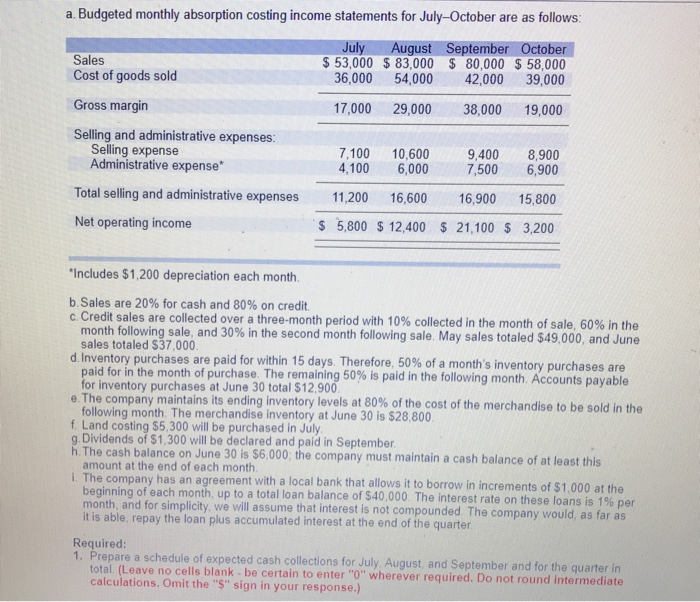

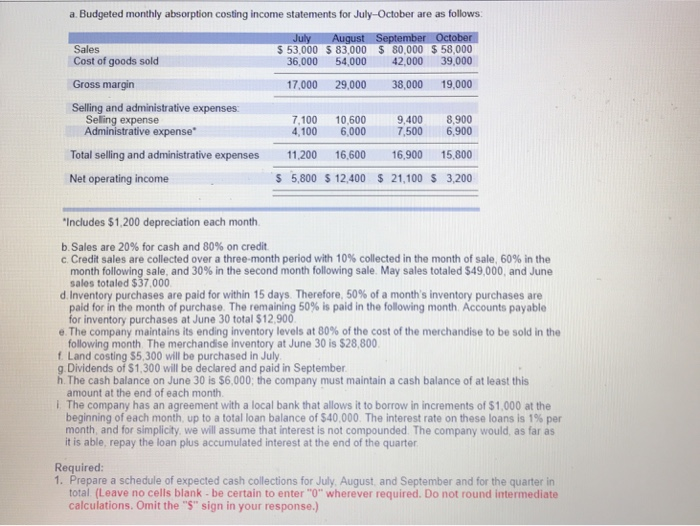

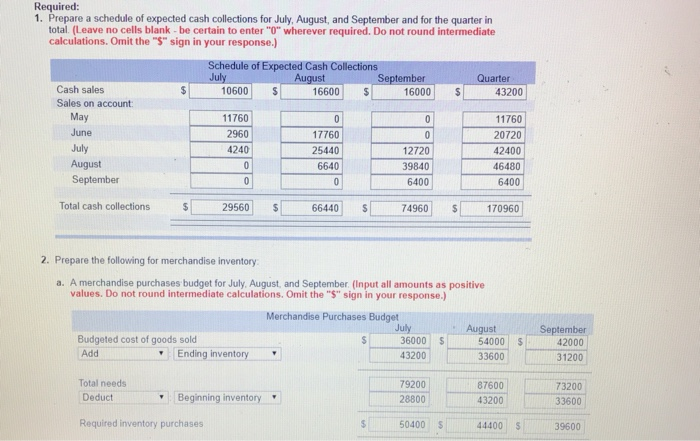

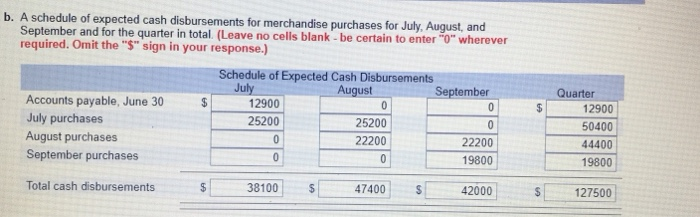

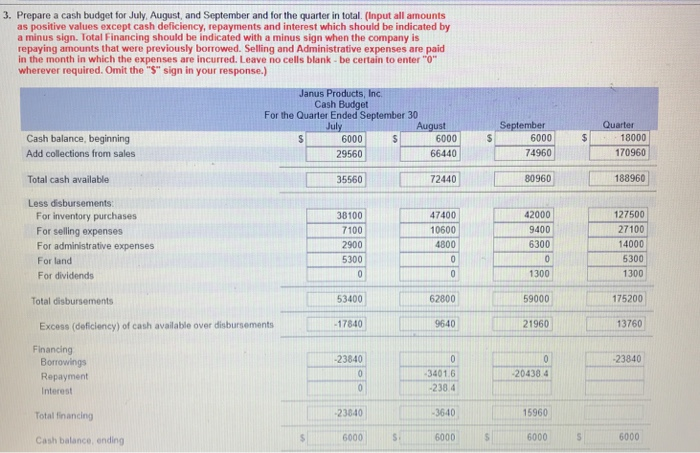

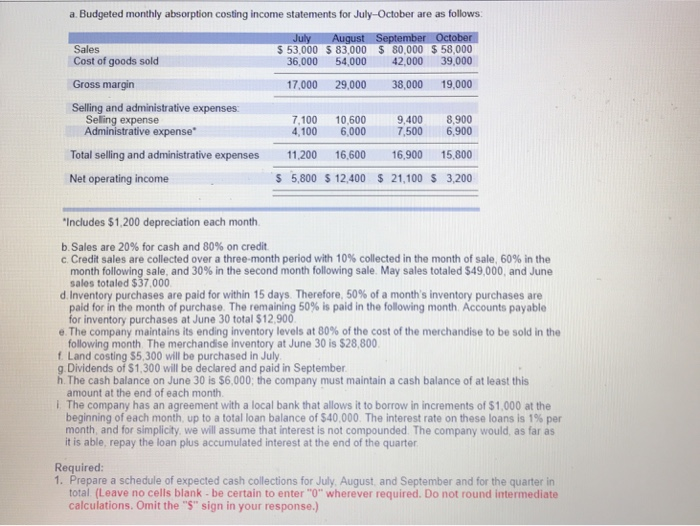

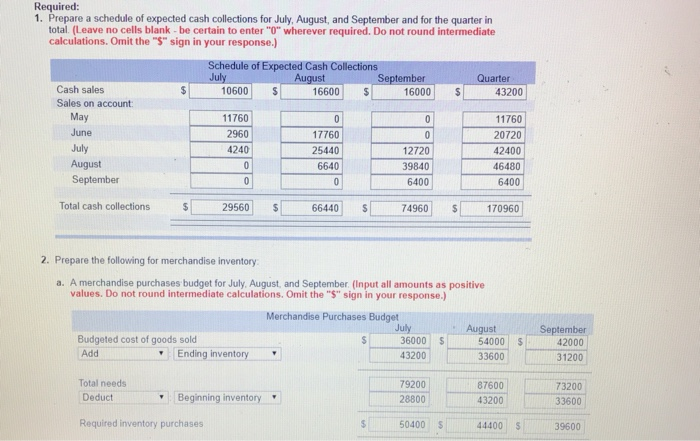

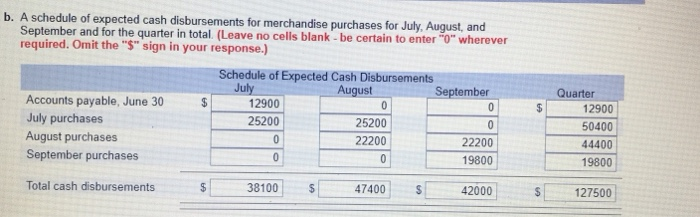

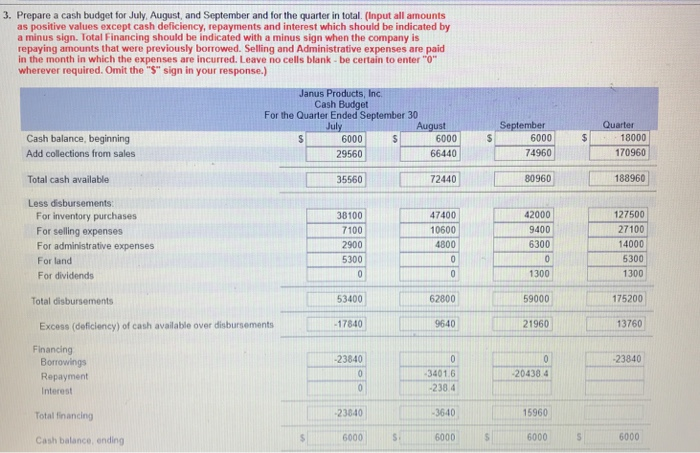

a. Budgeted monthly absorption costing income statements for July-October are as follows: July August September October 53,000 $ 83,000 80,000 $58,000 36,000 54,000 42,000 39,000 Sales Cost of goods sold Gross margin Selling and administrative expenses 17,000 29,000 38,000 19,000 Selling expense Administrative expense 7,100 10,600 9,400 8,900 7,500 6,900 4,100 6,000 Total selling and administrative expenses 11,200 16,600 16,900 15,800 Net operating income 5,800 $ 12,400 $ 21,100 $ 3,200 Includes $1,200 depreciation each month. b Sales are 20% for cash and 80% on credit. c Credit sales are collected over a three-month period with 10% collected in the month ofsale 60 % in the month following sale, and 30% in the second month following sale. May sales totaled $ sales totaled $37.000 49.000, and June d Inventory purchases are paid for within 15 days Therefore, 50% of a month's inventory purchases are paidfr in the month of purchase The remaining 50% is or inventory purchases at June 30 total $12,900 paid in the following month. Accounts payable e The company maintains its ending inventory levels at 80% of the cost of the merchandise to be sold in the following month. The merchandise inventory at June 30 is $28,800 f. Land costing $5,300 will be purchased in July g. Dividends of $1,300 will be declared and paid in September h. The cash balance i. The company has an agreement with a local bank that allows it to borrow in increments of $1.000 at the n June 30 is $6,000; the company must maintain a cash balance of at least this amount at the end of each month beginning of each month up to a total loan balance of$40,000 The interest rate on these loans is 1% month, and for simplicity, we will assume that interest is it is able, repay the loan plus accumulated interest at the end of the quarter per not compounded The company would, as far as Required: 1. Prepare a schedule of expected cash collections for July, August, and September and for the quarte total. (Leave no cells blank be certain to enter "O wherever required. Do not round intermediate calculations. Omit the "$" sign in your response.) a. Budgeted monthly absorption costing income statements for July-October are as follows Sales $ 53,000 $ 83,000 36,000 54,000 80,000 $ 58,000 42,000 39,000 Cost of goods sold Gross margin Selling and administrative expenses 17,000 29,000 38,000 19,000 Selling expense Administrative expense* 9,400 8.900 4,100 6,000 7,500 6,900 Total selling and administrative expenses ,20016,600 16,900 15,800 S 5,800 12,400 21,100 S 3,200 Net operating income Includes $1,200 depreciation each month b Sales are 20% for cash and 80% on credit C. Credit sales are collected over a three-month period with 10% collected in the month of sale, 60% in the month following sale, and 30% in the second month following sale May sales totaled $49,000, and June sales totaled $37,000 d inventory purchases are paid for within 15 days Therefore, 50% of a month's inventory purchases are id for in the month of purchase The remaining 50% is paid in the following month Accounts payable or inventory purchases at June 30 total $12,900 e The company maintains its ending inventory levels at 80% of the cost of the merchandise to be sold in the following month The merchandise inventory at June 30 is $28,800 g Dividends of $1,300 will be declared and paid in September h. The cash balance on June 30 is $6,000, the company must maintain a cash balance of at least this amount at the end of each month i The company has an agreement with a local bank that allows it to borrow in increments of $1,000 at the beginning of each month up to a total loan balance of $40.000 The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded The company would as far as it is able, repay the loan plus accumulated interest at the end of the quarter Required: 1. Prepare a schedule of expected cash collections for July, August, and September and for the quarter in total (Leave no cells blank- be certain to enter"O" wherever required. Do not round intermediate calculations. Omit the "$ sign in your response.) Required: 1. Prepare a schedule of expected cash collections for July, August, and September and for the quarter in total. (Leave no cells blank -be certain to enter "O wherever required. Do not round intermediate calculations. Omit the "S" sign in your response.) e of Expected Cash Collections Quarter Cash sales Sales on account 0600 16600 16000 S43200 May June July August September 11760 2960 4240 11760 20720 2400 46480 6400 17760 25440 6640 12720 39840 6400 Total cash collections 29560 66440 74960 170960 2. Prepare the following for merchandise inventory a. A merchandise purchases budget for July, August, and September (Input all amounts as positive values. Do not round intermediate calculations. Omit the "$" sign in your response.) Merchandise Purchases Budget July AugustSeptember 36000 S 54000 |SI 42000 31200 Budgeted cost of goods sold Add Ending inventory 43200 33600 Total needs Deduct 79200 28800 87600 43200 73200 33600 Beginning inventory Required inventory purchases S50400 44400 39600 b. A schedule of expected cash disbursements for merchandise purchases for July, August, and September and for the quarter in total. (Leave no cells blank - be certain to enter "0 wherever required. Omit the "$" sign in your response.) Schedule of Expected Cash Disbursements September Quarter Accounts payable, June 30 July purchases August purchases September purchases 12900 25200 12900 50400 44400 19800 25200 22200 22200 19800 Total cash disbursements s38100 3810047400 47400S 42000 127500 3. Prepare a cash budget for July, August, and September and for the quarter in total. (Input all amounts as positive values except cash deficiency, repayments and interest which should be indicated by a minus sign. Total Financing should be indicated with a minus sign when the company is repaying amounts that were previously borrowed. Selling and Administrative expenses are paid in the month in which the expenses are incurred. Leave no cells blank be certain to enter"O" wherever required. Omit the "$" sign in your response.) s Products Cash Budget For the Quarter Ended September 30 ember Quarter July ust 6000 66440 6000 74960 18000 170960 Cash balance, beginning 6000 29560 Add collections from sales Total cash available Less disbursements 80960 188960 72440 35560 47400 10600 4800 127500 27100 14000 5300 1300 38100 7100 2900 5300 42000 9400 6300 For inventory purchases For selling expenses For administrative expenses For land For dividends 1300 53400 59000 62800 175200 Total disbursements 2196013760 17840 Excess (deficiency) of cash available over disbursements Financing 640 23840 23840 Borrowings Repayment Interest 3401.6 20438 4 238 4 3640 6000 23840 15960 Total financing 6000S 6000 6000 Cash balance, ending