Question

a. b. Under the Average daily balance method (ADB), the interest of a loan is calculated by multiplying the daily interest rate with the average

a.

b. Under the Average daily balance method (ADB), the interest of a loan is calculated by multiplying the daily interest rate with the average amount owed at the end of each day.

c. Henry has $2,500 for a down payment and thinks he can afford monthly payments of $400 to be paid at the end of each month. If he can finance a vehicle with an 8%, 3-year loan, the maximum amount Henry can spend on the car is $15,265 (correct to nearest integer).

d. A financial plan must be measurable so that one can design an investment plan accordingly.

e. Saving deposit is regarded as the safest investment as there is no risk of losing the capital.

f. Financial advisers generally suggest mortgage payments plus other loan payments not to exceed 53 percent of your monthly disposable income.

g. A saving with positive interest can increase the value of your wealth but not necessarily improve your living standard.

h. As the interest rates on credit card are typically highest among all types of loans, we should avoid making payment with it.

Please answer the above statement whether it is true or false, and with explanation, thanks

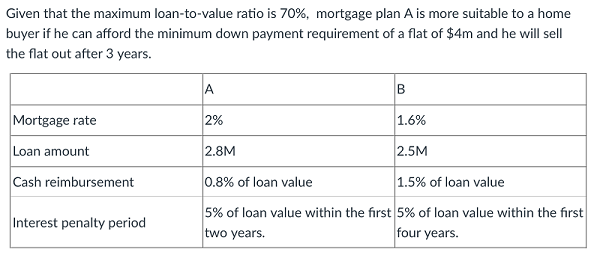

Given that the maximum loan-to-value ratio is 70%, mortgage plan A is more suitable to a home buyer if he can afford the minimum down payment requirement of a flat of $4m and he will sell the flat out after 3 years. A B Mortgage rate 2% 1.6% Loan amount Cash reimbursement 2.8M 2.5M 0.8% of loan value 1.5% of loan value 5% of loan value within the first 5% of loan value within the first two years. four years. Interest penalty period Given that the maximum loan-to-value ratio is 70%, mortgage plan A is more suitable to a home buyer if he can afford the minimum down payment requirement of a flat of $4m and he will sell the flat out after 3 years. A B Mortgage rate 2% 1.6% Loan amount Cash reimbursement 2.8M 2.5M 0.8% of loan value 1.5% of loan value 5% of loan value within the first 5% of loan value within the first two years. four years. Interest penalty periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started