Answered step by step

Verified Expert Solution

Question

1 Approved Answer

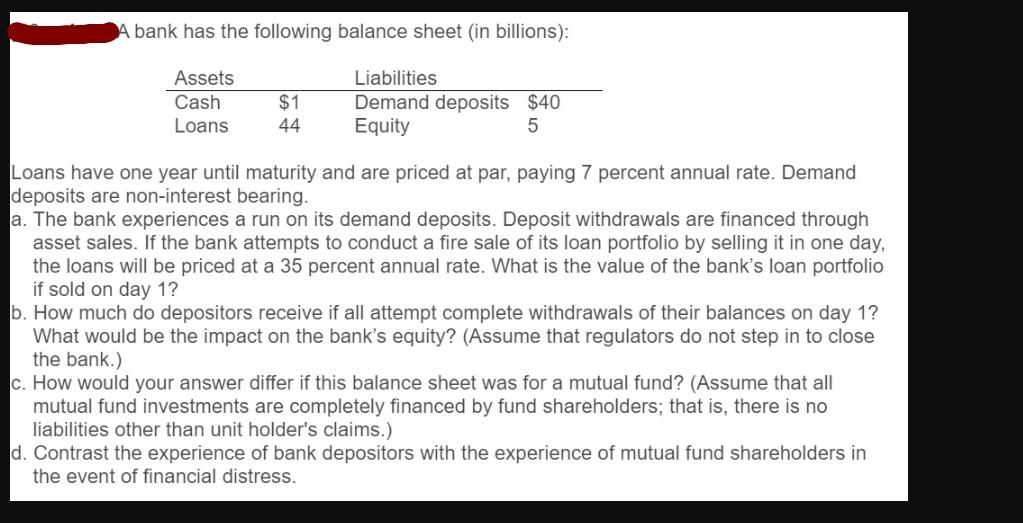

A bank has the following balance sheet (in billions): Assets Cash Loans $1 44 Liabilities Demand deposits $40 Equity 5 Loans have one year

A bank has the following balance sheet (in billions): Assets Cash Loans $1 44 Liabilities Demand deposits $40 Equity 5 Loans have one year until maturity and are priced at par, paying 7 percent annual rate. Demand deposits are non-interest bearing.. a. The bank experiences a run on its demand deposits. Deposit withdrawals are financed through asset sales. If the bank attempts to conduct a fire sale of its loan portfolio by selling it in one day, the loans will be priced at a 35 percent annual rate. What is the value of the bank's loan portfolio if sold on day 1? b. How much do depositors receive if all attempt complete withdrawals of their balances on day 1? What would be the impact on the bank's equity? (Assume that regulators do not step in to close the bank.) c. How would your answer differ if this balance sheet was for a mutual fund? (Assume that all mutual fund investments are completely financed by fund shareholders; that is, there is no liabilities other than unit holder's claims.) d. Contrast the experience of bank depositors with the experience of mutual fund shareholders in the event of financial distress.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers a Loan portfolio value on day 1 At a 35 annual discount the loan portfolio sells for 1001035 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started