Answered step by step

Verified Expert Solution

Question

1 Approved Answer

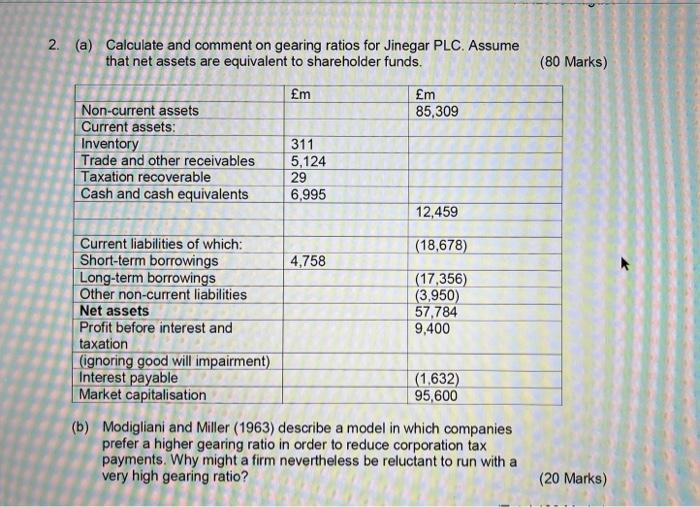

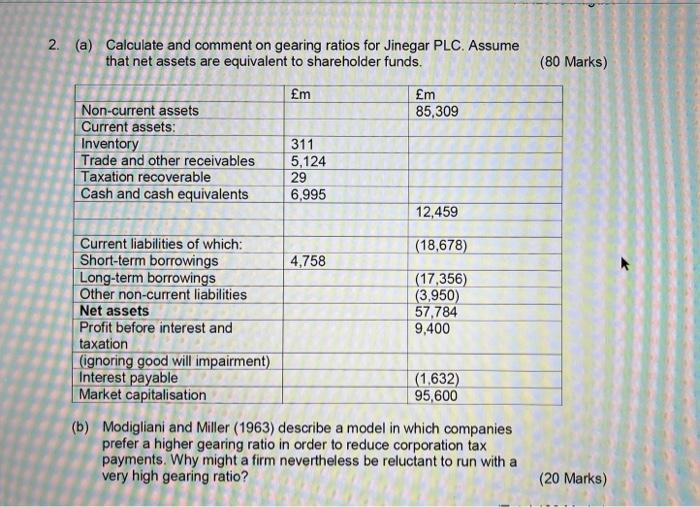

a. Calculate and comment on gearing ratios for Jinegar PLC. Assume that net assets are equivalent to shareholder funds. b. Modigliani and Miller (1963) describe

a. Calculate and comment on gearing ratios for Jinegar PLC. Assume that net assets are equivalent to shareholder funds.

2. (a) Calculate and comment on gearing ratios for Jinegar PLC. Assume that net assets are equivalent to shareholder funds. (80 Marks) m m 85,309 Non-current assets Current assets: Inventory Trade and other receivables Taxation recoverable Cash and cash equivalents 311 5,124 29 6,995 12,459 Current liabilities of which: (18,678) Short-term borrowings 4,758 Long-term borrowings (17,356) Other non-current liabilities (3,950) Net assets 57,784 Profit before interest and 9,400 taxation (ignoring good will impairment) Interest payable (1,632) Market capitalisation 95,600 (b) Modigliani and Miller (1963) describe a model in which companies prefer a higher gearing ratio in order to reduce corporation tax payments. Why might a firm nevertheless be reluctant to run with a very high gearing ratio? (20 Marks) b. Modigliani and Miller (1963) describe a model in which companies prefer a higher gearing ratio in order to reduce corporation tax payments. Why might a firm nevertheless be reluctant to run with a very high gearing ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started