Question

a) Based on the cost information above: i) Calculate the plant-wide predetermined overhead rate based on total overhead costs (both service department and production department),

a) Based on the cost information above:

i) Calculate the plant-wide predetermined overhead rate based on total overhead costs (both service department and production department), assuming that MTSB does not bother to allocate service department costs.

ii) From your answer in part (a)(i), compute the cost of Job 775.

iii) Compute the overhead over-applied or under-applied for Job 775.

b) i) Use the step-down method to allocate service department costs to the production departments. Allocate the cost of the Power Department first.

ii) Calculate departmental predetermined overhead rates for Machining Department and Assembly Department using your answers from part (b)(i).

iii) Based on the rates in part (b)(ii), compute the cost of Job 77

iv) Compute the overhead overapplied or underapplied for the Job 775.

c) Briefly explain why the suggestion by Mr. Zamri to use departmental overhead rates and allocating service departments cost to production departments is better to in allocating manufacturing overhead.

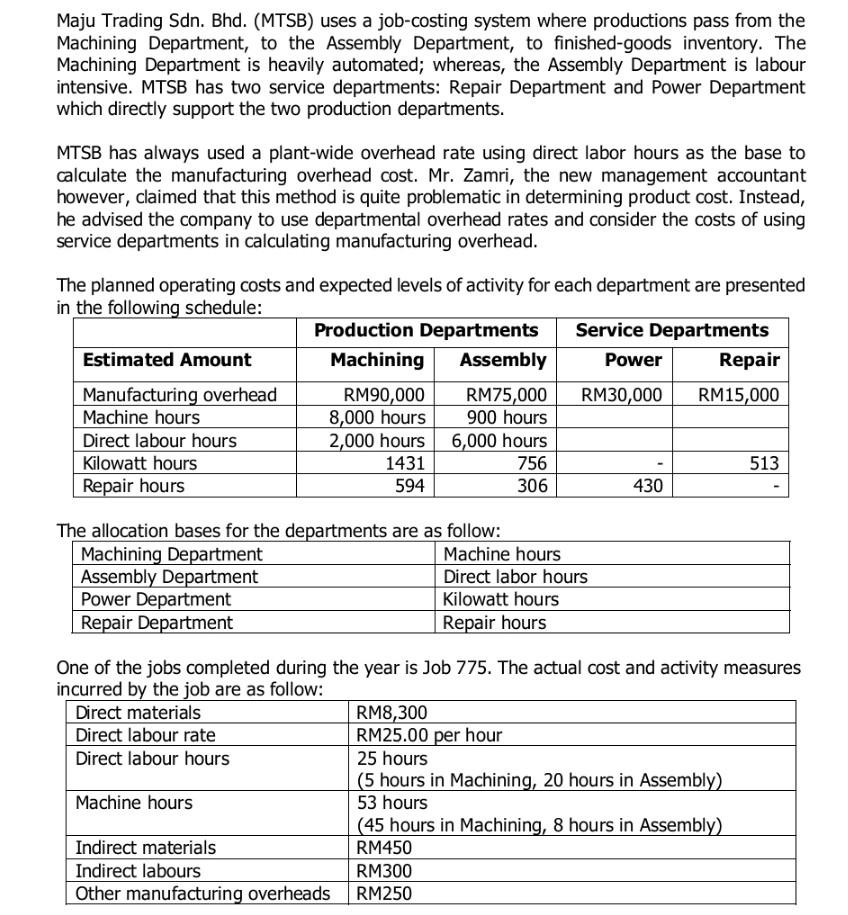

Maju Trading Sdn. Bhd. (MTSB) uses a job-costing system where productions pass from the Machining Department, to the Assembly Department, to finished-goods inventory. The Machining Department is heavily automated; whereas, the Assembly Department is labour intensive. MTSB has two service departments: Repair Department and Power Department which directly support the two production departments. MTSB has always used a plant-wide overhead rate using direct labor hours as the base to calculate the manufacturing overhead cost. Mr. Zamri, the new management accountant however, claimed that this method is quite problematic in determining product cost. Instead, he advised the company to use departmental overhead rates and consider the costs of using service departments in calculating manufacturing overhead. The planned operating costs and expected levels of activity for each department are presented in the following schedule: Production Departments Service Departments Estimated Amount Machining Assembly Power Repair Manufacturing overhead RM90,000 RM75,000 RM30,000 RM15,000 Machine hours 8,000 hours 900 hours Direct labour hours 2,000 hours 6,000 hours Kilowatt hours 1431 756 513 Repair hours 594 306 430 The allocation bases for the departments are as follow: Machining Department Machine hours Assembly Department Direct labor hours Power Department Kilowatt hours Repair Department Repair hours One of the jobs completed during the year is Job 775. The actual cost and activity measures incurred by the job are as follow: Direct materials RM8,300 Direct labour rate RM25.00 per hour Direct labour hours 25 hours (5 hours in Machining, 20 hours in Assembly) Machine hours 53 hours (45 hours in Machining, 8 hours in Assembly) Indirect materials RM450 Indirect labours RM300 Other manufacturing overheads RM250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started