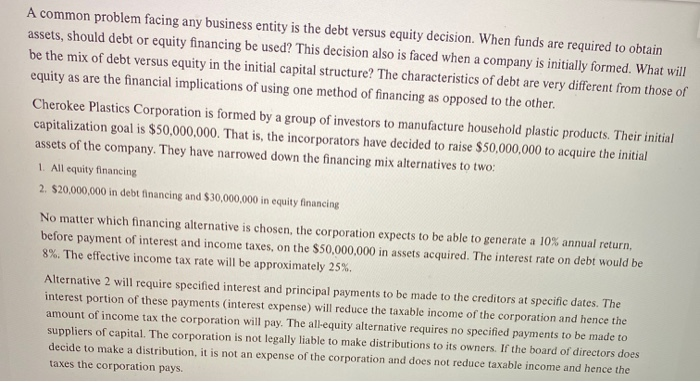

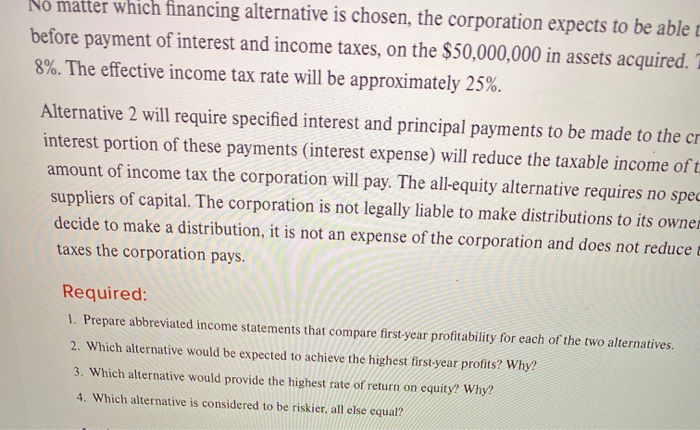

A common problem facing any business entity is the debt versus equity decision. When funds are required to obtain assets, should debt or equity financing be used? This decision also is faced when a company is initially formed. What will be the mix of debt versus equity in the initial capital structure? The characteristics of debt are very different from those of equity as are the financial implications of using one method of financing as opposed to the other. Cherokee Plastics Corporation is formed by a group of investors to manufacture household plastic products. Their initial capitalization goal is $50,000,000. That is, the incorporators have decided to raise $50,000,000 to acquire the initial assets of the company. They have narrowed down the financing mix alternatives to two: 1. All equity financing 2. $20,000,000 in debt financing and $30,000,000 in equity financing No matter which financing alternative is chosen, the corporation expects to be able to generate a 10% annual return before payment of interest and income taxes, on the $50,000,000 in assets acquired. The interest rate on debt would be 8%. The effective income tax rate will be approximately 25%. Alternative 2 will require specified interest and principal payments to be made to the creditors at specific dates. The interest portion of these payments interest expense) will reduce the taxable income of the corporation and hence the amount of income tax the corporation will pay. The all-equity alternative requires no specified payments to be made to suppliers of capital. The corporation is not legally liable to make distributions to its owners. If the board of directors does decide to make a distribution, it is not an expense of the corporation and does not reduce taxable income and hence the taxes the corporation pays. No matter which financing alternative is chosen, the corporation expects to be able 1 before payment of interest and income taxes, on the $50,000,000 in assets acquired. 8%. The effective income tax rate will be approximately 25%. Alternative 2 will require specified interest and principal payments to be made to the cr interest portion of these payments (interest expense) will reduce the taxable income of t amount of income tax the corporation will pay. The all-equity alternative requires no spet suppliers of capital. The corporation is not legally liable to make distributions to its owner decide to make a distribution, it is not an expense of the corporation and does not reduce taxes the corporation pays. Required: 1. Prepare abbreviated income statements that compare first-year profitability for each of the two alternatives. 2. Which alternative would be expected to achieve the highest first-year profits? Why? 3. Which alternative would provide the highest rate of return on equity? Why? 4. Which alternative is considered to be riskier, all else equal