a calital expendtiture in a debit to

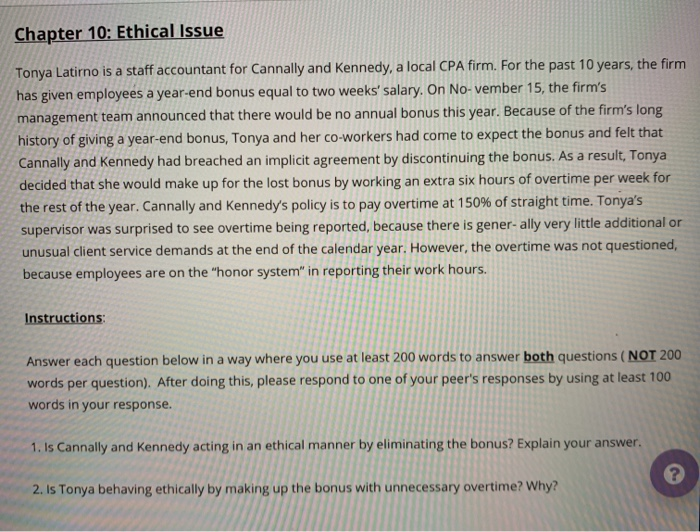

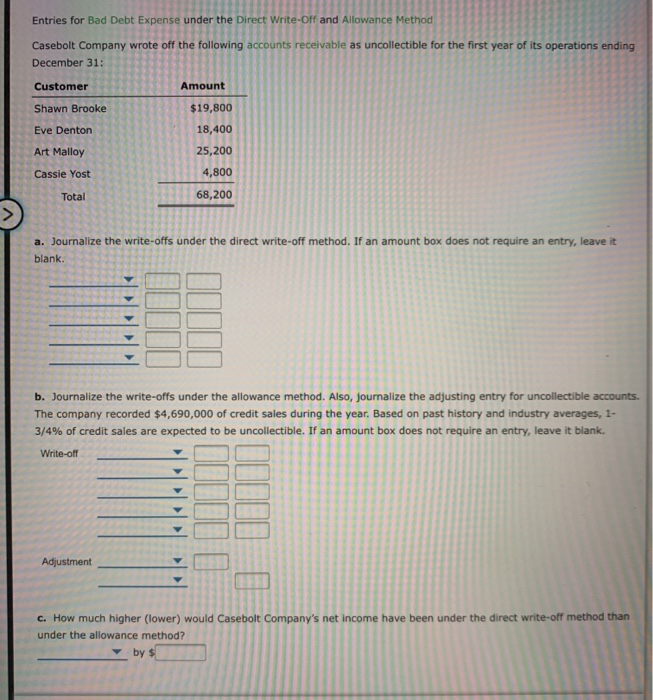

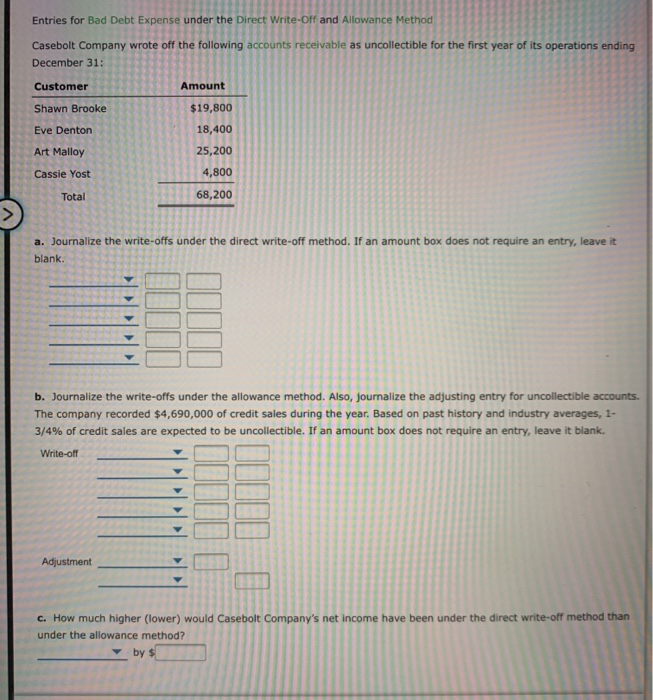

Chapter 10: Ethical Issue Tonya Latirno is a staff accountant for Cannally and Kennedy, a local CPA firm. For the past 10 years, the firm has given employees a year-end bonus equal to two weeks' salary. On November 15, the firm's management team announced that there would be no annual bonus this year. Because of the firm's long history of giving a year-end bonus, Tonya and her co-workers had come to expect the bonus and felt that Cannally and Kennedy had breached an implicit agreement by discontinuing the bonus. As a result, Tonya decided that she would make up for the lost bonus by working an extra six hours of overtime per week for the rest of the year. Cannally and Kennedy's policy is to pay overtime at 150% of straight time. Tonya's supervisor was surprised to see overtime being reported, because there is gener-ally very little additional or unusual client service demands at the end of the calendar year. However, the overtime was not questioned, because employees are on the "honor system in reporting their work hours. Instructions Answer each question below in a way where you use at least 200 words to answer both questions (NOT 200 words per question). After doing this, please respond to one of your peer's responses by using at least 100 words in your response. 1. Is Cannally and Kennedy acting in an ethical manner by eliminating the bonus? Explain your answer. 2. Is Tonya behaving ethically by making up the bonus with unnecessary overtime? Why? Entries for Bad Debt Expense under the Direct Write-Off and Allowance Method receivable as uncollectible operations ending Casebolt Company wrote off the following accounts December 31: Customer mount Shawn Brooke Eve Denton Art Malloy DD INNO3 A Cassie Yost Total write-offs under the direct write-off method. amount box does not require an entry, leave it TTTTT b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded $4,690,000 of credit sales during the year. Based on past history and industry averages, 1- 3/4% of credit sales are expected to be uncollectible. If an amount box does not require an entry, leave it blank. Write-off TIL Adjustment Compa income have been under the direct write-off method than c. How much higher (lower) would Casebo under the allowance method? by s