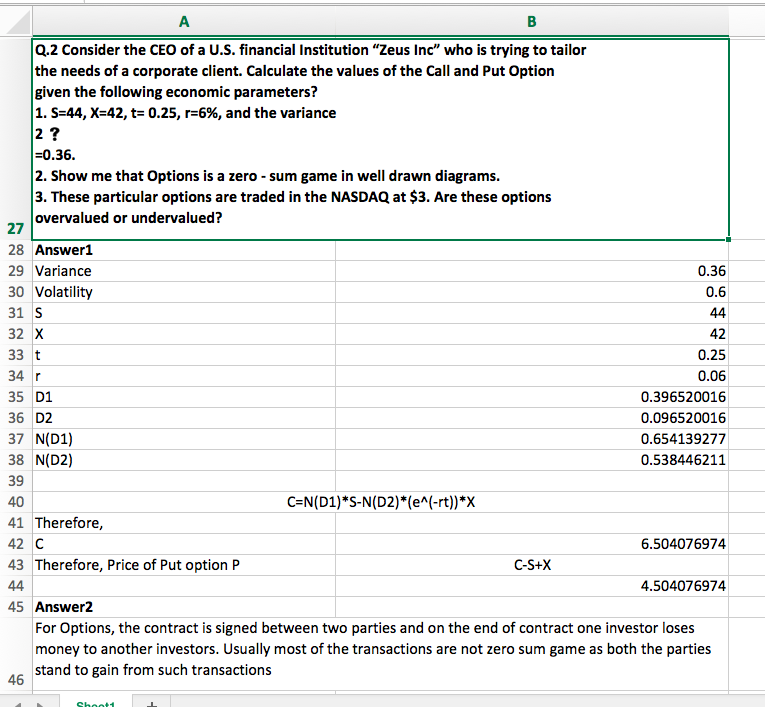

A B Q.2 Consider the CEO of a U.S. financial Institution Zeus Inc who is trying to tailor the needs of a corporate client. Calculate

A B Q.2 Consider the CEO of a U.S. financial Institution "Zeus Inc" who is trying to tailor the needs of a corporate client. Calculate the values of the Call and Put Option given the following economic parameters? 1. S=44, X=42, t= 0.25, r=6%, and the variance 2 ? 1=0.36. 2. Show me that Options is a zero- sum game in well drawn diagrams. 3. These particular options are traded in the NASDAQ at $3. Are these options overvalued or undervalued? 27 28 Answer1 29 Variance 0.36 30 Volatility 0.6 31 S 44 32 X 42 33 t 0.25 34 r 0.06 35 D1 0.396520016 36 D2 0.096520016 37 N(D1) 0.654139277 38 N(D2) 0.538446211 39 40 C=N(D1)*S-N(D2)*(e^(-rt))*X 41 Therefore, 42 C 6.504076974 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 Sbatt A B Q.2 Consider the CEO of a U.S. financial Institution "Zeus Inc" who is trying to tailor the needs of a corporate client. Calculate the values of the Call and Put Option given the following economic parameters? 1. S=44, X=42, t= 0.25, r=6%, and the variance 2 ? 1=0.36. 2. Show me that Options is a zero- sum game in well drawn diagrams. 3. These particular options are traded in the NASDAQ at $3. Are these options overvalued or undervalued? 27 28 Answer1 29 Variance 0.36 30 Volatility 0.6 31 S 44 32 X 42 33 t 0.25 34 r 0.06 35 D1 0.396520016 36 D2 0.096520016 37 N(D1) 0.654139277 38 N(D2) 0.538446211 39 40 C=N(D1)*S-N(D2)*(e^(-rt))*X 41 Therefore, 42 C 6.504076974 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 Sbatt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started