Suppose you are given the following data: (1) Risk-free yearly interest rate is r = 6%. (2)

Question:

Suppose you are given the following data:

(1) Risk-free yearly interest rate is r = 6%.

(2) The stock price follows:

St ? St?1 = ?St + ?St?t

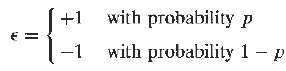

Where the ? is a serially uncorrelated binomial process assuming the following values:

The 0

(1) Volatility is 12% a year.

(2) The stock pays no dividends and the current stock price is 100.

Now consider the following questions.

(a) Suppose ? is equal to the risk-free interest rate:

? = r

And that the St is arbitrage-free. What is the value of p?

(b) Would a p = 1/3 be consistent with arbitrage-free St?

(c) Now suppose ? is given by:

? = r + risk premium

What do the p and ? represent under these conditions?

(d) Is it possible to determine the value of p?

Step by Step Answer:

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci