Question

a) Calculate the capital of 8th Eagle Scholarly Bank b) If students default on 5% of their loans and the Federal Government investigates the University

a) Calculate the capital of 8th Eagle Scholarly Bank

b) If students default on 5% of their loans and the Federal Government investigates the University of Phoenix, leading the value of the Universitys bonds to drop by 30%, what happens to the capital of 8 th Eagle Scholarly Bank? Is the bank solvent?

c) If regulators require the bank to have capital equal to at least 8% of the loans it gives out and the securities it owns, how much more capital would the bank need to meet this requirement after the events mentioned in part b)? (Use the value of the student loans and University of Phoenix bonds after the increased loan defaults and Federal investigation.) What could the bank do to satisfy this requirement?

d) Suppose that the Federal Reserve required that all banks hold reserves equal to 10% of checking deposits plus 1% of time deposits plus 5% of money market deposits. How much of 8 th Eagle Scholarly Banks reserves would be required reserves, and how much would be excess reserves?

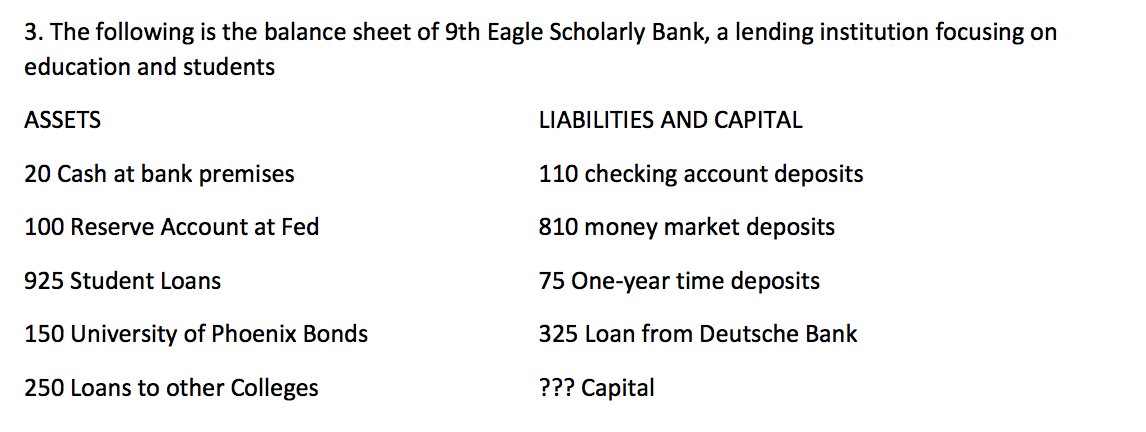

3. The following is the balance sheet of 9th Eagle Scholarly Bank, a lending institution focusing on education and students ASSETS LIABILITIES AND CAPITAL 20 Cash at bank premises 110 checking account deposits 100 Reserve Account at Fed 810 money market deposits 925 Student Loans 75 One-year time deposits 150 University of Phoenix Bonds 325 Loan from Deutsche Bank 250 Loans to other Colleges ??? CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started