Question

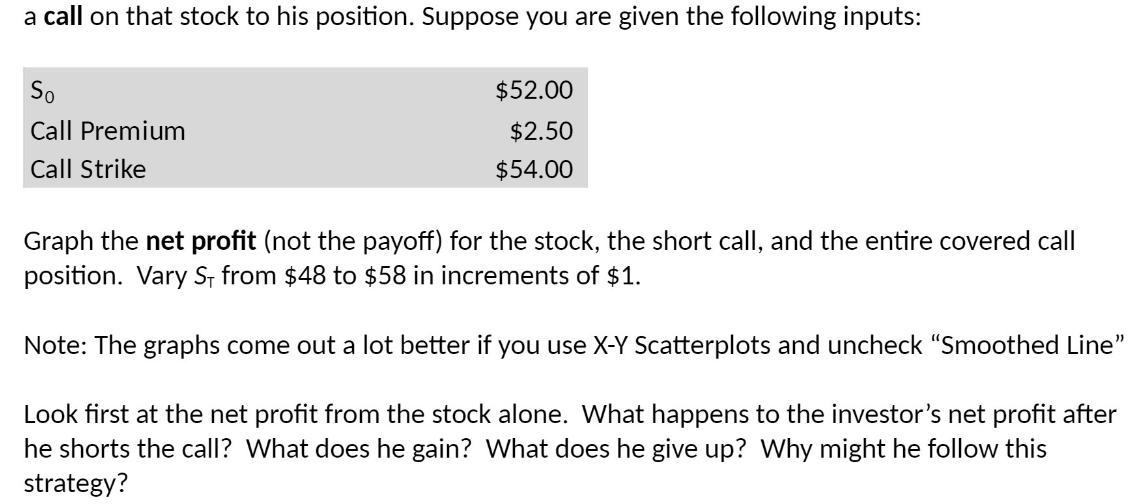

a call on that stock to his position. Suppose you are given the following inputs: So Call Premium Call Strike $52.00 $2.50 $54.00 Graph

a call on that stock to his position. Suppose you are given the following inputs: So Call Premium Call Strike $52.00 $2.50 $54.00 Graph the net profit (not the payoff) for the stock, the short call, and the entire covered call position. Vary S, from $48 to $58 in increments of $1. Note: The graphs come out a lot better if you use X-Y Scatterplots and uncheck "Smoothed Line" Look first at the net profit from the stock alone. What happens to the investor's net profit after he shorts the call? What does he gain? What does he give up? Why might he follow this strategy?

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets define the parameters provided S0 the initial stock price 5200 Call Premium the price received for selling a call option 250 Call Strike the strike price of the call option 5400 Were asked to gra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction to the Mathematics of financial Derivatives

Authors: Salih N. Neftci

2nd Edition

978-0125153928, 9780080478647, 125153929, 978-0123846822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App