Answered step by step

Verified Expert Solution

Question

1 Approved Answer

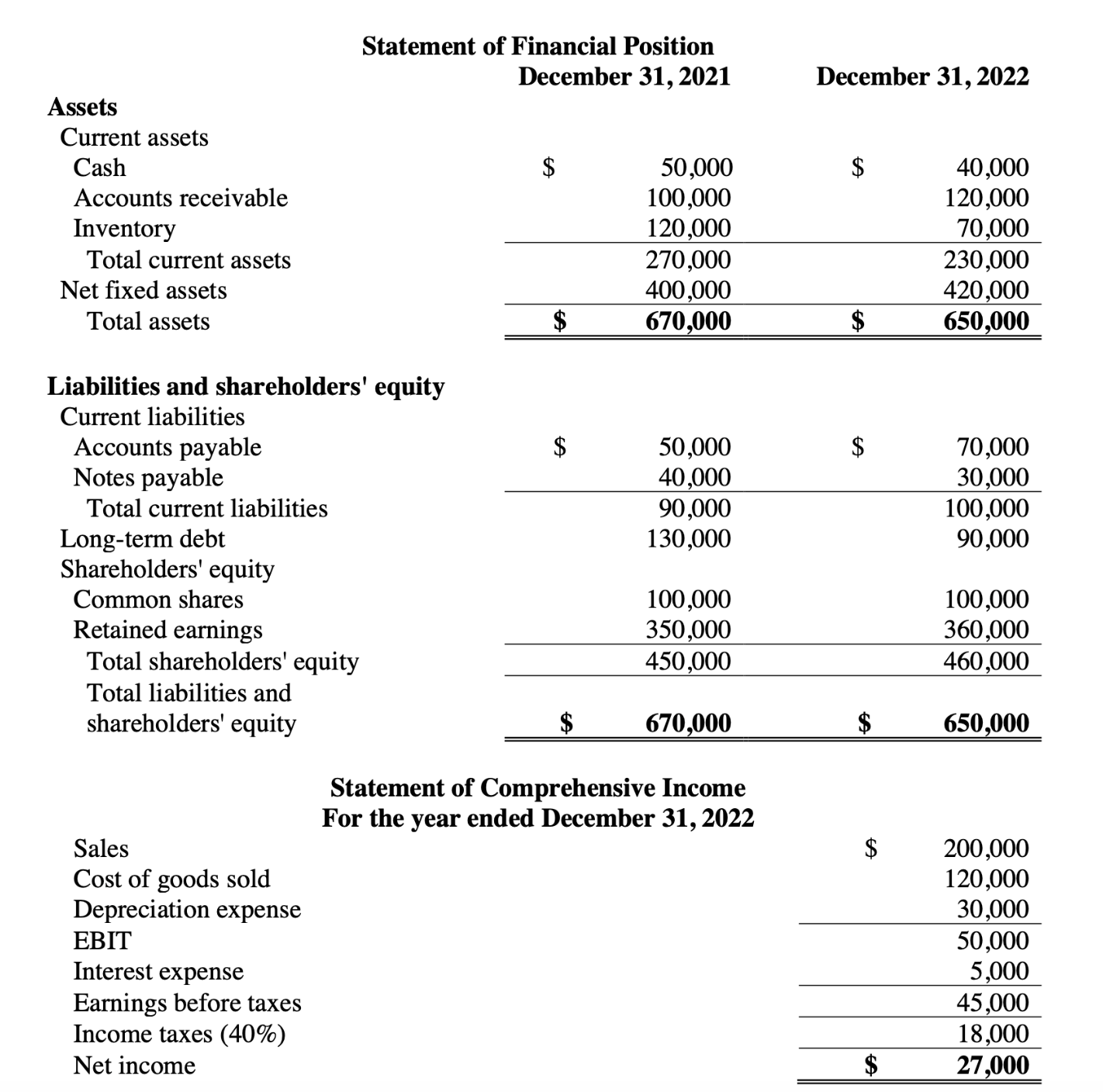

a. Choose and calculate the most relevant ratio for year 2022, if you would like to understand the companys liquidity in general. Show your work.

a. Choose and calculate the most relevant ratio for year 2022, if you would like to understand the companys liquidity in general. Show your work.

b. Choose and calculate the most relevant ratio for year 2022, if you would like to understand the companys liquidity by focusing only on the cash component of its assets. Show your work.

c. Choose and calculate the most relevant ratio for year 2022, if you would like to understand how much profit the company generated on its equity. Show your work.

Statement of Financial Position December 31, 2021 December 31, 2022 Assets Current assets Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Notes payable Total current liabilities Long-term debt Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity \begin{tabular}{crrr} $ & 50,000 & $ & 40,000 \\ 100,000 & & 120,000 \\ 120,000 & & 70,000 \\ \hline & 270,000 & & 230,000 \\ & 400,000 & & 420,000 \\ \hline & 670,000 & $ & 650,000 \\ \hline \hline \end{tabular} Sales \begin{tabular}{rrr} 50,000 & $ & 70,000 \\ 40,000 & & 30,000 \\ \hline 90,000 & & 100,000 \\ 130,000 & & 90,000 \end{tabular} Cost of goods sold Depreciation expense EBIT Interest expense Earnings before taxes Income taxes (40\%) Net income Statement of Comprehensive Income For the year ended December 31, 2022 \begin{tabular}{cccc} & 100,000 & & 100,000 \\ 350,000 & & 360,000 \\ \hline & 450,000 & & 460,000 \\ \hline & & & \\ $ & 670,000 & $ & 650,000 \\ \hline \hline \end{tabular} come \begin{tabular}{rr} $200,000 \\ 120,000 \\ 30,000 \\ \hline 50,000 \\ 5,000 \\ \hline 45,000 \\ \hline 18,000 \\ \hline 27,000 \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started