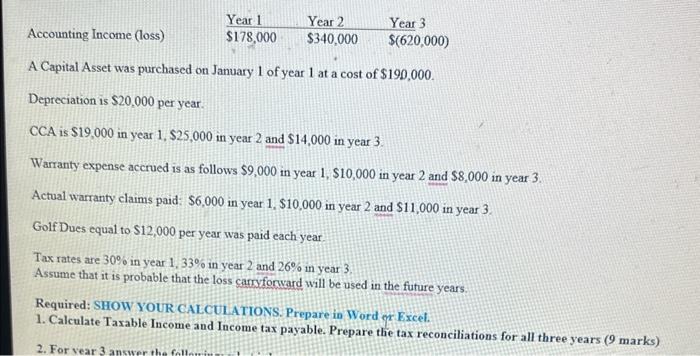

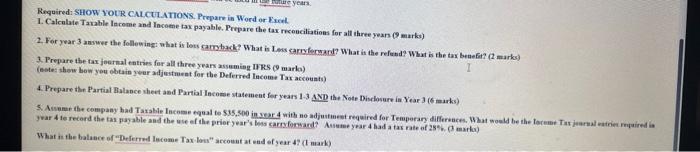

A Capital Asset was purchased on January 1 of year 1 at a cost of $190,000. Depreciation is $20,000 per year. CCA is $19,000 in year 1,$25,000 in year 2 and $14,000 in year 3. Warranty expense accrued is as follows $9,000 in year 1,$10,000 in year 2 and $8,000 in year 3 . Actual warranty claims paid: $6,000 in year 1,$10,000 in year 2 and $11,000 in year 3 . Golf Dues equal to $12,000 per year was paid each year. Tax rates are 30% in year 1,33% in year 2 and 26% in year 3 . Assume that it is probable that the loss carryfonvard will be used in the future years. Required: SHOW YOUR CALCUL ATIONS. Prepare io Word er Excel. 1. Calculate Taxable Income and Income tax payable. Prepare the tax reconciliations for all three years ( 9 marks) RequiredaSHow YotR CALCU ATIONS. Prepare in Word or Eicel. 1. Calcalate Tatable lacome and Incoene tax payable. Propare the tax recouciliation for all three yean ( 9 marks) 2. For year 3 answe the follewingt what is lows gatohack? What is Les sarcyferwand? What is the refend? What is the tax benefi? (2 marks) 3. Prepare the tax joernal entries for all thrce yrars assumiog IRE (9 marka) (este: show bow you obtain ywer adjestment for the Deferred lacome Tas accouaty) 4. Prepare the Partial Balapee sheet asd Partial Income statement fer years 13AND the Note Diedosure in Year 3 ( 6 marks) What in the balaner of "Deferred laceme Tax lon" arcount at end of year 4? ( ( mark) A Capital Asset was purchased on January 1 of year 1 at a cost of $190,000. Depreciation is $20,000 per year. CCA is $19,000 in year 1,$25,000 in year 2 and $14,000 in year 3. Warranty expense accrued is as follows $9,000 in year 1,$10,000 in year 2 and $8,000 in year 3 . Actual warranty claims paid: $6,000 in year 1,$10,000 in year 2 and $11,000 in year 3 . Golf Dues equal to $12,000 per year was paid each year. Tax rates are 30% in year 1,33% in year 2 and 26% in year 3 . Assume that it is probable that the loss carryfonvard will be used in the future years. Required: SHOW YOUR CALCUL ATIONS. Prepare io Word er Excel. 1. Calculate Taxable Income and Income tax payable. Prepare the tax reconciliations for all three years ( 9 marks) RequiredaSHow YotR CALCU ATIONS. Prepare in Word or Eicel. 1. Calcalate Tatable lacome and Incoene tax payable. Propare the tax recouciliation for all three yean ( 9 marks) 2. For year 3 answe the follewingt what is lows gatohack? What is Les sarcyferwand? What is the refend? What is the tax benefi? (2 marks) 3. Prepare the tax joernal entries for all thrce yrars assumiog IRE (9 marka) (este: show bow you obtain ywer adjestment for the Deferred lacome Tas accouaty) 4. Prepare the Partial Balapee sheet asd Partial Income statement fer years 13AND the Note Diedosure in Year 3 ( 6 marks) What in the balaner of "Deferred laceme Tax lon" arcount at end of year 4? ( ( mark)