Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A commercial real estate company has an option to develop a parcel of land. Assuming the dynamics of land value, L, are described by geometric

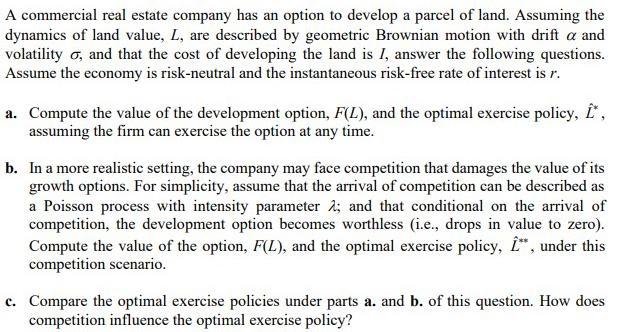

A commercial real estate company has an option to develop a parcel of land. Assuming the dynamics of land value, L, are described by geometric Brownian motion with drift a and volatility o, and that the cost of developing the land is 1, answer the following questions. Assume the economy is risk-neutral and the instantaneous risk-free rate of interest is r. a. Compute the value of the development option, F(L), and the optimal exercise policy, it, assuming the firm can exercise the option at any time. b. In a more realistic setting, the company may face competition that damages the value of its growth options. For simplicity, assume that the arrival of competition can be described as a Poisson process with intensity parameter 1; and that conditional on the arrival of competition, the development option becomes worthless (i.e., drops in value to zero). Compute the value of the option, F(L), and the optimal exercise policy, , under this competition scenario. c. Compare the optimal exercise policies under parts a. and b. of this question. How does competition influence the optimal exercise policy? A commercial real estate company has an option to develop a parcel of land. Assuming the dynamics of land value, L, are described by geometric Brownian motion with drift a and volatility o, and that the cost of developing the land is 1, answer the following questions. Assume the economy is risk-neutral and the instantaneous risk-free rate of interest is r. a. Compute the value of the development option, F(L), and the optimal exercise policy, it, assuming the firm can exercise the option at any time. b. In a more realistic setting, the company may face competition that damages the value of its growth options. For simplicity, assume that the arrival of competition can be described as a Poisson process with intensity parameter 1; and that conditional on the arrival of competition, the development option becomes worthless (i.e., drops in value to zero). Compute the value of the option, F(L), and the optimal exercise policy, , under this competition scenario. c. Compare the optimal exercise policies under parts a. and b. of this question. How does competition influence the optimal exercise policy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started