Question

a. Commonwealth Bank of Australia (CBA) has reported a 99% Value at Risk (VaR) of 3.09% over a 1268 trading period. What does this mean?

a. Commonwealth Bank of Australia (CBA) has reported a 99% Value at Risk (VaR) of 3.09% over a 1268 trading period. What does this mean? (3 marks)

a. Commonwealth Bank of Australia (CBA) has reported a 99% Value at Risk (VaR) of 3.09% over a 1268 trading period. What does this mean? (3 marks)

b. Why do some investors prefer to use Lower Partial Standard Deviations (LPSD) as compared to the standard deviation? (3 marks)

c. Why will the standard deviation not be a good measure of risk when returns are negatively skewed? (3 marks)

d. What are the risk implications for an investor for a returns series that exhibits fat tails? (3 marks)

e. A price weighted index places more weight on stocks with a higher price, whilst a value weighted index places more weight on stocks with a higher market capitalization. Discuss. (3 marks)

f. Price weighted indices have been criticized because they introduce a downward bias by reducing the weight of growing companies whose stock split. What does this mean and why does the underweighting occur? (3 marks)

g. What should be the risk premium and return on a stock with a Beta of zero under the Capital Asset Pricing Model (CAPM)? What about the risk premium and return on a stock with a Beta of 1? (3 marks)

h. In a world of certainty, investors will always invest in the asset with the highest return. In the real world, investors hold a diversified portfolio of securities. Why is this the case? (3 marks)

i. Theoretically, returns on stocks or assets can be negatively correlated. In the real world, however, we usually encounter only positive correlations. Why may this be the case? (3 marks)

j. It is said that the key factor that determines the risk of stocks in a large portfolio is not the risk of the individual assets but the covariances of the securities in the portfolio. What does this mean? (3 marks)

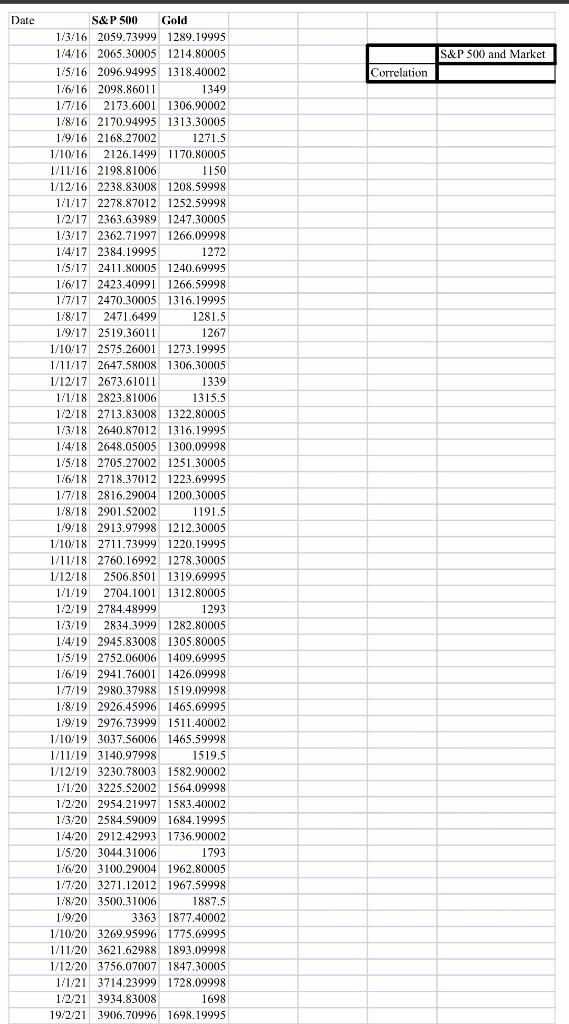

k. What do you expect the correlation between Gold and the S&P 500 to be based on theoretical arguments? (3 marks)

l. Using the Excel file Gold/Market provided, find the correlation between Gold and the S&P 500 index. (attach your completed excel file as part of your submission). (3 marks) m. What is the implication of this correlation for an investor who holds the S&P 500 and wants to add Gold to his/her portfolio?

Date S&P 500 and Market Correlation S&P 500 Gold 1/3/16 2059.73999 1289.19995 1/4/16 2065.30005 1214.80005 1/5/16 2096.94995 1318.40002 1/6/16 2098.86011 1349 1/7/16 2173.6001 1306.90002 1/8/16 2170.94995 1313.30005 1:9/16 2168.27002 1271.5 HUTC 100 1/10/16 2126.1499 1170.80005 1/11/16 2198.81006 1150 1920 one 000 1/12:16 2238.83008 1208.59998 U 770 71 1/1/17 2278.87012 1252.59998 1/2/17 2363.63989 1247.30005 W9 100 1/3/17 2362.71997 1266.09998 We of 1/4/17 2384.19995 1272 June 24 1/5/17 2411.80005 1240.69995 1/6/17 2423.40991 1266.59998 sto 1/7/17 2470.30005 1316.19995 . 1/8/17 2471.6499 1281.5 1:9/17 2519,36011 1267 400 1/10/17 2575.26001 1273.19995 1/11/17 2647.58008 1306.30005 1/12/17 2673.61011 2073.00 1339 we 1/1/18 2823.81006 We 1315.5 1/2:18 2713.83008 1322.80005 1/3/18 2640.87012 1316.19995 1/4/18 2648.05005 1300.09998 1:5:18 2705.27002 1251.30005 Wino 2100 1/6/18 2718.37012 1223.69995 COS 1/7/18 2816.29004 1200,30005 1/8/18 2901.52002 1191.5 w 000 1.9/18 2913.97998 1212.30005 1/10/18 2711.73999 1220.19995 www 1/11/18 2760.16992 1278.30005 -- 1/12/18 2506.8501 1319,69995 0.0.0 1/1/19 2704.1001 1312.80005 . 1/2/19 2784.48999 1293 1/3/19 2834.3999 1282.80005 . 1/4/19 2945.83008 1305.80005 we 1/5/19 2752.06006 1409.69995 1/6/19 2941.76001 1426.09998 1/7/19 2980.37988 1919.09998 1/8/19 2926.45996 1465.69995 Thor 1230.13220 1:9:19 2976.73999 1511.40002 in 1/10/19 3037.56006 1465.59998 1/11/19 3140.97998 1519.5 1/12/19 3230.78003 1582.90002 1/1/20 3225.52002 1564.09998 1/2/20 2954.21997 1583.40002 1/3/20 2584.59009 1684.19995 1:4:20 2912.42993 1736.90002 1/5/20 3044.31006 1793 1/6/20 3100.29004 1962.80005 1/7/20 3271.12012 1967.59998 1/8/20 3500.31006 1887.5 1/9/20 3363 1877.40002 or 1/10/20 3269.95996 1775.69995 270 1/11/20 3621.62988 1893.09998 Wu 1/12/20 3756.07007 1847.30005 1/1/21 3714.23999 1728.09998 1:2:21 3934.83008 1698 19:2:21 3906.70996 1698.19995Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started