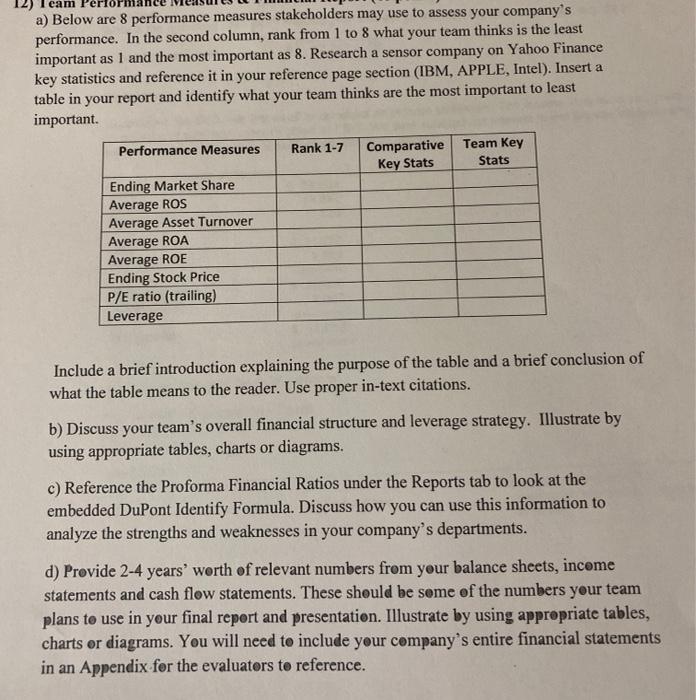

a) Below are 8 performance measures stakeholders may use to assess your company's performance. In the second column, rank from 1 to 8 what your team thinks is the least important as 1 and the most important as 8. Research a sensor company on Yahoo Finance key statistics and reference it in your reference page section (IBM, APPLE, Intel). Insert a table in your report and identify what your team thinks are the most important to least important Performance Measures Rank 1-7 Comparative Key Stats Team Key Stats Ending Market Share Average ROS Average Asset Turnover Average ROA Average ROE Ending Stock Price P/E ratio (trailing) Leverage Include a brief introduction explaining the purpose of the table and a brief conclusion of what the table means to the reader. Use proper in-text citations. b) Discuss your team's overall financial structure and leverage strategy. Illustrate by using appropriate tables, charts or diagrams. c) Reference the Proforma Financial Ratios under the Reports tab to look at the embedded DuPont Identify Formula. Discuss how you can use this information to analyze the strengths and weaknesses in your company's departments. d) Provide 2-4 years' worth of relevant numbers from your balance sheets, income statements and cash flow statements. These should be some of the numbers your team plans to use in your final report and presentation. Illustrate by using appropriate tables, charts or diagrams. You will need to include your company's entire financial statements in an Appendix for the evaluators to reference. a) Below are 8 performance measures stakeholders may use to assess your company's performance. In the second column, rank from 1 to 8 what your team thinks is the least important as 1 and the most important as 8. Research a sensor company on Yahoo Finance key statistics and reference it in your reference page section (IBM, APPLE, Intel). Insert a table in your report and identify what your team thinks are the most important to least important Performance Measures Rank 1-7 Comparative Key Stats Team Key Stats Ending Market Share Average ROS Average Asset Turnover Average ROA Average ROE Ending Stock Price P/E ratio (trailing) Leverage Include a brief introduction explaining the purpose of the table and a brief conclusion of what the table means to the reader. Use proper in-text citations. b) Discuss your team's overall financial structure and leverage strategy. Illustrate by using appropriate tables, charts or diagrams. c) Reference the Proforma Financial Ratios under the Reports tab to look at the embedded DuPont Identify Formula. Discuss how you can use this information to analyze the strengths and weaknesses in your company's departments. d) Provide 2-4 years' worth of relevant numbers from your balance sheets, income statements and cash flow statements. These should be some of the numbers your team plans to use in your final report and presentation. Illustrate by using appropriate tables, charts or diagrams. You will need to include your company's entire financial statements in an Appendix for the evaluators to reference