Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Cash flow analysis. Please show your calculations for NPV and Payback Period b. What is the payback period for this project? What is the

a. Cash flow analysis. Please show your calculations for NPV and Payback Period

b. What is the payback period for this project? What is the net present value of this project?

c. Should the company go forward with this project? Explain your answer.

d. How sensitive is the profitability of this project to the companys discount rate (APR)? What is the discount rate at which the NPV is zero? Explain your answer

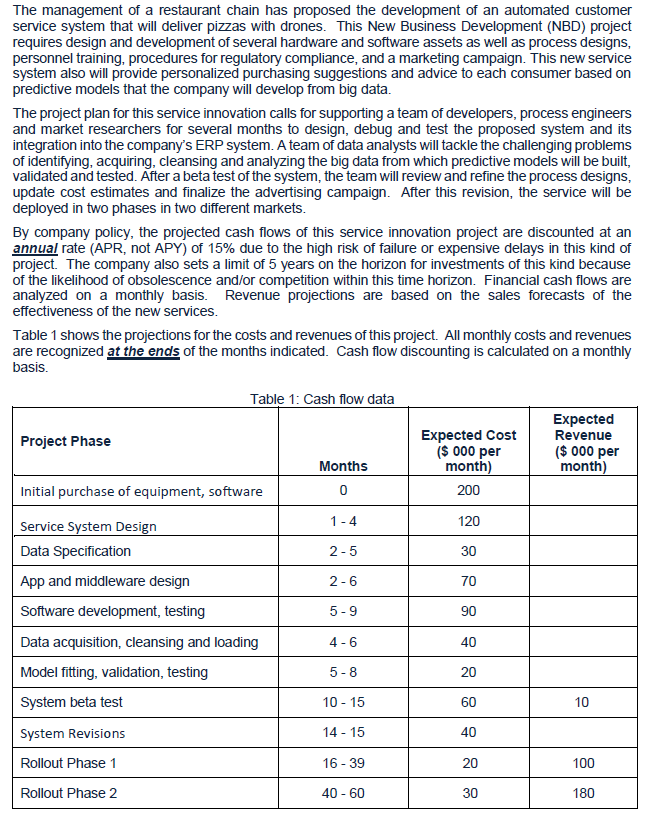

The management of a restaurant chain has proposed the development of an automated customer service system that will deliver pizzas with drones. This New Business Development (NBD) project requires design and development of several hardware and software assets as well as process designs, personnel training, procedures for regulatory compliance, and a marketing campaign. This new service system also will provide personalized purchasing suggestions and advice to each consumer based on predictive models that the company will develop from big data. The project plan for this service innovation calls for supporting a team of developers, process engineers and market researchers for several months to design, debug and test the proposed system and its integration into the company's ERP system. A team of data analysts will tackle the challenging problems of identifying, acquiring, cleansing and analyzing the big data from which predictive models will be built, validated and tested. After a beta test of the system, the team will review and refine the process designs, update cost estimates and finalize the advertising campaign. After this revision, the service will be deployed in two phases in two different markets By company policy, the projected cash flows of this service innovation project are discounted at an annual rate (APR, not APY) of 15% due to the high risk of failure or expensive delays in this kind of project. The company also sets a limit of 5 years on the horizon for investments of this kind because of the likelihood of obsolescence and/or competition within this time horizon. Financial cash flows are analyzed on a monthly basis. Revenue projections are based on the sales forecasts of the effectiveness of the new services Table 1 shows the projections for the costs and revenues of this project. All monthly costs and revenues are recognized at the ends of the months indicated. Cash flow discounting is calculated on a monthly basis. Table 1: Cash flow data Expected Expected Cost $000 per month Revenue Project Phase 000 per month Months 0 200 120 30 70 90 40 20 60 40 20 30 Initial purchase of equipment, software Service Svstem Design Data Specification App and middleware design Software development, testing Data acquisition, cleansing and loading Model fitting, validation, testing System beta test System Revisions Rollout Phase 1 Rollout Phase 2 2-5 4-6 10-15 14 15 16-39 40 60 10 100 180Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started