Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate each projects payback period, net present value (NPV), internal rate of return (IRR), and modified internal rate of return (MIRR) when the WACC

a. Calculate each projects payback period, net present value (NPV), internal rate of return (IRR), and modified internal rate of return (MIRR) when the WACC is 12%. Which has the highest NPV? IRR?

b. Which project or projects should be accepted if they are independent (WACC = 12%)?

c. Which project should be accepted if they are mutually exclusive (WACC = 12%)? Explain how this depends on the decision criteria used (e.g., if there is a conflict in what is best between decision rules, explain why and which to use).

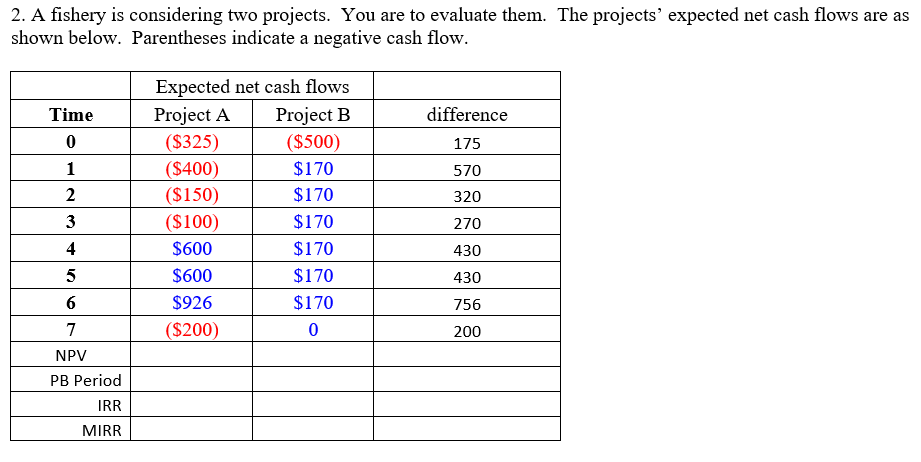

2. A fishery is considering two projects. You are to evaluate them. The projects' expected net cash flows are as shown below. Parentheses indicate a negative cash flow. Time difference 0 175 1 570 N 320 Expected net cash flows Project A Project B ($325) ($500) ($400) $170 ($150) $170 ($100) $170 $600 $170 $600 $170 $926 $170 ($200) 0 3 270 4 430 5 430 6 756 7 200 NPV PB Period IRR MIRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started