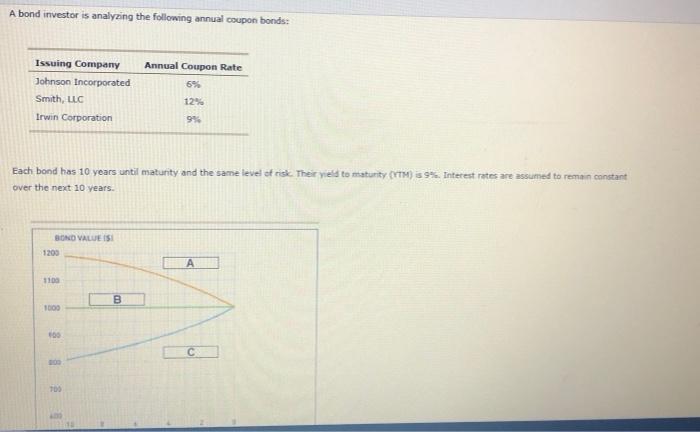

A bond investor is analyzing the following annual coupon bonds: Annual Coupon Rate Issuing Company Johnson Incorporated Smith, LLC 12% 9% Irwin Corporation Each bond has 10 years until maturity and the same level of risk. The yield to maturity (TM) 59%. Interest rates are assumed to remain constant over the next 10 years. BOND VALUES 1200 1100 B 1300 00 C 100 2 0 YEARS TO MATURITY Using the previous information, correctly match each curve on the graph to it's corresponding issuing company. (Hint: Each curve indicates the path that each bond's price, or value, is expected to follow.) Curve A Curve B Curvec - Based on the preceding information, which of the following statements are true? Check all that apply The expected capital gains yield for Smith, LLC's bonds is negative. The expected capital gains yield for Smith, LLC's bonds is greater than 12%. Johnson Incorporated's bonds have the highest expected total return The bonds have the same expected total return Johnson Incorporated just registered and issued its bonds, which will be sold in the bond market for the first time. Johnson Incorporated's bonds would be referred to as the previous information, correctly match each curve on the graph to it's corresponding that each bond's price, or value, is expected to follow.) Curve A Curve B Curve C Based on the preceding information, which of the following statements are true? Check all that The expected capital gains yield for Smith, LLC's bonds is negative. The expected capital gains yield for Smith, LLC's bonds is greater than 12%. Johnson Incorporated's bonds have the highest expected total return. The bon cted total return. a new issue an outstanding bond Johnson Incorpora be referred to as issued its bonds, which will be sold in the bond marke Using the previous information, correctly match each curve on the graph to it's corresponding issuing that each bond's price, or value, is expected to follow.) Curve A Curve B Curve C Smith, LLC Based on the Johnson Incorporated hich of the following statements are true? Check all that apply. The Irwin Corporation eld for Smith, LLC's bonds is negative. The expected capital gains yield for Smith, LLC's bonds is greater than 12%. Johnson Incorporated's bonds have the highest expected total return. The bonds have the same expected total return. Johnson Incorporated just registered and issued its bonds, which will be sold in the bond market for ti be referred to as