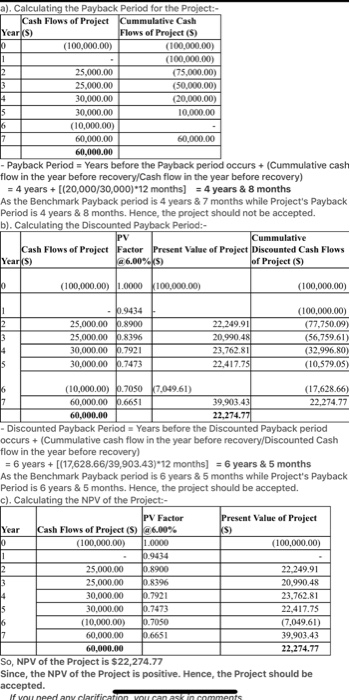

- a). Calculating the Payback period for the Project:- Cash Flows of Project Cummulative Cash Yearks) Flows of Project (S) O (100,000.00) (100.000,00) (100.000,00) 25,000.00 (75.000.00) 3 25,000.00 (50,000.00) 5 30,000.00 (20.000.00) 5 30,000.00 10,000.00 5 (10,000.00) 2 60,000.00 60,000.00 60,000.00 - Payback Period = Years before the Payback period occurs + (Cummulative cash flow in the year before recovery/Cash flow in the year before recovery) = 4 years + [(20,000/30,000)*12 months] = 4 years & 8 months As the Benchmark Payback period is 4 years & 7 months while Project's Payback Period is 4 years & 8 months. Hence, the project should not be accepted. b). Calculating the Discounted Payback Period:- Cummulative Cash Flows of Project Factor Present Value of Project Discounted Cash Flows Year(s) a 6.00%) of Project (5) 0 (100,000.00) 1.0000 $100,000.00) (100,000.00) - 0.9434 (100,000.00) 2 25,000.00 0.8900 22.249.911 (77,750.09) 3 25,000.00 0.8396 20.990.48 (56.759.61) 5 30,000.00 0.7921 23.762.81 (32,996.80) S 30,000.00 0.7473 22,417.75 (10.579.05) 5 (10,000.00) 0.7050 7,049.61) (17,628.66) 60,000.00 0.6651 39.903.43 22,274.77 60,000.00 22,274.77 -Discounted Payback Period = Years before the Discounted Payback period occurs + (Cummulative cash flow in the year before recovery/Discounted Cash flow in the year before recovery) = 6 years + [(17,628.66/39,903.43)*12 months] = 6 years & 5 months As the Benchmark Payback period is 6 years & 5 months while Project's Payback Period is 6 years & 5 months. Hence, the project should be accepted. c). Calculating the NPV of the Project:- PV Factor Present Value of Project Year Cash Flows of Project (S) a 6.00% KS) 0 (100,000.00) 1.0000 (100,000.00) 0.9434 2 25,000.00 0.8900 22.249.91 3 25,000.00 0.8396 20.990.48 30,000.00 10.7921 23.762.81 30,000.00 0.7473 22,417.75 (10,000.00) 0.7050 (7,049.61) 60,000.00 0.6651 39.903.43 60,000.00 22,274.77 So, NPV of the Project is $22,274.77 Since, the NPV of the Project is positive. Hence, the Project should be accepted. If you need any clarification you can ask in comment You are the CFO of XYZ Co. that prints textbook using an outdated system. The owner provides you with the following information about a new super modification project "Alpha" that will last for years. The project requires a new machine that costs $100,000 today. The project will not generate any cash flow at time 1. In years 2 and 3, the annual cash flows is $25,000. In years 4 and 5 the annual cash flow is $30,000, in year 6 it is $10,000, and in year 7 it is $60,000. The required rate of return is 6 percent. Credit for questions (12) to (17) will only be given if you provide numerical support for your decision. What is the Pl ratio for the project? Will you accept the project based on the PI ratio? Compute the IRR of the project? Using IRR, will you accept the project