Question

A city is spending $10 million on building a new sewage system. Suppose the annual operating expenses for the system are projected to be $6,000

A city is spending $10 million on building a new sewage system. Suppose the annual operating expenses for the system are projected to be $6,000 for each year, starting in year one and continuing forever. And maintenance expense of $20,000 starts in year five, repeating every five years thereafter and continuing forever. If the citys MARR is 10% per year, what is the capitalized worth of the system?

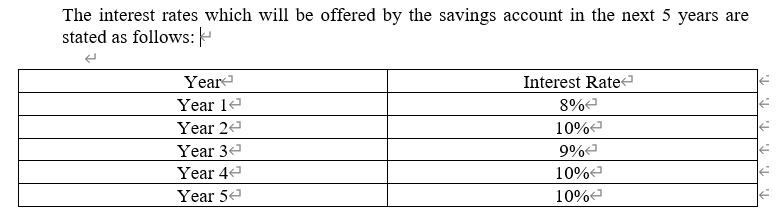

Alice deposits $2,000 in a savings account now which offers a variable rate of interest. She plans to withdraw all her money in 5 years. During the period, the annual interest rate paid on her deposits in this account changes each year. How much will Alice receive upon withdrawing her money after 5 years?

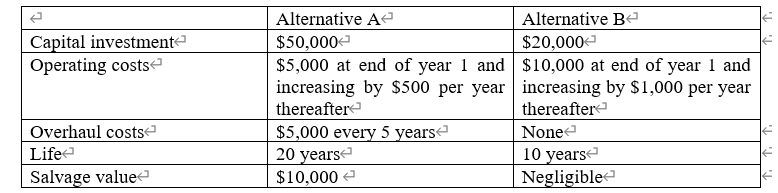

Consider two mutually exclusive alternatives A and B. Assume MARR = 10% per year, the alternatives are repeatable and the study period is 20 years, which alternative would you choose? Use both AW and PW methods of analysis.

John has purchased a bond that was issued by ABC Medical. The bond has a face value of $10,000 and will mature in eight years. The coupon rate of the bond is 8% per year, and interest payments are made to the bondholder every quarter. John bought the bond five years ago at the face value and he wants to sell it now for a price that will allow him to earn an annual yield of 12% compounded quarterly. How much does John need to sell the bond for to earn his desired return?

Remind: Round your answers to 2 decimal places. ALL calculation steps are shown clearly.

The interest rates which will be offered by the savings account in the next 5 years are stated as follows: Year Year 12 Year 2 Year 3e Year 42 Year 5e Interest Rate 8% 10% 9%e 10% 10% Capital investment Operating costs Alternative A Alternative Be $50,000 $20,000 $5,000 at end of year 1 and $10,000 at end of year 1 and increasing by $500 per year increasing by $1,000 per year thereafter thereafter $5,000 every 5 years None 20 years 10 years $10,000 e Negligible Overhaul costs Life Salvage value 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started