Answered step by step

Verified Expert Solution

Question

1 Approved Answer

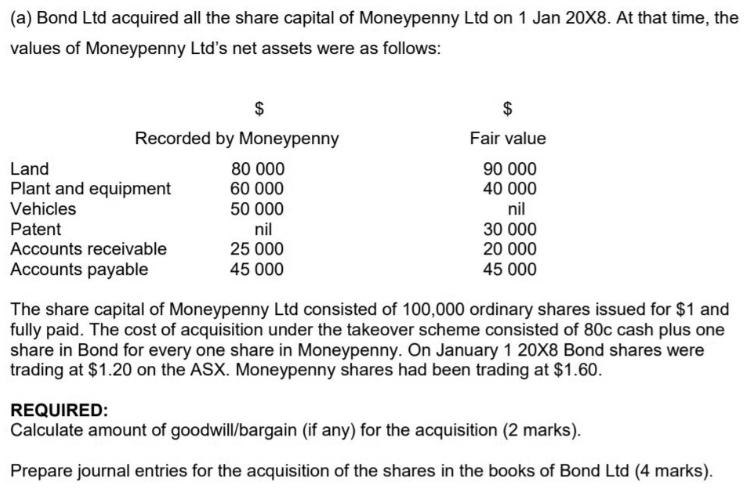

(a) Bond Ltd acquired all the share capital of Moneypenny Ltd on 1 Jan 20X8. At that time, the values of Moneypenny Ltd's net

(a) Bond Ltd acquired all the share capital of Moneypenny Ltd on 1 Jan 20X8. At that time, the values of Moneypenny Ltd's net assets were as follows: $ Recorded by Moneypenny Fair value Land 80 000 90 000 Plant and equipment Vehicles 60 000 40 000 50 000 nil nil Patent 30 000 20 000 Accounts receivable 25 000 Accounts payable 45 000 45 000 The share capital of Moneypenny Ltd consisted of 100,000 ordinary shares issued for $1 and fully paid. The cost of acquisition under the takeover scheme consisted of 80c cash plus one share in Bond for every one share in Moneypenny. On January 1 20X8 Bond shares were trading at $1.20 on the ASX. Moneypenny shares had been trading at $1.60. REQUIRED: Calculate amount of goodwill/bargain (if any) for the acquisition (2 marks). Prepare journal entries for the acquisition of the shares in the books of Bond Ltd (4 marks). %24

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Acquisition 120000 Net Asset of Money Penny 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started