Answered step by step

Verified Expert Solution

Question

1 Approved Answer

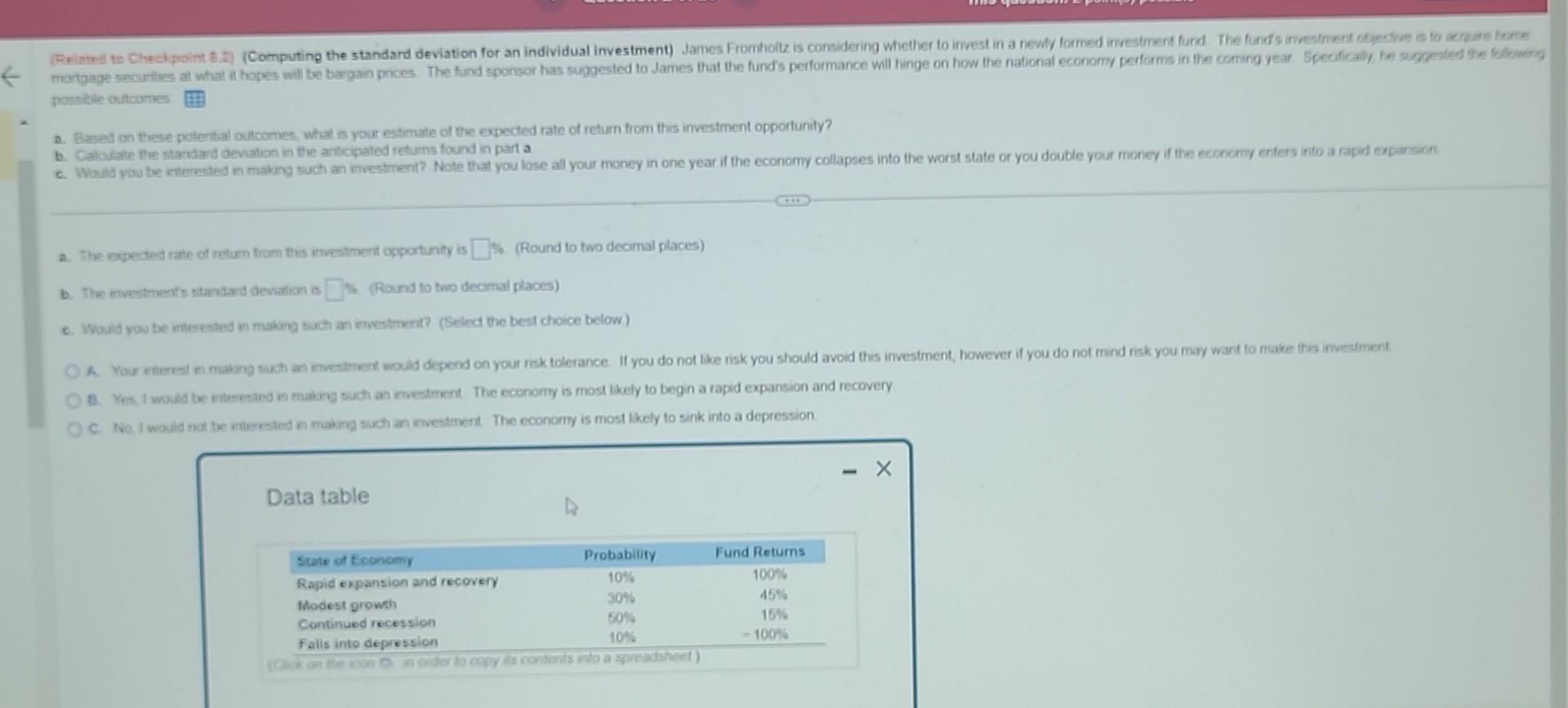

a. Based on these poteritial outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation

a. Based on these poteritial outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the articipated retums found in part a a. The expected rate of retum from this mventment coportunity is (Round to two decimal places) (Fend to two decar int paces) 8. Yes I would be nitureted en makro such an encetment. The economy is most likely to begin a rapid expansion and recovery C. No I would nat be rutereted ne makng such an mectment The cconomy is most likely to sink into a depression. Data table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started