Answered step by step

Verified Expert Solution

Question

1 Approved Answer

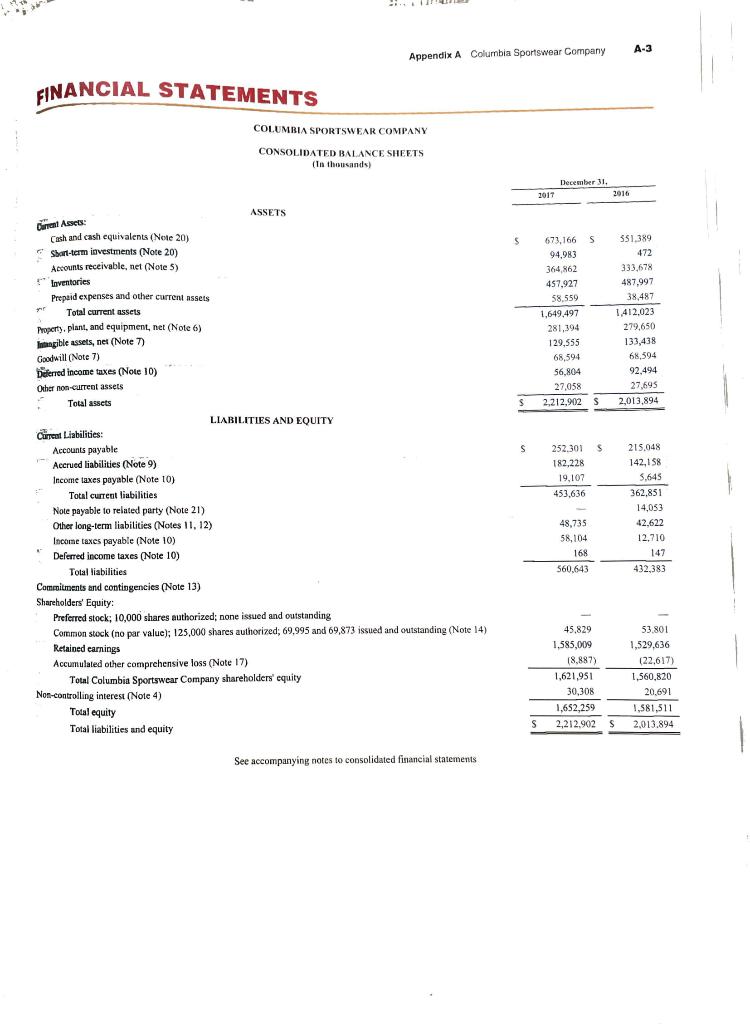

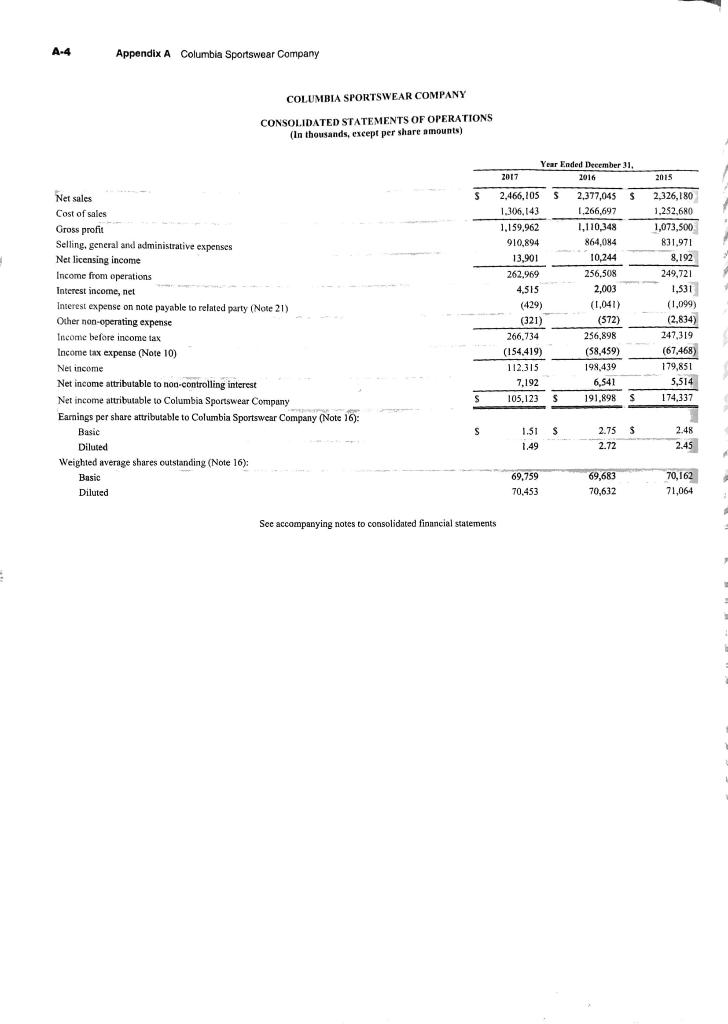

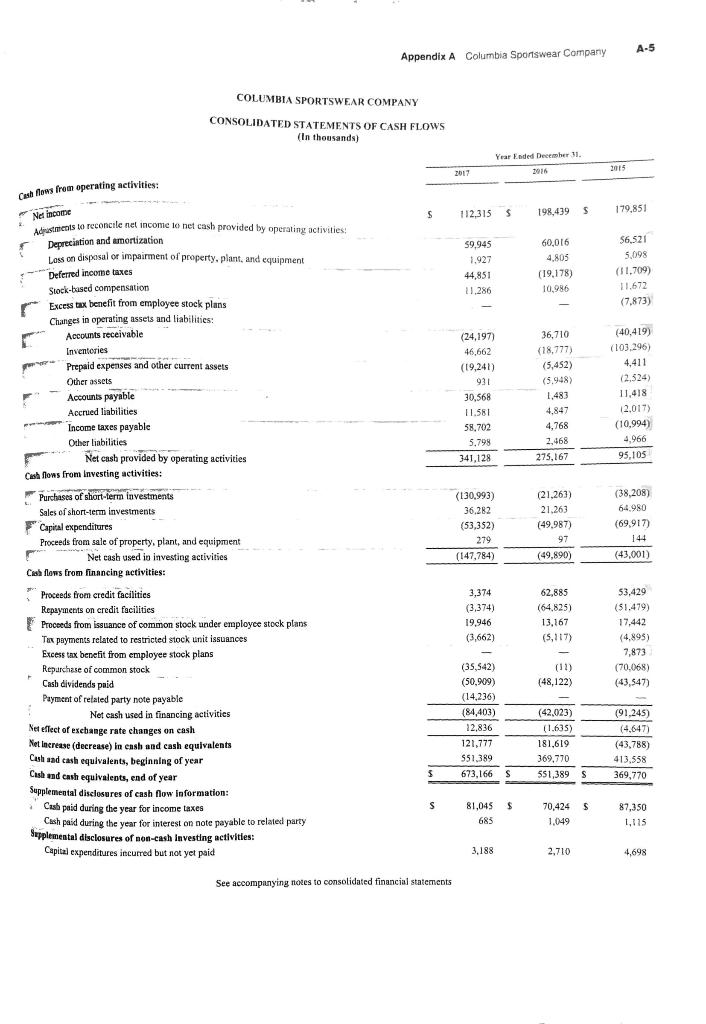

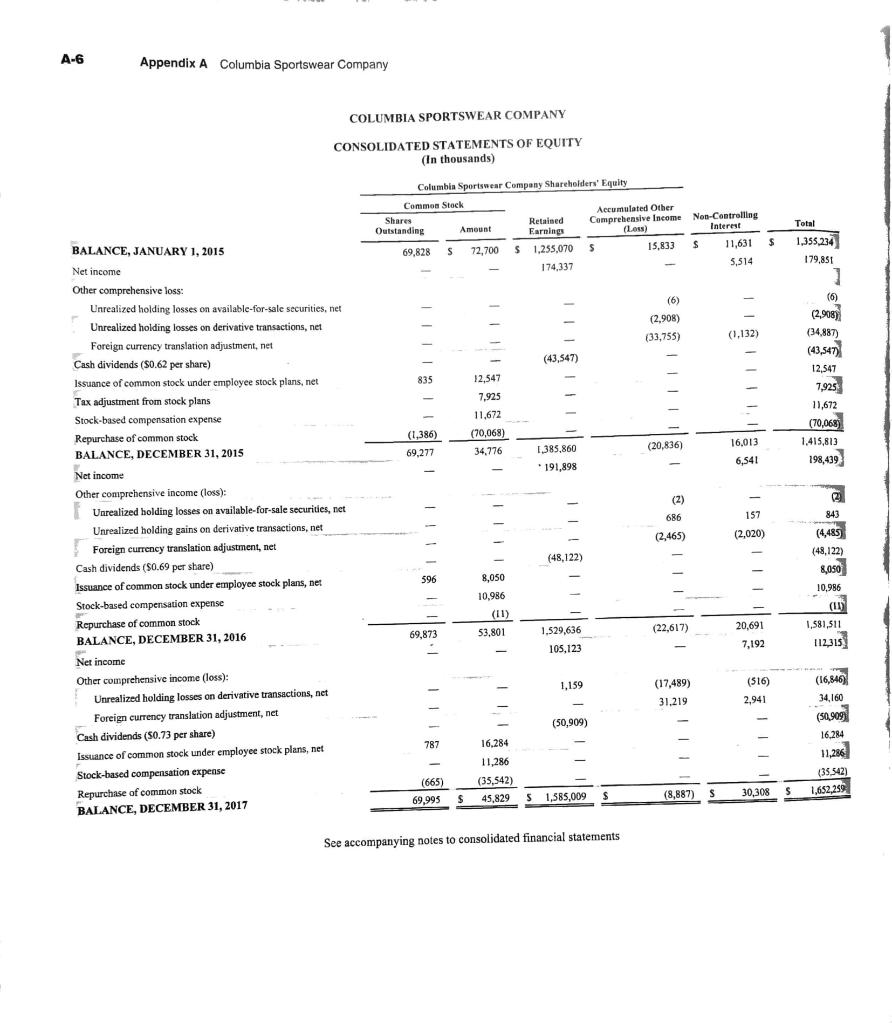

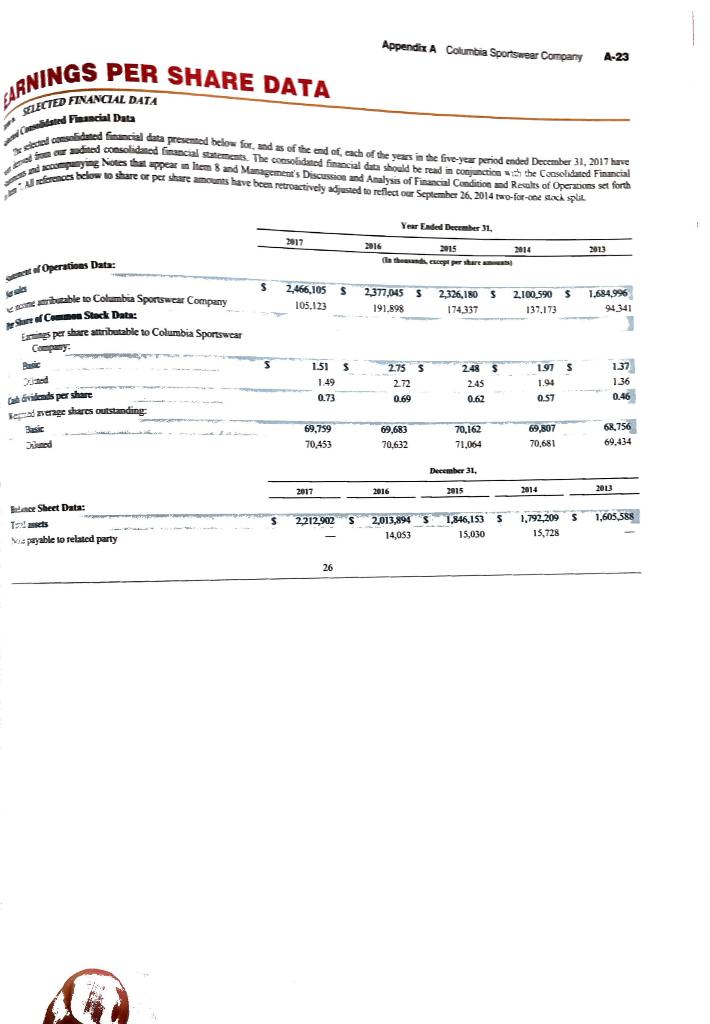

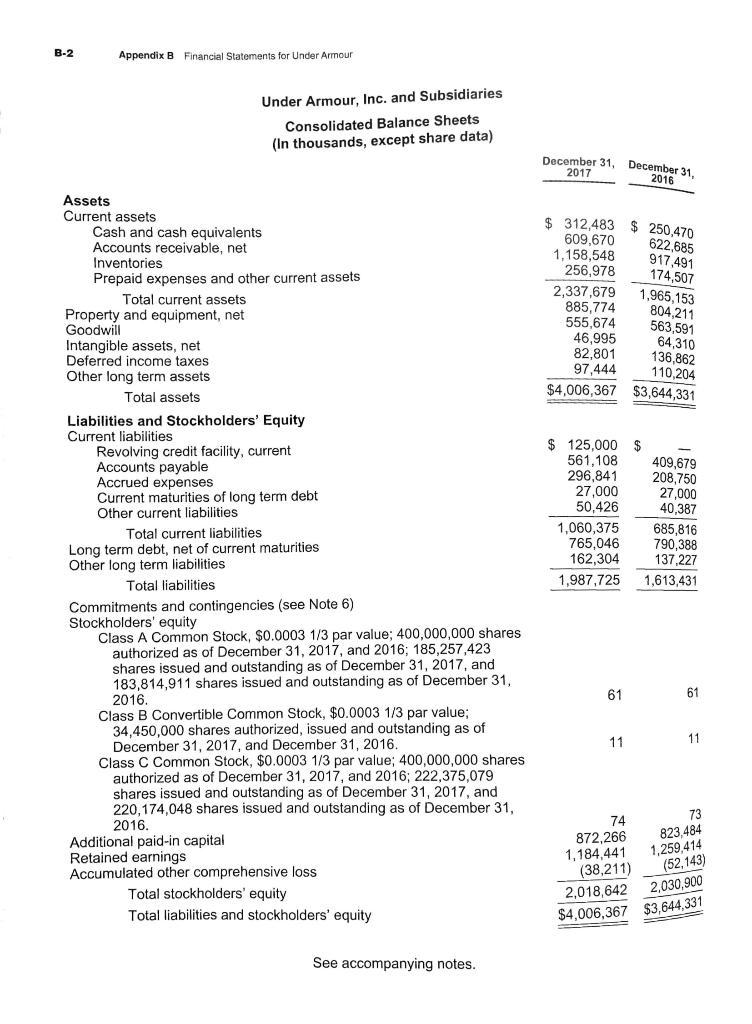

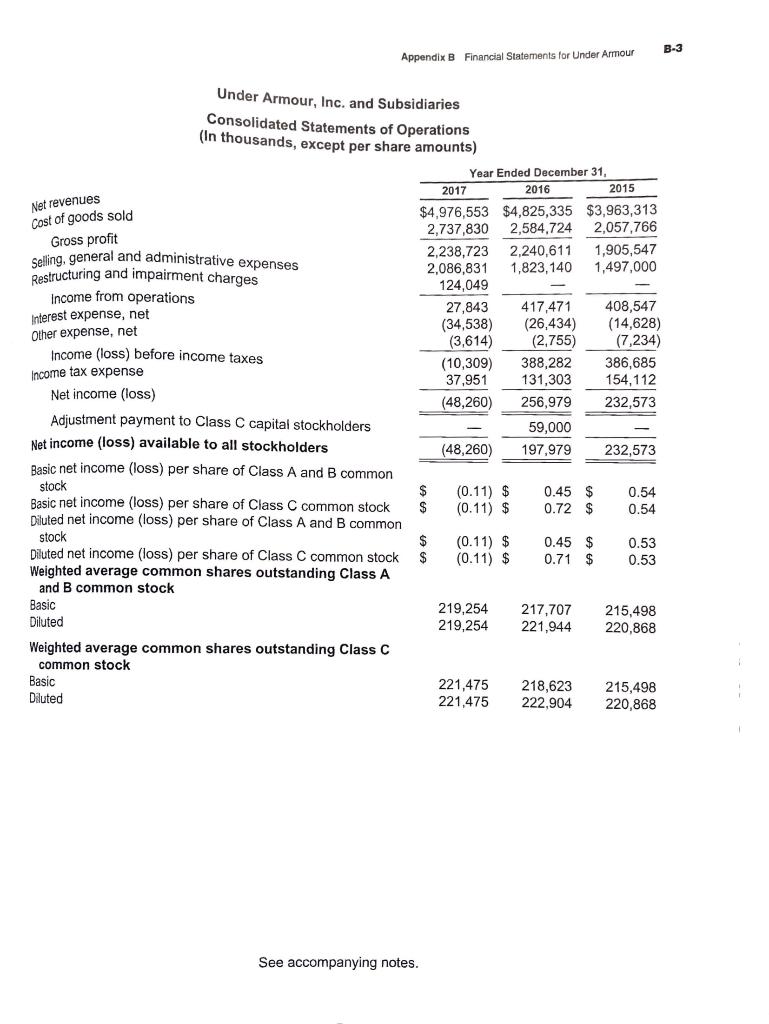

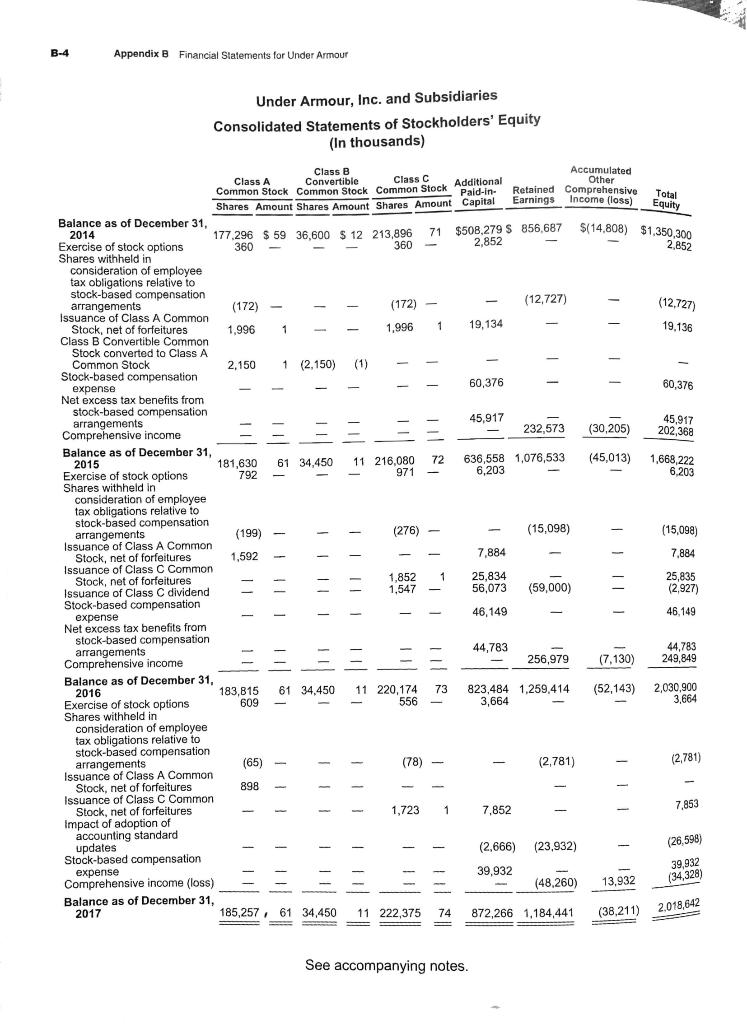

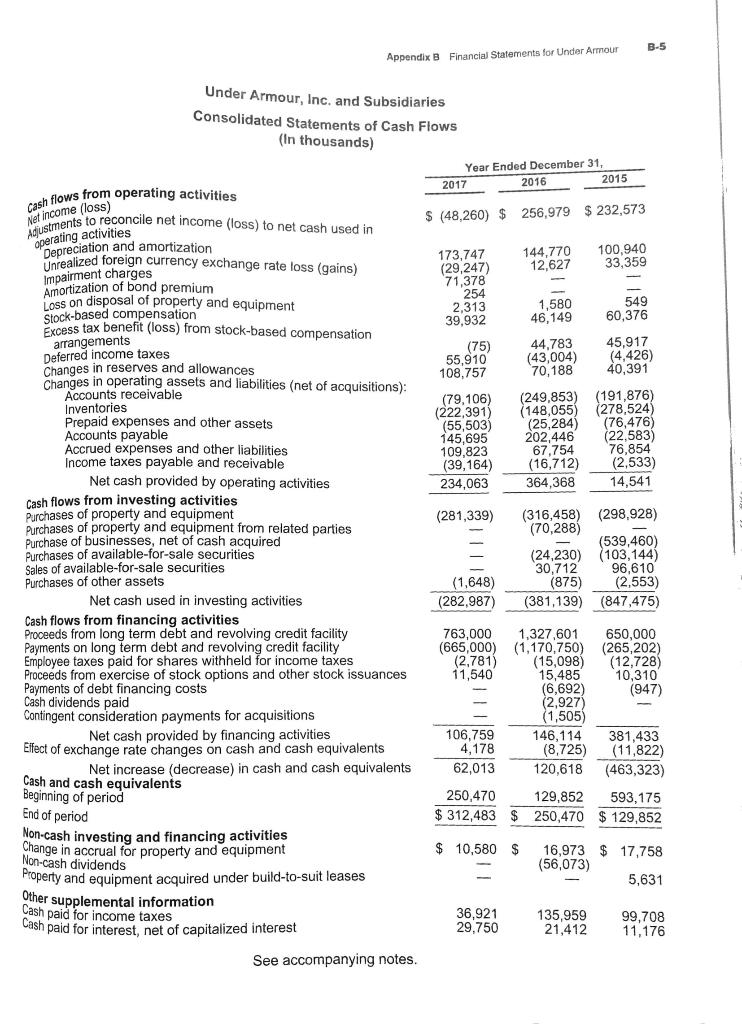

a. Calculate the return on common stockholders equity for each company for 2017. (round to 2 decimals) Columbia % Under Armour % b. Calculate the

a. Calculate the return on common stockholders equity for each company for 2017. (round to 2 decimals)

Columbia %

Under Armour %

b. Calculate the dividend payout ratio for each company for 2017 (round to 1 decimal)

Columbia %

Under Armour %

c. Based on the return on common stockholders equity and the dividend payout ratios for each company, which company performed better for its shareholders during 2017> (1-3 sentences)

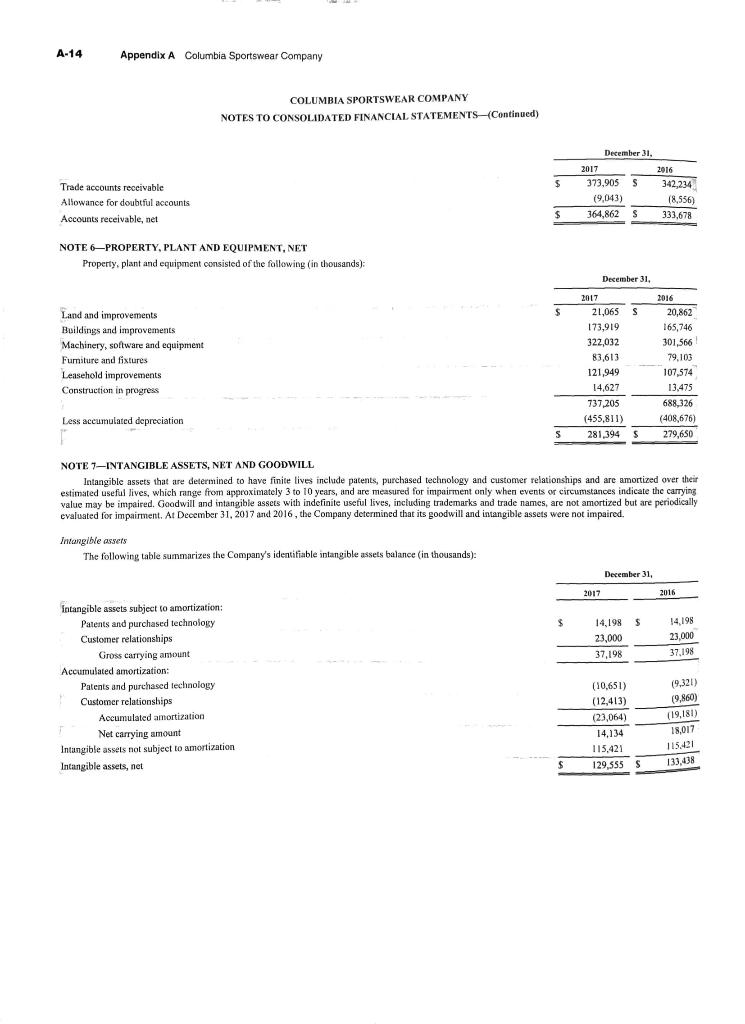

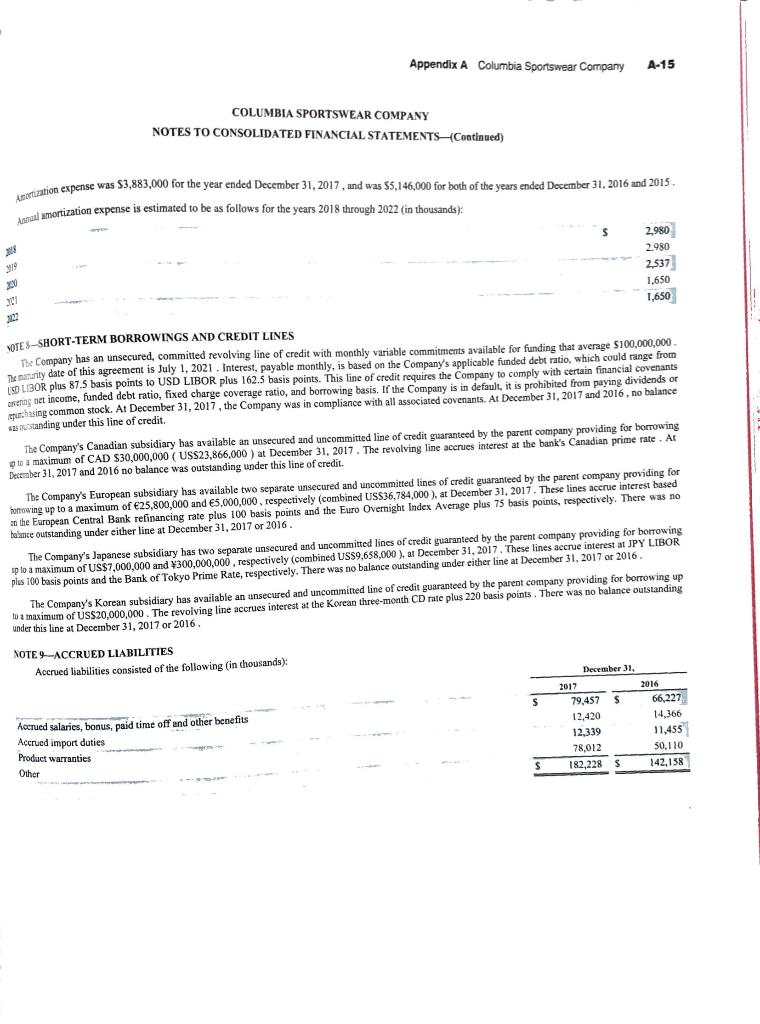

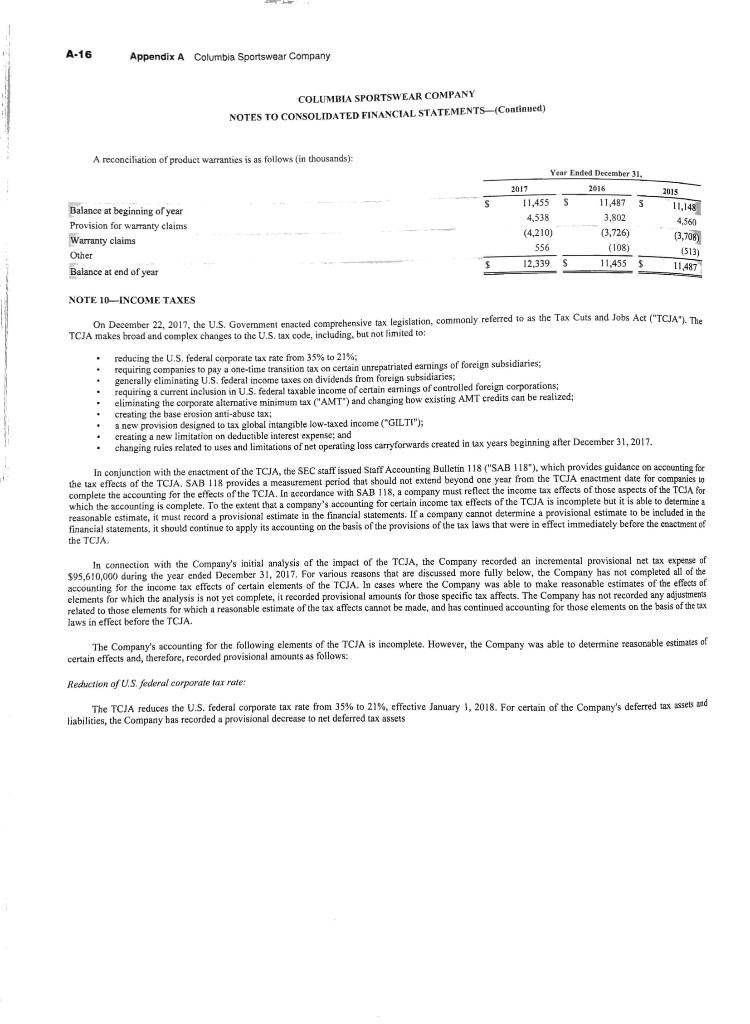

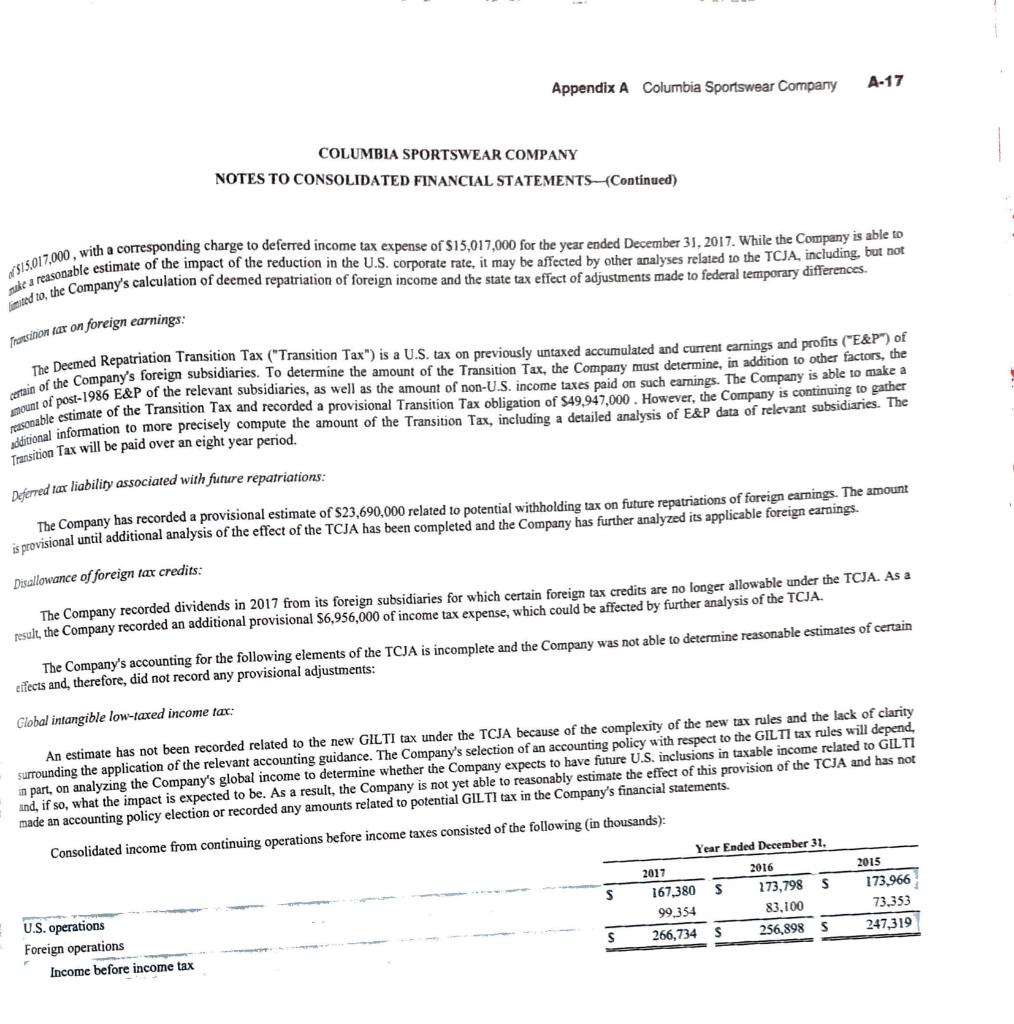

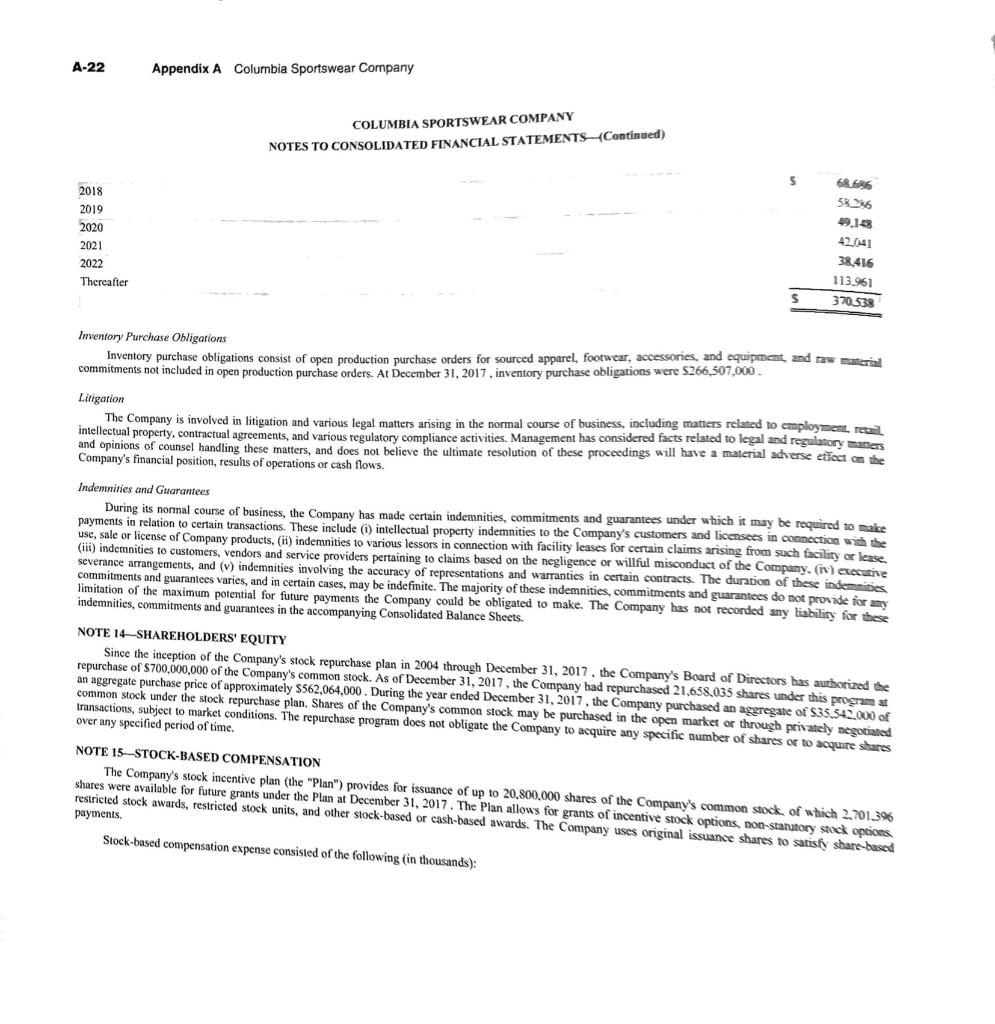

A-3 Appendix A Columbia Sportswear Company FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31, 2017 2016 ASSETS Carral Assets s 673.166 S 94,983 364,862 457,927 58,559 1,649.497 281,394 129.555 68,594 56,804 27.058 2.212,902 351 389 472 333,678 487,997 38,487 1,412,023 279,650 133,438 68,594 92,494 27,695 2,013,894 s S Cash and cash equivalents (Note 20) Sbart-term investments (Note 20) Accounts receivable, net (Note 5) Inventories Prepaid expenses and other current Assets Total current assets Property, plant, and equipment, net (Note 6) Integible assets, net (Note 7) Goodwill (Note 7) Deerred income taxes (Note 10) Other non-current assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Accrued liabilities (Note 9) Income taxes payable (Note 10) Total current liabilities Note payable to related party (Note 21) Other long-term liabilities (Notes 11, 12) Income taxes payable (Note 10) Deferred income taxes (Note 10) Total liabilities Commitments and contingencies (Note 13) Shareholders' Equity: Preferred stock; 10,000 shares authorized: none issued and outstanding Common stock (no par value); 125,000 shares authorized: 69,995 and 69,873 issued and outstanding (Note 14) Retained earnings Accumulated other comprehensive loss (Note 17) Total Columbia Sportswear Company shareholders' equity Non-controlling interest (Note 4) Total equity Total liabilities and equity 252.301 182,228 19.107 453,636 215.048 142,158 5.645 362.851 14,053 42.622 12.710 147 432,383 48,735 58,104 168 560.643 45.829 1,585,009 18.887) 1,621,951 30,308 1,652259 2,212 902 53.801 1,529,636 (22,617) 1,560,820 20.691 1,581,511 2.013.894 s $ See accompanying notes to consolidated financial statements A.4 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Ended December 31 2016 2017 2015 $ Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Income from operations Interest income, net Interest expense on note payable to related party (Note 21) Other non-operating expense Income before income tax Income tax expense (Note 10) 2.466,705 5 1,306,143 1.159,962 910,894 13,901 110 262.969 ALS 4,515 (429 (429) (321) 266,734 (154.419) ( 112.315 7,192 105,123 s 2,377,045 $ 1.266,697 1,110,348 864,084 10,244 256,508 2,003 (1041) (1.041) (572) 12) 256,898 (58,459) 198,439 6,541 191,898 $ 2,326,180 1,252,680 1,073,500 831,971 8,192 249,721 1,531 (1,099) (2,834) ( 147,319 (67,468) 179,851 5,514 174,337 Net income S Net income attributable to non-controlling interest Net income attributable to Columbia Sportswear Company Earnings per share attributable to Columbia Sportswear Company (Note 16): Basic Diluted Weighted average shares outstanding (Note 16): Basic S 1.51 $ 2.75$ 2.72 2.48 2.45 1,49 69,759 70,453 69,683 70,632 70,162 71,064 Diluted Sec accompanying notes to consolidated financial statements A-6 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Common Stock Accumulated Other Shares Retained Comprehensive Income Non-Controlling Outstanding Amount Earnings (Loss) 69,828 S 72,700 S 1,255,070 $ 15,833 $ 11,631 174,337 5,514 Interest Total $ 1,355.234 (6) (2,908) (33,755) (1,132) (43,547) 179,851 1 (6) (2.908) (34.887) (43,547) 12,547 7,925 11,672 (70,068) 1,415,813 198,439 835 BALANCE, JANUARY 1, 2015 Net income Other comprehensive loss: Unrealized holding losses on available-for-sale securities, net Unrealized holding losses on derivative transactions, net Foreign currency translation adjustment, net Cash dividends (S0.62 per share) Issuance of common stock under employee stock plans, net Tax adjustment from stock plans Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2015 Net income Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities, net Unrealized holding gains on derivative transactions, net Foreign currency translation adjustment, net Cash dividends ($0.69 per share) ( Issuance of common stock under employee stock plans, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2016 12,547 7,925 11,672 (70,068) 34,776 (1,386) 69,277 (20,836) 16,013 1,385,860 191,898 6,541 (2) 686 157 (2,465) (2,020) 2 843 (4,485 (48,122) 8,050 (48,122) 596 8,050 10,986 (11) 53,801 10,986 (11) 1,581,511 69,873 20,691 (22,617) 1.529,636 105,123 7,192 112,315) Net income 1.159 (17,489) 31,219 (516) 2,941 (50,909) Other comprehensive income (loss): Unrealized holding losses on derivative transactions, net Foreign currency translation adjustment, net Cash dividends (50.73 per share) ( Issuance of common stock under employee stock plans, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2017 (16,846) 34.160 (50,909 16.284 11,286 (35.542) 1,652,259 787 16,284 11,286 (665) 69,995 (35,542) 45,829 S 1,585,009 $ (8,887) 30,308 See accompanying notes to consolidated financial statements A-16 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTSContinued) A reconciliation of product warranties is as follows (in thousands): s Balance at beginning of year Provision for warranty claims Warranty claims Other Balance at end of year Year Ended December 31 2017 2016 11,455 11,4875 4,338 3.802 (4,210) (3.726) SS6 (108) 12,339 S 11,455 $ 2015 11,148 4,560 (3,708) (513) 11,487 $ NOTE 10-INCOME TAXES . On December 22, 2017, the U.S. Government enacted comprehensive tax legislation, commonly referred to as the Tax Cuts and Jobs Act ("TCJA"). The TCJA makes broad and complex changes to the U.S. tax code, including, but not limited to: reducing the U.S. federal corporate tax rate from 35% to 21%; requiring companies to pay a one-time transition tax on certain unrepatriated eamings of foreign subsidiaries; generally climinating US federal income taxes on dividends from foreign subsidiaries; requiring a current inclusion in U.S.federal taxable income of certain earnings of controlled foreign corporations eliminating the corporate alternative minimum tax ("AMT") and changing how existing AMT credits can be realized; creating the base erosion anti-abuse tax; a new provision designed to tax global intangible low-taxed income ("GILTI"); creating a new limitation on deductible interest expense; and changing rules related to uses and limitations of net operating loss carryforwards created in tax years beginning after December 31, 2017. In conjunction with the enactment of the TCJA, the SEC staff issued Staff Accounting Bulletin 118 ("SAB 118"), which provides guidance on accounting for the tax effects of the TCJA. SAB 118 provides a measurement period that should not extend beyond one year from the TCJA enactment date for companies to complete the accounting for the effects of the TCJA. In accordance with SAB 118, a company must reflect the income tax effects of those aspects of the TCJA for which the accounting is complete. To the extent that a company's accounting for certain income tax effects of the TCJA is incomplete but it is able to determine a reasonable estimate, it must record a provisional estimate in the financial statements. If a company cannot determine a provisional estimate to be included in the financial statements, it should continue to apply its accounting on the basis of the provisions of the tax laws that were in effect immediately before the enactment of the TCJA In connection with the Company's initial analysis of the impact of the TCJA, the Company recorded an incremental provisional net tax expense of $95,610,000 during the year ended December 31, 2017. For various reasons that are discussed more fully below, the Company has not completed all of the accounting for the income tax effects of certain elements of the TCJA. In cases where the Company was able to make reasonable estimates of the effects of elements for which the analysis is not yet complete, it recorded provisional amounts for those specific tax affects. The Company has not recorded any adjustments related to those elements for which a reasonable estimate of the tax affects cannot be made, and has continued accounting for those elements on the basis of the tax laws in effect before the TCJA The Company's accounting for the following elements of the TCJA is incomplete. However, the Company was able to determine reasonable estimates of certain effects and therefore, recorded provisional amounts as follows: Reduction of U.S. federal corporate tax rate: The TCJA reduces the U.S. federal corporate tax rate from 35% to 21%, effective January 1, 2018. For certain of the Company's deferred tax assets and liabilities, the Company has recorded a provisional decrease to net deferred tax assets A-20 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) the Company's 2014 corporate income tax return in 2016. Due to the nature of the findings in both of these audits, the Company has invoked the Mutual Agreement Procedures outlined in the U.S.-Korean income tax treaty. The Company does not anticipate that adjustments relative to this dispute, or any othbal Coming tax audits, will result in material changes to its financial condition, results of operations or cash flows. Other than the dispute previously noted her Company is not currently under examination in any major jurisdiction. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows (in thousands): $ Balance at beginning of year Increases related to prior year tax positions Decreases related to prior year tax positions Increases related to current year tax positions Expiration of statute of limitations Balance at end of year 2017 9,998 858 (2,895) 2,714 December 31, 2016 11,187 2,514 (5,119) 1,599 (183) 9,998 2015 6,630 365 (2,019) 6,564 (353) 11.187 (163) 10,512 Due to the potential for resolution of income tax audits currently in progress, and the expiration of various statutes of limitation, it is reasonably possible that the unrecognized tax benefits balance may change within the twelve months following December 31, 2017 by a range of zero to $2,066,000. Open tax years, including those previously mentioned, contain matters that could be subject to differing interpretations of applicable tax laws and regulations as they relate to the amount, timing, or inclusion of revenue and expenses or the sustainability of income tax credits for a given examination cycle. Unrecognized tax benefits of 6,892,000 and $7,723,000 would affect the effective tax rate if recognized at December 31, 2017 and 2016 , respectively. The Company recognizes interest expense and penalties related to income tax matters in income tax expense. The Company recognized a net reversal of accrued interest and penalties of $1,402,000 in 2017, and a net increase of accrued interest and penalties of $637,000 in 2016 and a net reversal of accrued interest and penalties of S356,000 in 2015, all of which related to uncertain tax positions. The Company had $1,640,000 and $3,042,000 of accrued interest and penalties related to uncertain tax positions at December 31, 2017 and 2016, respectively. NOTE 11-OTHER LONG-TERM LIABILITIES Other long-term liabilities consisted of the following in thousands): December 31, 2017 31,016 $ S 2016 30,869 3,342 8,411 Straight-line and deferred rent liabilities (Note 13) Asset retirement obligations Deferred compensation plan liability (Note 12) Derivative financial instruments (Note 19) 4,580 9,319 3,820 48.735 42,672 NOTE 12-RETIREMENT SAVINGS PLANS 401(k) Profil-Sharing Plan The Company has a 401(k) profit-sharing plan, which covers substantially all U.S. employees. Participation begins the first day of the quarter following completion of 30 days of service. The Company may elect to make discretionary matching or non-matching contributions. All Company contributions to the plan as determined by the Board of Directors totaled $7,666,000, $7,754,000 and $6,981,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Deferred Compensation Plan A-22 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS/Continued) 5 2018 2019 2020 2021 2022 Thereafter 38,416 113.961 370 538 Inventory Purchase Obligations Inventory purchase obligations consist of open production purchase orders for sourced apparel, footwear, accessories, and equipment and waterial commitments not included in open production purchase orders. At December 31, 2017, inventory purchase obligations were $266,507,000 Litigation The Company is involved in litigation and various legal matters arising in the normal course of business, including matters related to employment intellectual property, contractual agreements, and various regulatory compliance activities. Management has considered facts related to legal and regulatory aners and opinions of counsel handling these matters, and does not believe the ultimate resolution of these proceedings will have a material adverse efect cete Company's financial position, s of operations or cash flows. Indennities and Guarantees During its normal course of business, the Company has made certain indemnities, commitments and guarantees under which it may be required to make payments in relation to certain transactions. These include (1) intellectual property indemnities to the Company's customers and licensees in connection with the use, sale or license of Company products, (ii) indemnities to various lessors in connection with facility leases for certain claims arising from such facility or lease (iii) indemnities to customers, vendors and service providers pertaining to claims based on the negligence or willful misconduct of the Company. (iv) executive severance arrangements, and (v) indemnities involving the accuracy of representations and warranties in certain contracts. The duration of these indemnities commitments and guarantees varies, and in certain cases, may be indefinite. The majority of these indemnities, commitments and guarantees do not provide for any limitation of the maximum potential for future payments the Company could be obligated to make. The Company has not recorded any liability for these indemnities, commitments and guarantees in the accompanying Consolidated Balance Sheets. NOTE 14SHAREHOLDERS' EQUITY Since the inception of the Company's stock repurchase plan in 2004 through December 31, 2017, the Company's Board of Directors has authorized the repurchase of $700,000,000 of the Company's common stock. As of December 31, 2017, the Company had repurchased 21,638,035 shares under this program at an aggregate purchase price of approximately 5562,064,000. During the year ended December 31, 2017, the Company purchased an aggregate of $35.548.000 of common stock under the stock repurchase plan, Shares of the Company's common stock may be purchased in the open market or through privately negotiated transactions, subject to market conditions. The repurchase program does not obligate the Company to acquire any specific number of shares or to acquire shares over any specified period of time. NOTE 15STOCK-BASED COMPENSATION The Company's stock incentive plan (the "Plan") provides for issuance of up to 20.800.000 shares of the Company's common stock, of which 2.701_396 shares were available for future grants under the Plan at December 31, 2017. The Plan allows for grants of incentive stock options, non-statutory stock options restricted stock awards, restricted stock units, and other stock-based or cash-based awards. The Company uses original issuance shares to satisfy share-based payments Stock-based compensation expense consisted of the following (in thousands): B-4 Appendix B Financial Statements for Under Armour Under Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity (In thousands) Total Equity $(14,808) $1,350,300 2,852 (12,727) 19.136 60,376 45,917 202,368 1,668,222 6,203 Class B Accumulated Class A Convertible Class C Additional Other Common Stock Common Stock Common Stock Pald-in- Retained Comprehensive Shares Amount Shares Amount Shares Amount Capital Earnings Income (loss) Balance as of December 31, 2014 177,296 $ 59 36,600 $ 12 213,896 71 $508,279 S 856,687 Exercise of stock options 360 360 2,852 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (172) (172) (12,727) Issuance of Class A Common Stock, net of forfeitures 1.996 1 1,996 1 19,134 Class B Convertible Common Stock converted to Class A Common Stock 2,150 1 (2,150) (1) Stock-based compensation expense 60,376 Net excess tax benefits from stock-based compensation arrangements 45,917 Comprehensive income 232,573 (30,205) Balance as of December 31, 2015 181,630 61 34,450 11 216,080 72 636,558 1.076,533 (45,013) Exercise of stock options 792 971 6,203 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (199) (276) (15,098) Issuance of Class A Common Stock, net of forfeitures 1.592 7,884 Issuance of Class C Common Stock, net of forfeitures 1,852 1 25,834 Issuance of Class C dividend 1,547 (59,000) Stock-based compensation expense 46,149 Net excess tax benefits from stock-based compensation arrangements 44,783 Comprehensive income 256,979 (7,130) Balance as of December 31, 2016 183,B15 61 34.450 11 220,174 73 823,484 1,259,414 (52,143) Exercise of stock options 609 556 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (65) (78) (2,781) Issuance of Class A Common Stock, net of forfeitures 898 Issuance of Class C Common Stock, net of forfeitures 1,723 1 7,852 Impact of adoption of accounting standard updates (2,666) (23,932) Stock-based compensation expense 39,932 Comprehensive income (loss) (48,260 13,932 Balance as of December 31, , 2017 185,257, 61 34,450 11 222,375 74 872,266 1,184,441 (38.211) (15,098) 7,884 25,835 56,073 (2,927) 46,149 44,783 249,849 2,030,900 3,664 3,664 - (2.781) 7,853 (26,598) 39,932 (34,328) 2018,642 See accompanying notes. A-3 Appendix A Columbia Sportswear Company FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31, 2017 2016 ASSETS Carral Assets s 673.166 S 94,983 364,862 457,927 58,559 1,649.497 281,394 129.555 68,594 56,804 27.058 2.212,902 351 389 472 333,678 487,997 38,487 1,412,023 279,650 133,438 68,594 92,494 27,695 2,013,894 s S Cash and cash equivalents (Note 20) Sbart-term investments (Note 20) Accounts receivable, net (Note 5) Inventories Prepaid expenses and other current Assets Total current assets Property, plant, and equipment, net (Note 6) Integible assets, net (Note 7) Goodwill (Note 7) Deerred income taxes (Note 10) Other non-current assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Accrued liabilities (Note 9) Income taxes payable (Note 10) Total current liabilities Note payable to related party (Note 21) Other long-term liabilities (Notes 11, 12) Income taxes payable (Note 10) Deferred income taxes (Note 10) Total liabilities Commitments and contingencies (Note 13) Shareholders' Equity: Preferred stock; 10,000 shares authorized: none issued and outstanding Common stock (no par value); 125,000 shares authorized: 69,995 and 69,873 issued and outstanding (Note 14) Retained earnings Accumulated other comprehensive loss (Note 17) Total Columbia Sportswear Company shareholders' equity Non-controlling interest (Note 4) Total equity Total liabilities and equity 252.301 182,228 19.107 453,636 215.048 142,158 5.645 362.851 14,053 42.622 12.710 147 432,383 48,735 58,104 168 560.643 45.829 1,585,009 18.887) 1,621,951 30,308 1,652259 2,212 902 53.801 1,529,636 (22,617) 1,560,820 20.691 1,581,511 2.013.894 s $ See accompanying notes to consolidated financial statements A.4 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Ended December 31 2016 2017 2015 $ Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Income from operations Interest income, net Interest expense on note payable to related party (Note 21) Other non-operating expense Income before income tax Income tax expense (Note 10) 2.466,705 5 1,306,143 1.159,962 910,894 13,901 110 262.969 ALS 4,515 (429 (429) (321) 266,734 (154.419) ( 112.315 7,192 105,123 s 2,377,045 $ 1.266,697 1,110,348 864,084 10,244 256,508 2,003 (1041) (1.041) (572) 12) 256,898 (58,459) 198,439 6,541 191,898 $ 2,326,180 1,252,680 1,073,500 831,971 8,192 249,721 1,531 (1,099) (2,834) ( 147,319 (67,468) 179,851 5,514 174,337 Net income S Net income attributable to non-controlling interest Net income attributable to Columbia Sportswear Company Earnings per share attributable to Columbia Sportswear Company (Note 16): Basic Diluted Weighted average shares outstanding (Note 16): Basic S 1.51 $ 2.75$ 2.72 2.48 2.45 1,49 69,759 70,453 69,683 70,632 70,162 71,064 Diluted Sec accompanying notes to consolidated financial statements A-6 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Common Stock Accumulated Other Shares Retained Comprehensive Income Non-Controlling Outstanding Amount Earnings (Loss) 69,828 S 72,700 S 1,255,070 $ 15,833 $ 11,631 174,337 5,514 Interest Total $ 1,355.234 (6) (2,908) (33,755) (1,132) (43,547) 179,851 1 (6) (2.908) (34.887) (43,547) 12,547 7,925 11,672 (70,068) 1,415,813 198,439 835 BALANCE, JANUARY 1, 2015 Net income Other comprehensive loss: Unrealized holding losses on available-for-sale securities, net Unrealized holding losses on derivative transactions, net Foreign currency translation adjustment, net Cash dividends (S0.62 per share) Issuance of common stock under employee stock plans, net Tax adjustment from stock plans Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2015 Net income Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities, net Unrealized holding gains on derivative transactions, net Foreign currency translation adjustment, net Cash dividends ($0.69 per share) ( Issuance of common stock under employee stock plans, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2016 12,547 7,925 11,672 (70,068) 34,776 (1,386) 69,277 (20,836) 16,013 1,385,860 191,898 6,541 (2) 686 157 (2,465) (2,020) 2 843 (4,485 (48,122) 8,050 (48,122) 596 8,050 10,986 (11) 53,801 10,986 (11) 1,581,511 69,873 20,691 (22,617) 1.529,636 105,123 7,192 112,315) Net income 1.159 (17,489) 31,219 (516) 2,941 (50,909) Other comprehensive income (loss): Unrealized holding losses on derivative transactions, net Foreign currency translation adjustment, net Cash dividends (50.73 per share) ( Issuance of common stock under employee stock plans, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2017 (16,846) 34.160 (50,909 16.284 11,286 (35.542) 1,652,259 787 16,284 11,286 (665) 69,995 (35,542) 45,829 S 1,585,009 $ (8,887) 30,308 See accompanying notes to consolidated financial statements A-16 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTSContinued) A reconciliation of product warranties is as follows (in thousands): s Balance at beginning of year Provision for warranty claims Warranty claims Other Balance at end of year Year Ended December 31 2017 2016 11,455 11,4875 4,338 3.802 (4,210) (3.726) SS6 (108) 12,339 S 11,455 $ 2015 11,148 4,560 (3,708) (513) 11,487 $ NOTE 10-INCOME TAXES . On December 22, 2017, the U.S. Government enacted comprehensive tax legislation, commonly referred to as the Tax Cuts and Jobs Act ("TCJA"). The TCJA makes broad and complex changes to the U.S. tax code, including, but not limited to: reducing the U.S. federal corporate tax rate from 35% to 21%; requiring companies to pay a one-time transition tax on certain unrepatriated eamings of foreign subsidiaries; generally climinating US federal income taxes on dividends from foreign subsidiaries; requiring a current inclusion in U.S.federal taxable income of certain earnings of controlled foreign corporations eliminating the corporate alternative minimum tax ("AMT") and changing how existing AMT credits can be realized; creating the base erosion anti-abuse tax; a new provision designed to tax global intangible low-taxed income ("GILTI"); creating a new limitation on deductible interest expense; and changing rules related to uses and limitations of net operating loss carryforwards created in tax years beginning after December 31, 2017. In conjunction with the enactment of the TCJA, the SEC staff issued Staff Accounting Bulletin 118 ("SAB 118"), which provides guidance on accounting for the tax effects of the TCJA. SAB 118 provides a measurement period that should not extend beyond one year from the TCJA enactment date for companies to complete the accounting for the effects of the TCJA. In accordance with SAB 118, a company must reflect the income tax effects of those aspects of the TCJA for which the accounting is complete. To the extent that a company's accounting for certain income tax effects of the TCJA is incomplete but it is able to determine a reasonable estimate, it must record a provisional estimate in the financial statements. If a company cannot determine a provisional estimate to be included in the financial statements, it should continue to apply its accounting on the basis of the provisions of the tax laws that were in effect immediately before the enactment of the TCJA In connection with the Company's initial analysis of the impact of the TCJA, the Company recorded an incremental provisional net tax expense of $95,610,000 during the year ended December 31, 2017. For various reasons that are discussed more fully below, the Company has not completed all of the accounting for the income tax effects of certain elements of the TCJA. In cases where the Company was able to make reasonable estimates of the effects of elements for which the analysis is not yet complete, it recorded provisional amounts for those specific tax affects. The Company has not recorded any adjustments related to those elements for which a reasonable estimate of the tax affects cannot be made, and has continued accounting for those elements on the basis of the tax laws in effect before the TCJA The Company's accounting for the following elements of the TCJA is incomplete. However, the Company was able to determine reasonable estimates of certain effects and therefore, recorded provisional amounts as follows: Reduction of U.S. federal corporate tax rate: The TCJA reduces the U.S. federal corporate tax rate from 35% to 21%, effective January 1, 2018. For certain of the Company's deferred tax assets and liabilities, the Company has recorded a provisional decrease to net deferred tax assets A-20 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) the Company's 2014 corporate income tax return in 2016. Due to the nature of the findings in both of these audits, the Company has invoked the Mutual Agreement Procedures outlined in the U.S.-Korean income tax treaty. The Company does not anticipate that adjustments relative to this dispute, or any othbal Coming tax audits, will result in material changes to its financial condition, results of operations or cash flows. Other than the dispute previously noted her Company is not currently under examination in any major jurisdiction. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows (in thousands): $ Balance at beginning of year Increases related to prior year tax positions Decreases related to prior year tax positions Increases related to current year tax positions Expiration of statute of limitations Balance at end of year 2017 9,998 858 (2,895) 2,714 December 31, 2016 11,187 2,514 (5,119) 1,599 (183) 9,998 2015 6,630 365 (2,019) 6,564 (353) 11.187 (163) 10,512 Due to the potential for resolution of income tax audits currently in progress, and the expiration of various statutes of limitation, it is reasonably possible that the unrecognized tax benefits balance may change within the twelve months following December 31, 2017 by a range of zero to $2,066,000. Open tax years, including those previously mentioned, contain matters that could be subject to differing interpretations of applicable tax laws and regulations as they relate to the amount, timing, or inclusion of revenue and expenses or the sustainability of income tax credits for a given examination cycle. Unrecognized tax benefits of 6,892,000 and $7,723,000 would affect the effective tax rate if recognized at December 31, 2017 and 2016 , respectively. The Company recognizes interest expense and penalties related to income tax matters in income tax expense. The Company recognized a net reversal of accrued interest and penalties of $1,402,000 in 2017, and a net increase of accrued interest and penalties of $637,000 in 2016 and a net reversal of accrued interest and penalties of S356,000 in 2015, all of which related to uncertain tax positions. The Company had $1,640,000 and $3,042,000 of accrued interest and penalties related to uncertain tax positions at December 31, 2017 and 2016, respectively. NOTE 11-OTHER LONG-TERM LIABILITIES Other long-term liabilities consisted of the following in thousands): December 31, 2017 31,016 $ S 2016 30,869 3,342 8,411 Straight-line and deferred rent liabilities (Note 13) Asset retirement obligations Deferred compensation plan liability (Note 12) Derivative financial instruments (Note 19) 4,580 9,319 3,820 48.735 42,672 NOTE 12-RETIREMENT SAVINGS PLANS 401(k) Profil-Sharing Plan The Company has a 401(k) profit-sharing plan, which covers substantially all U.S. employees. Participation begins the first day of the quarter following completion of 30 days of service. The Company may elect to make discretionary matching or non-matching contributions. All Company contributions to the plan as determined by the Board of Directors totaled $7,666,000, $7,754,000 and $6,981,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Deferred Compensation Plan A-22 Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS/Continued) 5 2018 2019 2020 2021 2022 Thereafter 38,416 113.961 370 538 Inventory Purchase Obligations Inventory purchase obligations consist of open production purchase orders for sourced apparel, footwear, accessories, and equipment and waterial commitments not included in open production purchase orders. At December 31, 2017, inventory purchase obligations were $266,507,000 Litigation The Company is involved in litigation and various legal matters arising in the normal course of business, including matters related to employment intellectual property, contractual agreements, and various regulatory compliance activities. Management has considered facts related to legal and regulatory aners and opinions of counsel handling these matters, and does not believe the ultimate resolution of these proceedings will have a material adverse efect cete Company's financial position, s of operations or cash flows. Indennities and Guarantees During its normal course of business, the Company has made certain indemnities, commitments and guarantees under which it may be required to make payments in relation to certain transactions. These include (1) intellectual property indemnities to the Company's customers and licensees in connection with the use, sale or license of Company products, (ii) indemnities to various lessors in connection with facility leases for certain claims arising from such facility or lease (iii) indemnities to customers, vendors and service providers pertaining to claims based on the negligence or willful misconduct of the Company. (iv) executive severance arrangements, and (v) indemnities involving the accuracy of representations and warranties in certain contracts. The duration of these indemnities commitments and guarantees varies, and in certain cases, may be indefinite. The majority of these indemnities, commitments and guarantees do not provide for any limitation of the maximum potential for future payments the Company could be obligated to make. The Company has not recorded any liability for these indemnities, commitments and guarantees in the accompanying Consolidated Balance Sheets. NOTE 14SHAREHOLDERS' EQUITY Since the inception of the Company's stock repurchase plan in 2004 through December 31, 2017, the Company's Board of Directors has authorized the repurchase of $700,000,000 of the Company's common stock. As of December 31, 2017, the Company had repurchased 21,638,035 shares under this program at an aggregate purchase price of approximately 5562,064,000. During the year ended December 31, 2017, the Company purchased an aggregate of $35.548.000 of common stock under the stock repurchase plan, Shares of the Company's common stock may be purchased in the open market or through privately negotiated transactions, subject to market conditions. The repurchase program does not obligate the Company to acquire any specific number of shares or to acquire shares over any specified period of time. NOTE 15STOCK-BASED COMPENSATION The Company's stock incentive plan (the "Plan") provides for issuance of up to 20.800.000 shares of the Company's common stock, of which 2.701_396 shares were available for future grants under the Plan at December 31, 2017. The Plan allows for grants of incentive stock options, non-statutory stock options restricted stock awards, restricted stock units, and other stock-based or cash-based awards. The Company uses original issuance shares to satisfy share-based payments Stock-based compensation expense consisted of the following (in thousands): B-4 Appendix B Financial Statements for Under Armour Under Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity (In thousands) Total Equity $(14,808) $1,350,300 2,852 (12,727) 19.136 60,376 45,917 202,368 1,668,222 6,203 Class B Accumulated Class A Convertible Class C Additional Other Common Stock Common Stock Common Stock Pald-in- Retained Comprehensive Shares Amount Shares Amount Shares Amount Capital Earnings Income (loss) Balance as of December 31, 2014 177,296 $ 59 36,600 $ 12 213,896 71 $508,279 S 856,687 Exercise of stock options 360 360 2,852 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (172) (172) (12,727) Issuance of Class A Common Stock, net of forfeitures 1.996 1 1,996 1 19,134 Class B Convertible Common Stock converted to Class A Common Stock 2,150 1 (2,150) (1) Stock-based compensation expense 60,376 Net excess tax benefits from stock-based compensation arrangements 45,917 Comprehensive income 232,573 (30,205) Balance as of December 31, 2015 181,630 61 34,450 11 216,080 72 636,558 1.076,533 (45,013) Exercise of stock options 792 971 6,203 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (199) (276) (15,098) Issuance of Class A Common Stock, net of forfeitures 1.592 7,884 Issuance of Class C Common Stock, net of forfeitures 1,852 1 25,834 Issuance of Class C dividend 1,547 (59,000) Stock-based compensation expense 46,149 Net excess tax benefits from stock-based compensation arrangements 44,783 Comprehensive income 256,979 (7,130) Balance as of December 31, 2016 183,B15 61 34.450 11 220,174 73 823,484 1,259,414 (52,143) Exercise of stock options 609 556 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (65) (78) (2,781) Issuance of Class A Common Stock, net of forfeitures 898 Issuance of Class C Common Stock, net of forfeitures 1,723 1 7,852 Impact of adoption of accounting standard updates (2,666) (23,932) Stock-based compensation expense 39,932 Comprehensive income (loss) (48,260 13,932 Balance as of December 31, , 2017 185,257, 61 34,450 11 222,375 74 872,266 1,184,441 (38.211) (15,098) 7,884 25,835 56,073 (2,927) 46,149 44,783 249,849 2,030,900 3,664 3,664 - (2.781) 7,853 (26,598) 39,932 (34,328) 2018,642 See accompanying notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started