Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A client has $ 2 0 , 0 0 0 of reforestation expenses. Site preparation and planting should start after Thanksgiving and finish by New

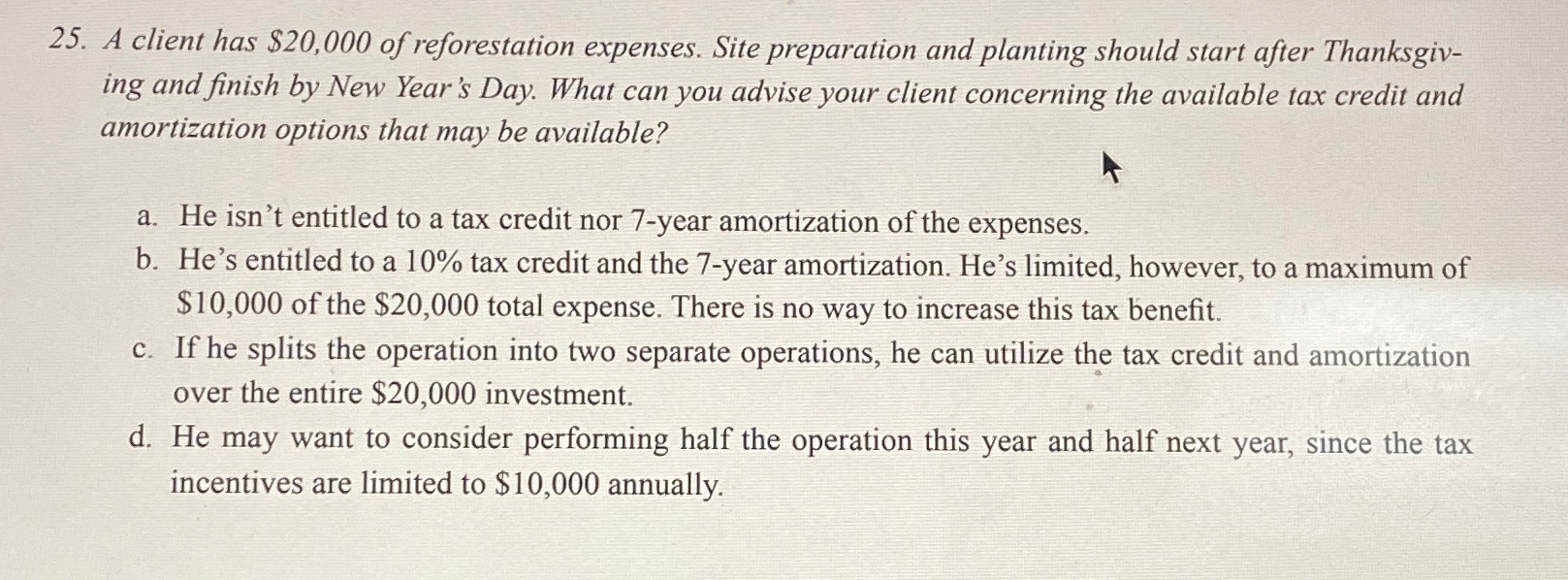

A client has $ of reforestation expenses. Site preparation and planting should start after Thanksgiving and finish by New Year's Day. What can you advise your client concerning the available tax credit and amortization options that may be available?

a He isn't entitled to a tax credit nor year amortization of the expenses.

b He's entitled to a tax credit and the year amortization. He's limited however, to a maximum of $ of the $ total expense. There is no way to increase this tax benefit.

c If he splits the operation into two separate operations, he can utilize the tax credit and amortization over the entire $ investment.

d He may want to consider performing half the operation this year and half next year, since the tax incentives are limited to $ annually.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started