Answered step by step

Verified Expert Solution

Question

1 Approved Answer

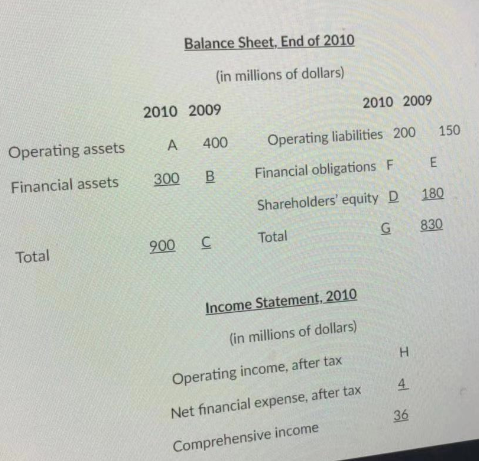

a. Below are financial statements for a firm that paid a net $16 million to shareholders in 2010. Supply the missing numbers (indicated by capital

a. Below are financial statements for a firm that paid a net $16 million to shareholders in 2010. Supply the missing numbers (indicated by capital letters) in the financial statements. Make sure that show how you got to the numbers.

b. Calculate free cash flow for 2010.

c. Calculate the cash flow with respect to net financial obligations.

d. Calculate return on common equity (ROCE) and return of net operating assets (RNOA) for 2010 on beginning-of-year denominators.

e. Show that ROCE and RNOA reconcile according to the financing leverage equation.

Balance Sheet, End of 2010 (in millions of dollars) 2010 2009 2010 2009 Operating assets A 400 Operating liabilities 200 150 Financial assets 300 B Financial obligations F E Shareholders' equity D 180 Total Total 900 C G 830 Income Statement. 2010 in millions of dollars) Operating income, after tax Net financial expense, after tax Comprehensive income 36Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started