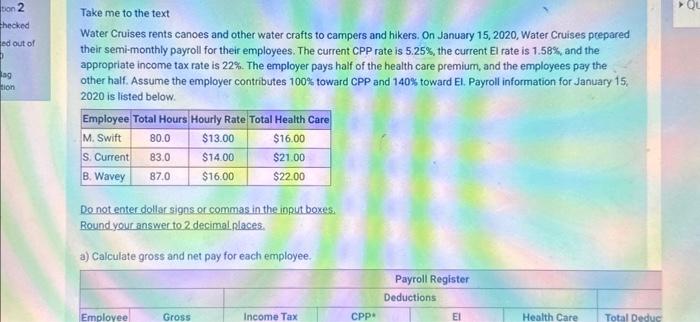

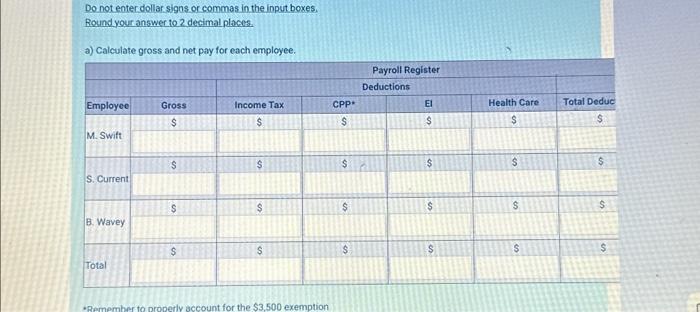

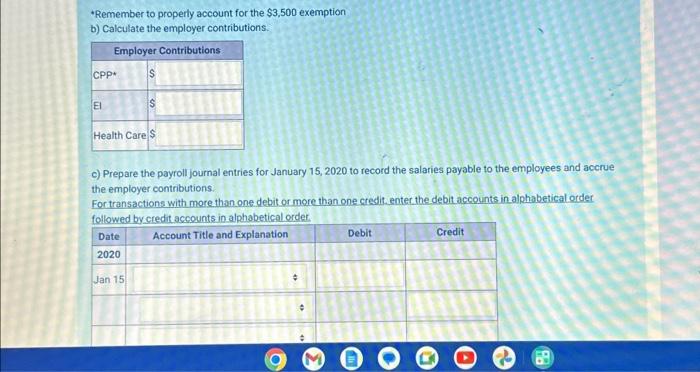

a) Calculate gross and net pay for each employee. *Remember to properly account for the \\( \\$ 3,500 \\) exemption b) Calculate the employer contributions. c) Prepare the payroll journal entries for January 15,2020 to record the salaries payable to the employees and accrue the employer contributions. Fortransactions with more than one debit or more than one credit. enter the debit accounts in alphabetical order. followed bv credit accounts in alphabetical order. Take me to the text Water Cruises rents canoes and other water crafts to campers and hikers. On January 15, 2020, Water Cruises prepared their semi-monthly payroll for their employees. The current CPP rate is \5.25, the current El rate is \1.58, and the appropriate income tax rate is \22. The employer pays half of the health care premium, and the employees pay the other half. Assume the employer contributes 100\\% toward CPP and \140 toward EI. Payroll information for January 15 , 2020 is listed below. Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. a) Calculate gross and net pay for each employee. a) Calculate gross and net pay for each employee. *Remember to properly account for the \\( \\$ 3,500 \\) exemption b) Calculate the employer contributions. c) Prepare the payroll journal entries for January 15,2020 to record the salaries payable to the employees and accrue the employer contributions. Fortransactions with more than one debit or more than one credit. enter the debit accounts in alphabetical order. followed bv credit accounts in alphabetical order. Take me to the text Water Cruises rents canoes and other water crafts to campers and hikers. On January 15, 2020, Water Cruises prepared their semi-monthly payroll for their employees. The current CPP rate is \5.25, the current El rate is \1.58, and the appropriate income tax rate is \22. The employer pays half of the health care premium, and the employees pay the other half. Assume the employer contributes 100\\% toward CPP and \140 toward EI. Payroll information for January 15 , 2020 is listed below. Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. a) Calculate gross and net pay for each employee